Factors Influencing Car Loan Amounts

Securing a car loan involves understanding the various factors that significantly impact the total cost. These factors interact to determine the interest rate offered, the loan amount approved, and ultimately, the monthly payments you’ll make. A thorough understanding of these factors empowers you to make informed decisions and potentially save significant money over the life of the loan.

Key Factors Determining Car Loan Costs

Several key elements contribute to the final cost of your car loan. Understanding their individual and combined effects is crucial for financial planning. The following table summarizes these factors:

| Factor | Description | Impact on Loan Amount | Example |

|---|---|---|---|

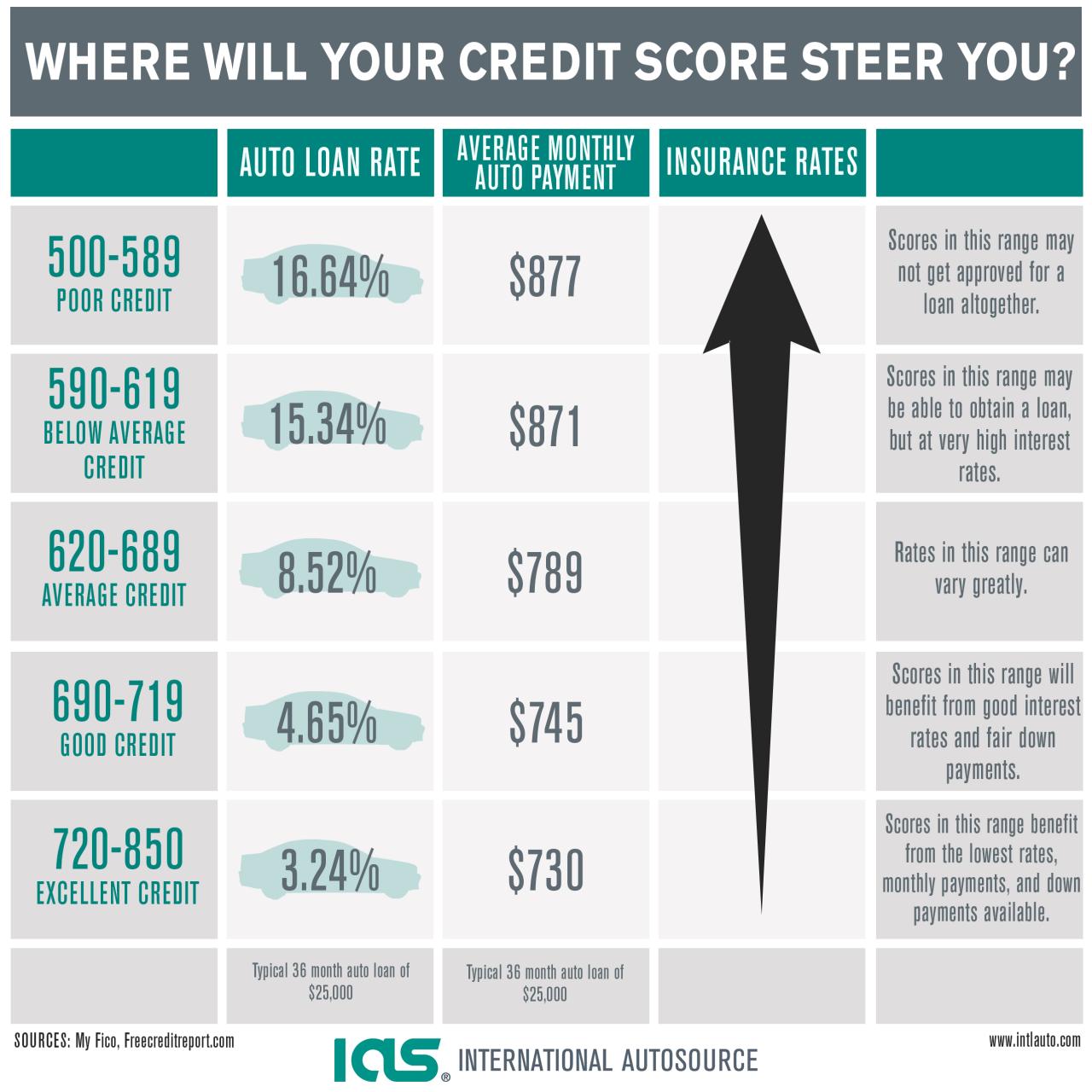

| Credit Score | A numerical representation of your creditworthiness based on past borrowing and repayment history. | Higher scores qualify for lower interest rates and larger loan amounts. Lower scores result in higher rates and potentially smaller loan amounts or loan denials. | A 750 credit score might get a 3% interest rate, while a 600 score might receive a 10% rate or loan rejection. |

| Loan Term Length | The duration of the loan, typically expressed in months. | Longer terms result in lower monthly payments but significantly higher total interest paid. Shorter terms mean higher monthly payments but less interest paid overall. | A 60-month loan will have lower monthly payments than a 36-month loan for the same principal amount, but the total interest paid will be considerably more. |

| Down Payment | The initial upfront payment towards the car’s purchase price. | Larger down payments reduce the loan amount needed, leading to lower monthly payments and less total interest paid. | A 20% down payment on a $25,000 car reduces the loan amount to $20,000, leading to smaller monthly payments and less interest paid compared to a 5% down payment. |

| Interest Rate | The percentage charged by the lender for borrowing money. | Higher interest rates increase the total cost of the loan significantly, even with a smaller loan amount. | A 5% interest rate will result in less total interest paid compared to a 7% interest rate on the same loan amount and term. |

Credit Score’s Impact on Interest Rates and Loan Amounts

Your credit score is a critical factor determining the interest rate and loan amount you qualify for. Lenders use it to assess your risk of defaulting on the loan. A higher credit score indicates lower risk, resulting in more favorable loan terms.

| Credit Score Range | Approximate Interest Rate (Example) |

|---|---|

| 750-850 (Excellent) | 3-5% |

| 670-749 (Good) | 5-7% |

| 620-669 (Fair) | 7-10% |

| Below 620 (Poor) | 10% or higher, or loan denial |

*Note: These are illustrative examples, and actual interest rates vary depending on the lender, loan type, and other factors.*

Loan Term Length and Total Amount Paid

The length of your loan significantly affects the total interest paid. While a longer loan term reduces monthly payments, it leads to substantially higher overall interest costs.

Here’s a comparison for a $20,000 loan at a 5% fixed interest rate:

| Loan Term (Months) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|

| 36 | $591 | $1278 |

| 48 | $449 | $1556 |

| 60 | $373 | $1832 |

*Note: These calculations are approximate and may vary slightly depending on the lender’s specific calculations.*

Down Payment’s Influence on Loan Amount and Monthly Payments

The size of your down payment directly impacts both the loan amount and your monthly payments.

- A larger down payment reduces the principal loan amount, resulting in lower monthly payments and less total interest paid over the loan’s life.

- A smaller down payment increases the loan amount, leading to higher monthly payments and more interest paid over the loan term.

- A larger down payment might also improve your chances of securing a better interest rate from the lender.

Calculating Monthly Car Payments

Understanding how to calculate your monthly car payment is crucial for budgeting and making informed financial decisions. This section will guide you through the process, using various methods and scenarios to illustrate the impact of different loan parameters.

The Formula for Calculating Monthly Car Payments

The most common formula used to calculate monthly car payments is based on the present value of an annuity. This formula takes into account the loan amount, interest rate, and loan term to determine the monthly payment. The formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly payment

* P = Principal loan amount (the price of the car minus your down payment)

* i = Monthly interest rate (annual interest rate divided by 12)

* n = Total number of payments (loan term in years multiplied by 12)

Let’s illustrate with an example: Suppose you’re financing $20,000 at a 5% annual interest rate over 60 months.

1. Calculate the monthly interest rate: 5% annual interest / 12 months = 0.004167 (approximately)

2. Calculate the total number of payments: 60 months

3. Plug the values into the formula: M = 20000 [ 0.004167 (1 + 0.004167)^60 ] / [ (1 + 0.004167)^60 – 1]

4. Solve the equation: After performing the calculations, the monthly payment (M) comes to approximately $377.42.

Using Online Car Loan Calculators

Online car loan calculators simplify the process significantly. These calculators typically require you to input the loan amount, interest rate, loan term (in months or years), and sometimes a trade-in value or down payment. Upon inputting these values, the calculator will output the estimated monthly payment, the total interest paid over the loan term, and the total amount repaid. Many calculators also allow you to adjust these inputs to see how different scenarios affect the monthly payment. For example, you can experiment with different loan terms to see how that impacts your monthly payment.

Comparison of Monthly Payment Amounts Under Different Loan Scenarios

The following table illustrates how varying loan amounts, interest rates, and loan terms impact monthly payments.

| Loan Amount | Interest Rate | Loan Term (Months) | Monthly Payment (Approximate) |

|---|---|---|---|

| $20,000 | 5% | 60 | $377.42 |

| $25,000 | 5% | 60 | $471.78 |

| $20,000 | 7% | 60 | $400.86 |

| $20,000 | 5% | 72 | $321.88 |

Impact of Additional Fees on Total Loan Cost and Monthly Payments

Additional fees, such as processing fees or origination fees, are often added to the loan amount, increasing the total cost and monthly payments. For example, a $500 processing fee added to a $20,000 loan increases the principal to $20,500, resulting in a higher monthly payment. Similarly, a 1% origination fee on a $20,000 loan adds $200 to the principal, again leading to a higher monthly payment. It’s crucial to factor these fees into your calculations to get a complete picture of your total loan cost.

Exploring Different Loan Options: How Much To Finance A Car

Choosing the right car loan is crucial for managing your finances effectively. Understanding the various options available and their implications is key to making an informed decision that aligns with your budget and financial goals. This section will explore different loan types, compare financing sources, and provide a guide to comparing loan offers.

Secured Versus Unsecured Car Loans

The primary distinction between car loans lies in whether the loan is secured or unsecured. A secured loan uses the car itself as collateral. If you default on payments, the lender can repossess the vehicle. An unsecured loan, conversely, does not require collateral. However, unsecured loans typically come with higher interest rates due to the increased risk for the lender.

- Secured Loan: Lower interest rates, higher risk of repossession in case of default.

- Unsecured Loan: Higher interest rates, no risk of repossession, but may be harder to qualify for.

Fixed-Rate Versus Variable-Rate Car Loans

Another important distinction is between fixed-rate and variable-rate loans. A fixed-rate loan maintains a consistent interest rate throughout the loan term, offering predictability in monthly payments. A variable-rate loan, on the other hand, has an interest rate that fluctuates based on market conditions. This can lead to unpredictable monthly payments, potentially increasing over time.

- Fixed-Rate Loan: Predictable monthly payments, easier budgeting.

- Variable-Rate Loan: Potentially lower initial interest rates, but payments can increase unpredictably.

Dealership Financing Versus Bank/Credit Union Financing

Borrowers often have the choice of financing through the dealership or a separate financial institution like a bank or credit union. Each option presents advantages and disadvantages.

| Dealership Financing | Bank/Credit Union Financing |

|---|---|

| Convenience: Simplified process, often completed during the car purchase. | Potentially lower interest rates: Banks and credit unions often offer more competitive rates. |

| Potentially higher interest rates: Dealerships may offer less competitive rates to maximize profits. | More time-consuming process: Requires separate application and approval. |

| May offer incentives: Dealerships sometimes offer special financing promotions. | Greater flexibility in loan terms: May offer a wider range of loan terms and options. |

Examples of Lenders and Loan Terms, How much to finance a car

Several lenders offer car loans, each with varying terms and interest rates. The specific rates offered will depend on factors like credit score, loan amount, and loan term. The following table provides examples; these rates are illustrative and may not reflect current market conditions.

| Lender | Interest Rate Range (APR) | Loan Term Options (Years) |

|---|---|---|

| Example Bank A | 3.5% – 8.0% | 3, 4, 5, 6, 7 |

| Example Credit Union B | 2.9% – 7.5% | 2, 3, 4, 5, 6 |

| Example Dealership C | 4.9% – 10.0% | 3, 4, 5 |

Comparing Loan Offers from Multiple Lenders

Comparing loan offers is crucial for securing the best possible financing terms. A systematic approach can help you navigate the process effectively.

- Check your credit report: Understanding your credit score is the first step. A higher score typically leads to better interest rates.

- Pre-qualify for loans: This allows you to get an idea of the interest rates you’re likely to qualify for without impacting your credit score.

- Shop around: Obtain loan offers from multiple lenders (banks, credit unions, dealerships).

- Compare APRs and loan terms: Carefully compare the annual percentage rate (APR) and the length of the loan. A lower APR and shorter loan term will save you money in the long run.

- Consider all fees: Factor in any origination fees, prepayment penalties, or other associated charges.

- Choose the best offer: Select the loan with the lowest APR and most favorable terms that fit your budget.

Tim Redaksi