Advertising and Selling a Financed Vehicle

Selling a financed vehicle requires a strategic approach to advertising and marketing to attract potential buyers and clearly communicate the financing details. A well-crafted advertisement, combined with strategic platform selection, significantly increases the chances of a successful sale.

Effective advertising highlights the vehicle’s positive aspects while transparently addressing the financing. This approach builds trust and encourages serious inquiries.

Compelling Advertisement Creation

To create a compelling advertisement, focus on the vehicle’s most attractive features and benefits. Consider highlighting features that are particularly desirable in the current market, such as fuel efficiency, safety features, or technological advancements. Use strong action verbs and descriptive language to paint a vivid picture of the vehicle’s appeal. For example, instead of simply stating “reliable car,” describe it as “a meticulously maintained sedan, boasting a proven track record of reliability and smooth performance.” Showcase its unique selling points. If it’s a sporty model, emphasize its handling and acceleration. If it’s a family vehicle, highlight its spaciousness and safety features.

Effective Sales Platforms

Online and offline platforms offer diverse avenues for reaching potential buyers. Online marketplaces like Craigslist, Facebook Marketplace, and specialized automotive websites (e.g., AutoTrader, Cars.com) provide extensive reach. Offline options include local dealerships (potentially for consignment), classified ads in newspapers or community publications, and even displaying a “For Sale” sign on the vehicle itself if it’s parked in a visible location. The choice of platforms should align with your target audience and budget.

Essential Advertisement Information

A successful advertisement includes crucial details to attract and inform potential buyers. This includes: high-quality photographs showcasing the vehicle’s interior and exterior; the year, make, and model; mileage; a concise and accurate description of its condition (mechanical, cosmetic, etc.); the asking price; clear details about the financing (loan amount, monthly payment, remaining term, and lender details if permissible). Including contact information (phone number and/or email address) makes it easy for interested parties to connect. Consider adding a statement regarding the vehicle’s history report availability.

Vehicle Condition Description

Describing the vehicle’s condition requires honesty and precision. Avoid vague terms like “good condition.” Instead, be specific. For example, instead of saying “minor scratches,” specify “a few minor scratches on the driver’s side door.” If there are any mechanical issues, disclose them transparently. Mention any recent repairs or maintenance performed. Highlight any unique features or upgrades. A well-written description builds trust and minimizes misunderstandings. For example, “This vehicle has been meticulously maintained with all scheduled services performed on time. Recent work includes new brakes and tires. While there are a few minor paint chips on the hood (pictured), the vehicle is in excellent mechanical condition.”

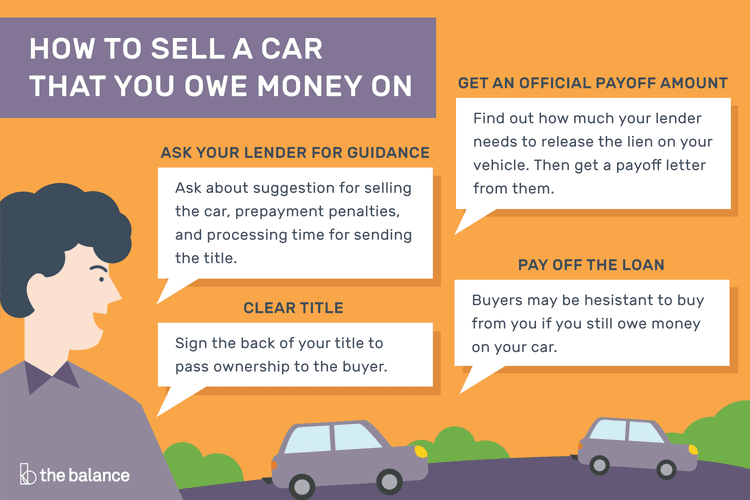

Managing the Loan Payoff: How To Sell A Financed Vehicle

Successfully selling a financed vehicle hinges on efficiently managing the loan payoff. This involves understanding the process, addressing potential discrepancies between the sale price and loan amount, and ensuring a smooth transition of ownership. Proper handling of the payoff safeguards both the seller and buyer from future complications.

The process of paying off the remaining loan balance after a sale generally begins with determining the exact payoff amount. Contact your lender directly to request a payoff quote, which will specify the precise amount needed to settle the loan in full. This quote usually has an expiration date, so act promptly. Once you receive the payoff amount, you’ll need to arrange payment through your chosen method, whether it’s a wire transfer, cashier’s check, or other accepted forms of payment. Remember to confirm the payment with your lender to ensure it’s received and processed correctly.

Handling Discrepancies Between Sale Price and Loan Balance

Differences between the vehicle’s sale price and the loan payoff amount are common. If the sale price exceeds the loan payoff, the seller retains the surplus. Conversely, if the sale price is less than the payoff amount, the seller is responsible for covering the difference. Strategies for handling a shortfall might include using personal savings, seeking a loan, or negotiating with the buyer for a higher purchase price. A detailed financial plan before the sale is crucial to mitigating such situations. For example, if you anticipate a shortfall, you could proactively adjust your asking price to account for it. If the sale price is higher, you can allocate the surplus towards paying down other debts or making a down payment on a new vehicle.

Obtaining a Payoff Letter from the Lender

Securing a payoff letter from your lender is paramount. This official document confirms the exact amount required to pay off the loan and serves as proof of payment upon settlement. The payoff letter is typically provided by the lender after the loan is paid in full. Without this document, the title transfer may be delayed or even blocked, leaving both the buyer and seller in a difficult situation. For instance, a buyer may hesitate to complete the transaction without assurance that the lien on the title has been released.

Post-Loan Payoff Checklist, How to sell a financed vehicle

After the loan is paid off and the payoff letter is received, several essential steps ensure a complete and smooth transaction. A comprehensive checklist aids in this process.

- Verify receipt of the payoff letter from your lender, checking the accuracy of all details.

- Confirm the release of the lien on the vehicle’s title with the Department of Motor Vehicles (DMV).

- Transfer the title to the buyer, following all legal requirements for your state.

- Obtain a signed receipt from the buyer, confirming the transaction.

- Maintain copies of all relevant documents – payoff letter, title transfer, and sales agreement – for your records.

Tim Redaksi