Comparison with Other Medicare Parts

Medicare Part B, covering physician services and outpatient care, has a distinct financing mechanism compared to other Medicare parts. Understanding these differences is crucial for comprehending the overall financial structure of the Medicare program and its potential vulnerabilities. This section will compare and contrast Part B’s financing with that of Parts A, C, and D.

How is medicare part b financed – The primary difference lies in the funding sources and the beneficiary’s cost-sharing responsibilities. While Part A relies heavily on payroll taxes, Part B incorporates a significant premium component paid directly by beneficiaries, supplemented by general federal revenue. Parts C and D introduce additional complexities with their private plan involvement and varying subsidy structures.

Funding Sources for Medicare Parts A, B, C, and D, How is medicare part b financed

The following table summarizes the key funding sources for each part of Medicare, highlighting the significant differences in their financing mechanisms. Note that the percentages presented are approximate and can fluctuate based on annual budget appropriations and enrollment numbers.

| Medicare Part | Primary Funding Source | Secondary Funding Source(s) | Beneficiary Cost-Sharing |

|---|---|---|---|

| Part A (Hospital Insurance) | Payroll Taxes (dedicated taxes on employers and employees) | General Federal Revenue (smaller portion) | Deductibles and co-insurance |

| Part B (Medical Insurance) | Beneficiary Premiums (monthly premiums based on income) | General Federal Revenue (significant portion) | Premiums, deductibles, co-insurance, and 20% coinsurance for most services. |

| Part C (Medicare Advantage) | General Federal Revenue (subsidies to private plans) | Beneficiary Premiums (vary widely by plan) | Premiums, deductibles, and co-pays (vary widely by plan) |

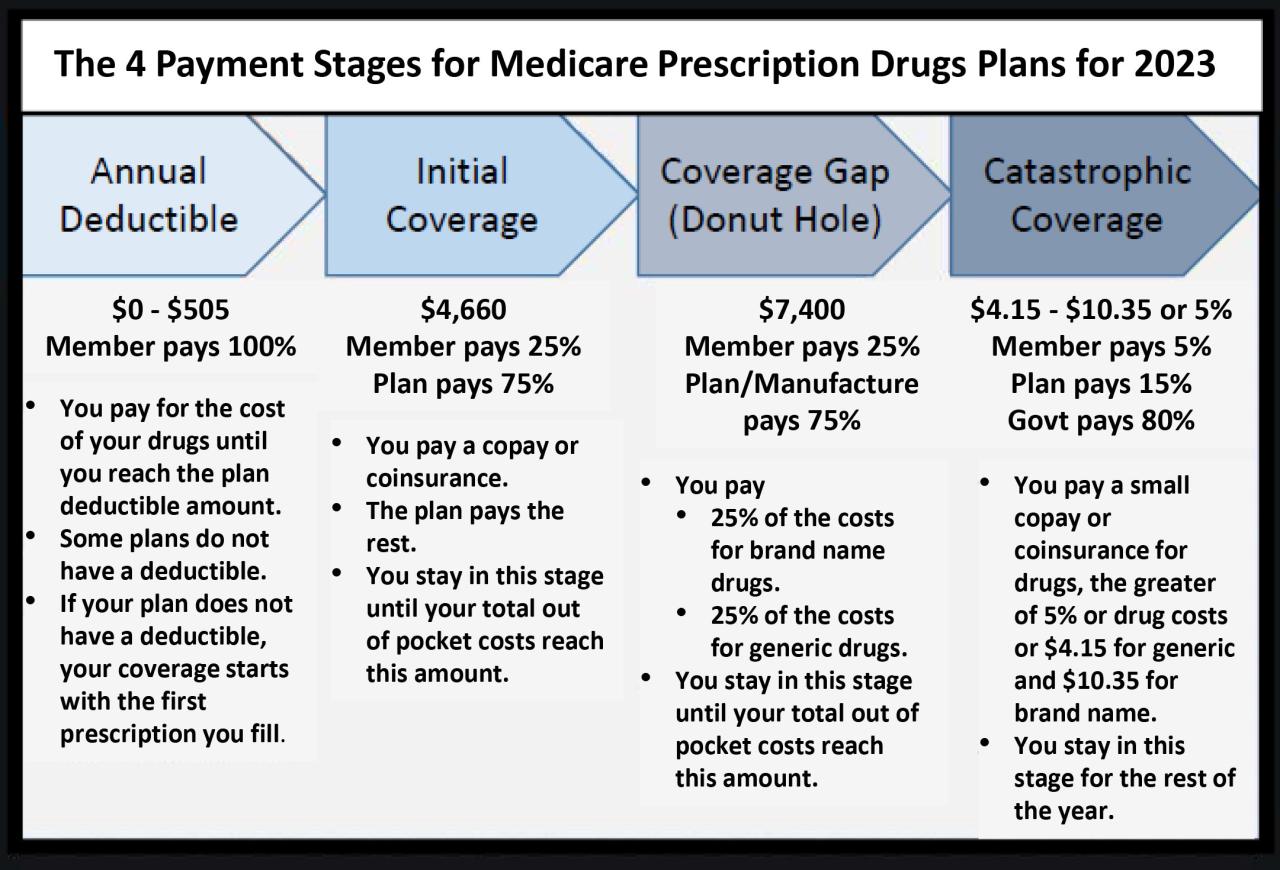

| Part D (Prescription Drug Insurance) | General Federal Revenue (subsidies to private plans) | Beneficiary Premiums (vary widely by plan) | Premiums, deductibles, and co-pays (vary widely by plan, depending on the chosen plan and drug costs) |

Role of Private Insurance and Supplemental Plans: How Is Medicare Part B Financed

Medicare Part B, while covering a significant portion of medical expenses, doesn’t cover everything. This is where Medigap supplemental insurance plans and other private insurance options play a crucial role in filling the gaps and providing beneficiaries with more comprehensive coverage. These plans help manage out-of-pocket costs and offer additional peace of mind.

Medigap supplemental insurance plans are private insurance policies designed to help pay for some of the healthcare costs that Medicare Part B doesn’t cover. These plans, offered by private insurance companies, help offset expenses like copayments, coinsurance, and deductibles associated with Part B services. The specific benefits vary depending on the type of Medigap plan purchased (Plans A through N and some high-deductible plans). For example, a Plan F Medigap policy might cover most or all of the Part B coinsurance and deductible, significantly reducing the beneficiary’s out-of-pocket expenses. The availability and cost of these plans vary by location and insurance provider.

Medigap Plan Costs and Their Impact on Healthcare Spending

The cost of Medigap plans varies greatly depending on several factors including the plan type, age, location, and health status of the beneficiary. Monthly premiums can range from a few hundred dollars to over a thousand dollars. This cost adds to the overall healthcare spending of beneficiaries, representing an additional expense beyond their Medicare Part B premiums. For many seniors, however, the added financial protection provided by a Medigap plan may outweigh the cost, particularly considering the potential for high medical bills without supplemental coverage. For instance, a senior with a pre-existing condition might find a Medigap plan essential to manage potential expenses from ongoing treatment, even if the monthly premium is substantial. The decision to purchase a Medigap plan is a personal one, involving careful consideration of individual financial circumstances and healthcare needs.

Tim Redaksi