Understanding Zacks Finance and its Features

Zacks Finance is a comprehensive financial research platform offering a wide array of tools and data to aid investors in making informed decisions. It provides access to a vast library of research reports, stock ratings, and analytical tools, all designed to simplify the complexities of financial markets. Understanding its features and subscription options is crucial for determining its suitability for individual investor needs.

Zacks Finance’s core functionality revolves around providing actionable investment insights. Its primary features include stock ratings, research reports, portfolio tracking tools, and various screening options to help investors identify potential investment opportunities. The platform utilizes proprietary algorithms and a team of analysts to generate these insights, aiming to provide a competitive edge in the market. The depth and breadth of data available vary depending on the chosen subscription tier.

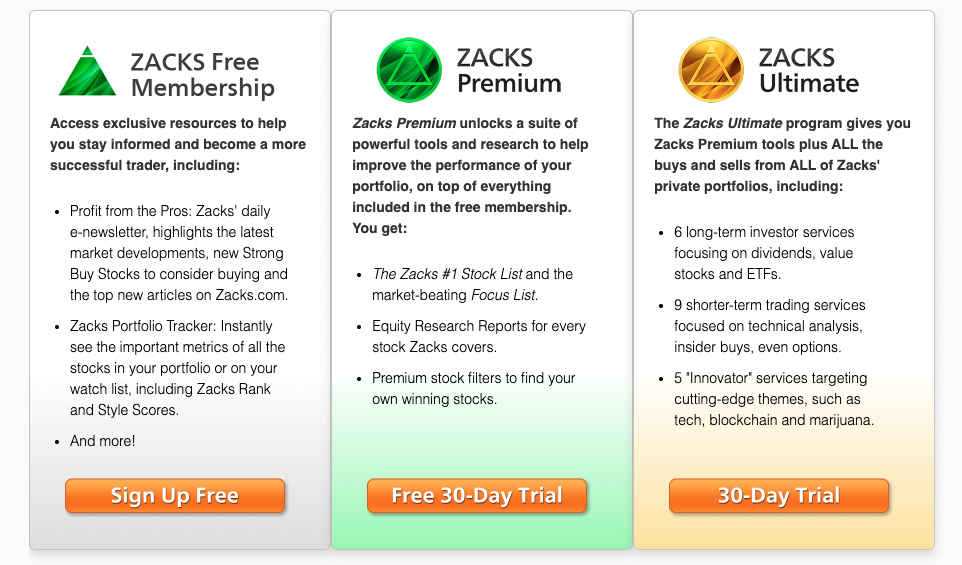

Zacks Finance Subscription Tiers

The availability of features and the level of access to data within Zacks Finance depend heavily on the subscription tier selected. Generally, Zacks offers multiple tiers, ranging from basic access to premium packages with extensive features. A basic subscription might provide access to fundamental data and some stock ratings, while higher-tier subscriptions unlock access to more in-depth research reports, advanced analytical tools, and potentially real-time data feeds. The exact features included in each tier are subject to change, and it’s crucial to review Zacks’ official website for the most up-to-date information on pricing and features. Each tier typically comes with a different price point, reflecting the increased value and features offered. Consider your investment experience and needs before selecting a subscription.

Benefits of Using Zacks Finance for Financial Analysis

Utilizing Zacks Finance offers several potential benefits for investors. The platform’s proprietary stock rating system can help investors quickly identify potentially undervalued or overvalued stocks. Access to detailed research reports can provide a deeper understanding of a company’s financial health, competitive landscape, and future prospects. The portfolio tracking tools can assist in monitoring investment performance and making informed adjustments. Furthermore, the screening options allow investors to filter stocks based on specific criteria, such as industry, market capitalization, or financial ratios, enabling them to focus on companies that align with their investment strategies. The platform’s aim is to empower investors with the tools and information needed to make data-driven investment decisions.

Comparison with Similar Financial Platforms

Zacks Finance competes with other financial platforms like Bloomberg Terminal, Refinitiv Eikon, and Morningstar. While Bloomberg and Refinitiv cater more towards professional investors and financial institutions due to their extensive data sets and sophisticated tools, and often come with a significantly higher price tag, Zacks aims for a broader audience, including individual investors. Morningstar, similar to Zacks, focuses on individual investors but differs in its emphasis on mutual fund analysis and ratings. Zacks distinguishes itself through its proprietary stock rating system and its focus on actionable investment recommendations, aiming to bridge the gap between professional-grade research and accessible tools for individual investors. The choice of platform ultimately depends on individual needs and budget.

Exploring Free Alternatives to Zacks Finance

While Zacks Finance offers a comprehensive suite of tools for financial analysis, its subscription cost can be prohibitive for some users. Fortunately, several free alternatives exist, though they may not provide the same depth or breadth of features. Understanding the limitations of these free options is crucial to making an informed decision about which resource best suits your needs.

Free Financial Websites and Resources

Numerous websites offer free access to financial data and analysis tools. These resources often cater to individual investors and provide a basic level of information, including stock quotes, financial news, and company profiles. However, the depth of analysis and the sophistication of the tools available are generally less extensive than those found in paid services like Zacks Finance. It’s important to remember that the information found on these sites is often publicly available and may not represent unique insights.

- Yahoo Finance: Provides real-time stock quotes, financial news, and company profiles. It also offers charting tools and some fundamental data.

- Google Finance: Offers similar features to Yahoo Finance, including stock quotes, financial news, and basic charting tools.

- Finviz: Presents a comprehensive stock screener and provides visualizations of financial data.

- Seeking Alpha: A platform featuring articles, analysis, and commentary from various contributors. While much of the content is user-generated, it can provide diverse perspectives on financial markets.

Open-Source Financial Data APIs

Open-source APIs offer programmatic access to financial data, allowing developers to integrate this data into their own applications. While this can be a powerful tool for advanced users, it requires programming skills and may involve significant effort to process and analyze the data effectively. The quality and reliability of data from open-source APIs can also vary.

- Alpha Vantage: Provides free access to a wide range of financial data, including real-time stock quotes, historical data, and fundamental data.

- IEX Cloud: Offers both free and paid plans. The free tier provides access to a limited amount of data, but it’s a good starting point for experimenting with financial data APIs.

Limitations of Free Alternatives

Free alternatives to Zacks Finance typically lack the depth and breadth of features offered by paid services. They may offer limited historical data, fewer analytical tools, and less sophisticated screening capabilities. Furthermore, the quality and timeliness of data can be inconsistent across different free resources. The reliance on publicly available information means that these services may not provide the same level of unique insights or proprietary research as Zacks Finance.

Comparison of Features and Limitations

| Feature | Zacks Finance | Yahoo Finance | Google Finance | Alpha Vantage API (Free Tier) |

|---|---|---|---|---|

| Stock Quotes | Yes (Real-time) | Yes (Real-time) | Yes (Real-time) | Yes (Real-time, limited frequency) |

| Historical Data | Extensive | Limited | Limited | Limited |

| Fundamental Analysis Tools | Extensive | Basic | Basic | Requires custom development |

| Technical Analysis Tools | Extensive | Basic | Basic | Requires custom development |

| Research Reports | Yes (Extensive) | No | No | No |

| Stock Screeners | Advanced | Basic | Basic | Requires custom development |

| Portfolio Tracking | Yes | Yes | Yes | Requires custom development |

Utilizing Free Resources for Similar Data: How To Get Zacks Finance For Free

Accessing comprehensive financial data doesn’t necessitate a subscription to premium services like Zacks Finance. Numerous free resources provide comparable information, allowing for effective investment research and analysis. By strategically utilizing these free alternatives, investors can significantly reduce their costs while maintaining a robust understanding of the market.

Free financial news and market data are readily available from various sources. These sources offer a wealth of information, although it’s crucial to assess their reliability and potential biases. While the depth and breadth of information might not match paid services, free resources still provide valuable insights for informed decision-making.

Free Sources for Financial News and Market Data

Many reputable news outlets offer free access to financial news and market data, albeit often with some limitations. These sources typically cover major market events, company announcements, and economic indicators. Examples include major financial news websites like Yahoo Finance, Google Finance, and MarketWatch. These platforms offer real-time stock quotes, historical price data, and news articles relevant to specific companies and the broader market. While not as comprehensive as paid services, they provide a solid foundation for staying informed about market trends and individual company performance. Furthermore, government websites like the Securities and Exchange Commission (SEC) EDGAR database offer free access to company filings, including 10-K and 10-Q reports, providing crucial financial information directly from the source.

Accessing and Interpreting Free Financial Statements

Understanding and interpreting financial statements is a cornerstone of fundamental analysis. The SEC’s EDGAR database is invaluable for accessing free company filings. These filings include the 10-K annual report and the 10-Q quarterly report, which contain detailed information about a company’s financial performance. While navigating these documents may initially seem daunting, focusing on key metrics such as revenue, net income, earnings per share (EPS), and debt-to-equity ratio provides a solid understanding of a company’s financial health. Many online resources offer guides and tutorials on how to interpret financial statements, simplifying the process for those new to financial analysis. For example, understanding the difference between net income and free cash flow is critical for evaluating a company’s profitability and its ability to generate cash. A company with high net income but low free cash flow might be masking underlying issues.

Using Free Tools to Screen Stocks

Several free online tools allow investors to screen stocks based on specific criteria. These tools often provide customizable filters, enabling users to focus on companies meeting their investment objectives. For instance, an investor might screen for companies with a specific market capitalization, price-to-earnings ratio (P/E), or dividend yield. Websites like Finviz and Yahoo Finance offer robust stock screening capabilities. These tools allow for the creation of sophisticated filters to identify undervalued or high-growth companies that align with an investor’s risk tolerance and investment strategy. For example, an investor seeking value stocks might screen for companies with a low P/E ratio and a high dividend yield.

Performing Fundamental Analysis Using Free Resources

Fundamental analysis involves assessing a company’s intrinsic value by examining its financial statements, competitive landscape, and management quality. Using free resources, this process can be broken down into several steps. First, gather information from the company’s financial statements (10-K and 10-Q reports from EDGAR). Next, analyze key financial ratios such as the P/E ratio, price-to-book ratio, and return on equity (ROE) to evaluate the company’s profitability and efficiency. Then, research the company’s industry and competitive landscape to understand its position within the market. Finally, assess the company’s management team and its long-term strategic goals. By combining information from free financial statements and news sources, investors can develop a comprehensive understanding of a company’s financial health and future prospects, allowing for informed investment decisions. For example, analyzing a company’s revenue growth rate in conjunction with its debt levels can provide insights into its financial sustainability. A high revenue growth rate coupled with low debt suggests strong financial health, while slow revenue growth with high debt might indicate potential risks.

Leveraging Publicly Available Information

Accessing and interpreting publicly available financial data is crucial for informed investment decisions, offering a cost-effective alternative to subscription-based services like Zacks Finance. This information empowers investors to conduct thorough due diligence and make well-reasoned choices, regardless of their budget. By understanding where to find this data and how to interpret it, you can significantly enhance your investment strategy.

This section details how to locate and utilize company filings, free stock quotes, and other publicly available resources to gain valuable insights into company performance and market trends. We will Artikel a practical workflow to effectively integrate this information into your investment process.

Company Filings (10-K, 10-Q) and Key Information Interpretation

Companies listed on major U.S. stock exchanges are required by the Securities and Exchange Commission (SEC) to regularly file reports detailing their financial performance and operational activities. The 10-K is an annual report providing a comprehensive overview of the company’s financial condition, while the 10-Q is a quarterly report offering updates on key performance indicators. Analyzing these filings allows investors to assess a company’s financial health, growth prospects, and potential risks. Key information to focus on includes revenue, net income, earnings per share (EPS), cash flow statements, debt levels, and any significant changes in the company’s business operations. Understanding these elements provides a solid foundation for evaluating investment opportunities. For example, a consistently increasing revenue stream coupled with strong cash flow suggests a healthy and potentially growing company. Conversely, a declining revenue trend accompanied by rising debt might signal financial distress.

Websites Offering Free Access to SEC Filings

Several websites provide free access to SEC filings, eliminating the need for paid subscriptions. The SEC’s own EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system is the primary source. Other websites, such as the SEC’s website and several financial news sites often aggregate and provide easy access to these filings. These platforms typically allow users to search for companies by ticker symbol or company name, making the retrieval process straightforward. Using these resources enables investors to directly access the most up-to-date and accurate financial information from the source itself.

Resources for Obtaining Free Stock Quotes and Charts, How to get zacks finance for free

Numerous websites and applications provide free access to real-time or delayed stock quotes and charts. Many well-known brokerage firms offer free access to basic charting and quote functionalities. Google Finance, Yahoo Finance, and other financial portals are also valuable resources. These platforms often offer various charting tools, allowing investors to visualize stock price movements, identify trends, and analyze technical indicators. For example, Google Finance allows users to access real-time stock quotes, historical data, and basic charting capabilities, all without any subscription fees. This free access is essential for tracking market performance and assessing the value of potential investments.

Workflow for Using Publicly Available Information for Investment Decisions

A structured workflow can help maximize the value of publicly available information. First, identify potential investment opportunities based on your investment strategy and risk tolerance. Second, utilize free resources like EDGAR to access and analyze the company’s 10-K and 10-Q reports, focusing on key financial metrics. Third, use free stock quote and charting websites to track the company’s stock price performance and identify relevant trends. Fourth, compare the company’s financial performance and market trends to your investment criteria. Finally, make an informed investment decision based on your analysis. This methodical approach ensures a thorough evaluation before committing capital, enhancing the likelihood of achieving your investment goals.

Free Trials and Limited Access Options

Many financial data providers, including services similar to Zacks Finance, offer free trials to entice potential subscribers. These trials provide a limited-time opportunity to access a subset of the platform’s features and data, allowing users to assess its value before committing to a paid subscription. Understanding the nuances of these trials is crucial to maximizing their utility.

Free trials typically involve a straightforward registration process. Users usually provide an email address and potentially a credit card number (though the card may not be charged unless the trial isn’t canceled before its expiration). Upon registration, access to the specified features is granted immediately. The trial period, usually lasting between 7 to 30 days, is clearly stated during the signup process.

Limitations of Free Trials

Free trials, while valuable, inherently possess limitations. Access is usually restricted to a subset of the platform’s complete offerings. For example, a trial might offer access to only a limited number of stock reports, research tools, or a reduced data history. Real-time data feeds are often excluded, and advanced features like portfolio tracking tools or alert systems may be unavailable or limited. The availability of customer support during the trial period may also be restricted. Furthermore, after the trial concludes, access is automatically revoked unless a paid subscription is initiated.

Maximizing Free Trial Benefits

To effectively utilize a free trial, users should create a clear plan beforehand. Identify specific needs and prioritize the features that align with those needs. Focus on testing the aspects of the platform most relevant to your investment strategy. For instance, if you primarily use fundamental analysis, dedicate the trial period to exploring stock reports and financial data. If technical analysis is your focus, concentrate on charting tools and indicators. Thoroughly explore the help documentation and tutorials to become familiar with the platform’s interface and features.

Effective Utilization of Free Trial Information

During the free trial, it’s essential to focus on gathering actionable information. Instead of passively browsing, actively test the platform’s functionalities and evaluate its usefulness for your specific investment approach. For example, compare the stock reports provided during the trial to those from other free sources to assess the value-add. Analyze the accuracy and timeliness of the data and compare it against other publicly available data points. Note any limitations encountered and determine if they significantly impact your investment process. Consider tracking the performance of stocks identified through the platform’s tools and comparing this to a benchmark index to assess the potential return on investment associated with a full subscription.

Community Resources and Forums

Online communities and forums dedicated to finance offer a valuable, albeit sometimes risky, avenue for accessing information beyond commercially available services like Zacks Finance. These platforms allow individuals to share insights, analyses, and data, fostering a collaborative environment for learning and discussion. However, the decentralized nature of this information necessitates careful evaluation and critical thinking.

Exploring these communities can supplement your financial knowledge and provide diverse perspectives, but it’s crucial to approach them with a discerning eye, understanding the inherent limitations and potential pitfalls of relying solely on user-generated content.

Benefits and Risks of Community-Sourced Financial Information

Utilizing community-sourced financial information presents both advantages and disadvantages. On the positive side, these platforms can offer a wealth of diverse opinions and perspectives, often unavailable in mainstream financial media. The collective intelligence of many participants can lead to insightful discussions and the identification of emerging trends or undervalued opportunities. Furthermore, these communities often provide a sense of camaraderie and support among like-minded individuals.

Conversely, the inherent lack of regulation and verification within these forums introduces significant risks. Information shared might be inaccurate, biased, or even deliberately misleading. The anonymity afforded by many platforms can embolden users to promote unsubstantiated claims or engage in manipulative behavior. Relying heavily on community-sourced information without critical evaluation can lead to poor investment decisions and significant financial losses.

Evaluating the Credibility of Online Forum Information

Several key factors should be considered when evaluating the credibility of information found in online financial communities. First, assess the source’s expertise and track record. Look for users who consistently provide well-reasoned arguments supported by evidence and demonstrate a history of accurate predictions or insightful analyses. Second, cross-reference information with multiple sources. Don’t rely on a single post or opinion; instead, seek corroboration from other reputable sources or community members. Third, be wary of overly optimistic or pessimistic claims, particularly those lacking supporting evidence. Fourth, consider the overall tone and context of the discussion. A community rife with unsubstantiated claims or aggressive behavior should be approached with caution. Finally, remember that past performance is not indicative of future results. Even the most respected community members can make inaccurate predictions.

Reputable Financial Communities Offering Free Resources

While many online forums exist, identifying those with a reputation for credible information is crucial. Some platforms, such as Reddit’s r/investing subreddit, have established themselves as relatively reliable sources of discussion and analysis. However, even within these communities, critical evaluation remains paramount. Other forums dedicated to specific investment strategies or asset classes may also offer valuable insights, but users should always verify information from multiple sources and exercise caution. It’s important to remember that participation in these communities should complement, not replace, thorough research and professional financial advice. Always remember that these are merely discussion forums, and the information presented should be considered opinions, not financial advice.

Building Your Own Financial Tracking System

Creating a personal financial tracking system offers a powerful way to monitor your investments without relying on paid services. This allows for customized tracking and a deeper understanding of your portfolio’s performance. By building your own system, you gain control over the data and the metrics you find most important.

Spreadsheet Template Design for Stock Performance Tracking

A basic spreadsheet can effectively track key aspects of your stock investments. The design should include columns for essential data points to allow for efficient analysis. Consider using a spreadsheet program like Google Sheets or Microsoft Excel. A sample template might include columns for: Stock Symbol, Company Name, Purchase Date, Purchase Price, Number of Shares, Current Price, and relevant calculated metrics. This structure facilitates easy data entry and analysis.

Formulas for Key Financial Metrics

Several formulas are crucial for calculating key financial metrics. These calculations provide valuable insights into your investment’s performance.

- P/E Ratio: This is calculated by dividing the market value per share by the earnings per share (EPS). The formula is:

P/E Ratio = Market Value per Share / Earnings Per Share. For example, if a stock trades at $50 and has an EPS of $5, the P/E ratio is 10. - Return on Investment (ROI): ROI measures the profitability of an investment. The formula is:

ROI = [(Current Value - Initial Investment) / Initial Investment] * 100. If you invested $1000 and the investment is now worth $1200, the ROI is 20%.

Importing Data from Free Sources

Many free sources provide financial data suitable for importing into your spreadsheet. Websites like Yahoo Finance, Google Finance, and Alpha Vantage offer free APIs (Application Programming Interfaces) or downloadable data. These APIs allow you to automatically fetch real-time or historical stock data. The specific method of importing data will depend on the chosen source and your spreadsheet software. Generally, this involves using functions like IMPORTDATA (Google Sheets) or connecting to external data sources within your spreadsheet program.

Automating Data Updates

Automating data updates saves time and ensures your information remains current. Google Sheets, for example, offers features like scripts and add-ons to automate this process. You can write a simple script that regularly retrieves updated data from a free API and updates your spreadsheet. Alternatively, some spreadsheet programs offer built-in features to automatically refresh external data connections at specified intervals. This ensures your financial tracking system always reflects the most up-to-date information.

Tim Redaksi