How TIF Districts are Created

The creation of a Tax Increment Financing (TIF) district is a multi-step process involving various governmental bodies, developers, and community stakeholders. It requires careful planning, adherence to specific legal requirements, and a thorough understanding of the potential benefits and drawbacks. The process is often lengthy and can be complex, involving public hearings and negotiations.

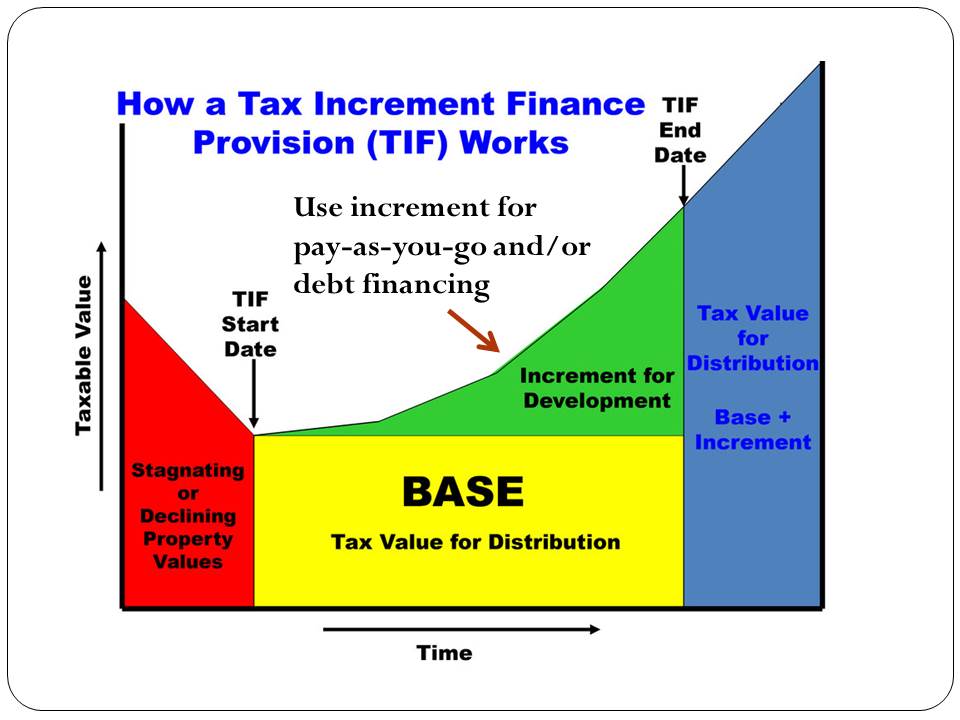

How does tax increment financing work – Establishing a TIF district begins with identifying an area in need of redevelopment. This area typically suffers from blight, underutilization, or economic stagnation. The potential for significant economic growth and property value increases must be demonstrable to justify the creation of a TIF district. The process then involves a series of formal steps, often overseen by a designated local government entity.

Steps Involved in Establishing a TIF District

The creation of a TIF district typically follows a sequence of steps, although the specific procedures may vary depending on state and local laws. These steps often include preliminary assessments, formal applications, public hearings, and final approval. Each step involves different stakeholders and requires careful documentation.

A typical sequence of events might include:

- Area Identification and Needs Assessment: A thorough analysis of a target area is conducted to identify its current condition, challenges, and redevelopment potential. This involves data collection on property values, tax revenue, infrastructure, and economic activity.

- TIF District Designation Proposal: A formal proposal is submitted to the relevant governing body (often a city council or county board of supervisors) outlining the proposed boundaries of the TIF district, the planned redevelopment activities, and the projected financial impact. This proposal typically includes a detailed financial plan and an environmental review.

- Public Hearings and Community Input: Public hearings are held to allow residents, businesses, and other stakeholders to express their views and concerns about the proposed TIF district. This ensures transparency and community involvement in the decision-making process. Amendments to the proposal may result from this feedback.

- Legal and Regulatory Compliance: The proposal must comply with all applicable state and local laws and regulations governing TIF districts. This includes environmental impact assessments, public notice requirements, and adherence to specific financial guidelines.

- Governing Body Approval: The governing body reviews the proposal, considers public input, and ultimately votes to approve or reject the creation of the TIF district. A supermajority vote is often required.

- TIF Plan Development and Implementation: Once approved, a detailed TIF plan is developed, outlining specific redevelopment projects, funding mechanisms, and performance metrics. This plan guides the implementation of the TIF district and serves as a framework for monitoring its progress.

Key Players and Their Roles

Several key players are involved in the creation and management of a TIF district. Their roles and responsibilities are interconnected and crucial to the success of the project.

The major players typically include:

- Local Government Agencies: These agencies, such as city councils, county boards, and planning departments, play a central role in initiating, approving, and overseeing the TIF district. They are responsible for establishing the legal framework, conducting public hearings, and ensuring compliance with regulations.

- Developers and Investors: Developers and investors are key to the success of TIF districts. They are responsible for undertaking the redevelopment projects within the designated area, generating the increased property tax revenue that funds the TIF.

- Community Stakeholders: Residents, businesses, and community organizations are important stakeholders. Their input is essential during the public hearing process, and their involvement ensures the TIF district aligns with community needs and priorities.

- Financial Institutions: Banks and other financial institutions often provide funding for redevelopment projects within TIF districts. They assess the financial viability of the projects and provide the necessary capital.

Legal and Regulatory Requirements

The legal and regulatory framework governing TIF districts varies significantly by state and locality. However, common requirements generally include adherence to specific state statutes, preparation of detailed financial plans, environmental impact assessments, and public notice requirements. These requirements aim to ensure transparency, accountability, and compliance with environmental and land-use regulations. Failure to meet these requirements can lead to legal challenges and potential delays or cancellation of the TIF district.

Examples of common legal requirements might include:

- Compliance with State Statutes: Each state has its own laws and regulations concerning TIF districts, defining eligibility criteria, procedures, and limitations.

- Environmental Impact Assessment: A thorough environmental review is often required to assess the potential environmental impacts of the proposed redevelopment projects.

- Public Notice and Hearings: Public notice and hearings are essential to ensure transparency and community involvement in the decision-making process.

- Financial Plan Approval: A detailed financial plan outlining the projected tax increment revenue and how it will be used to fund redevelopment projects must be approved by the governing body.

TIF Projects and Eligible Uses of Funds: How Does Tax Increment Financing Work

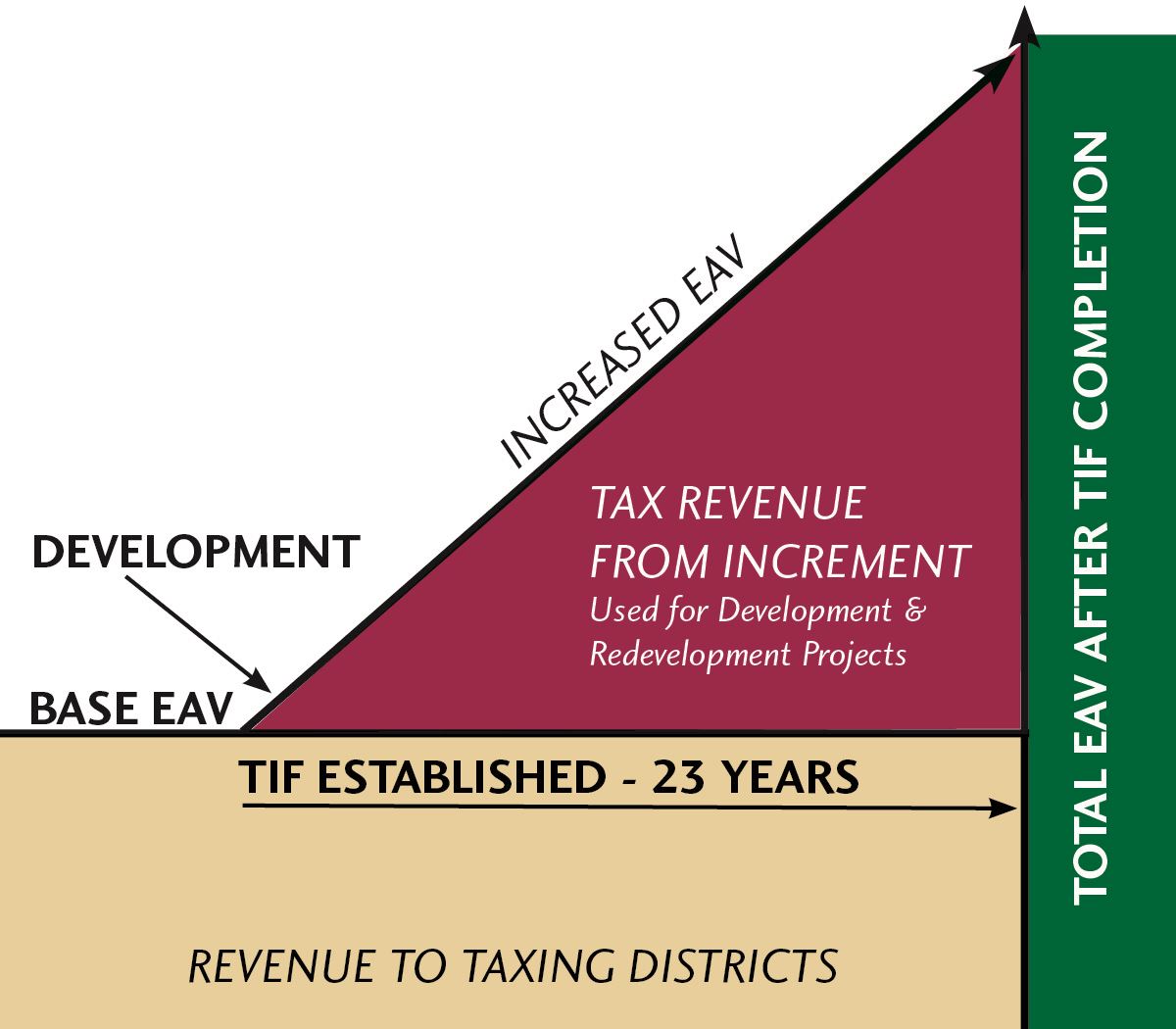

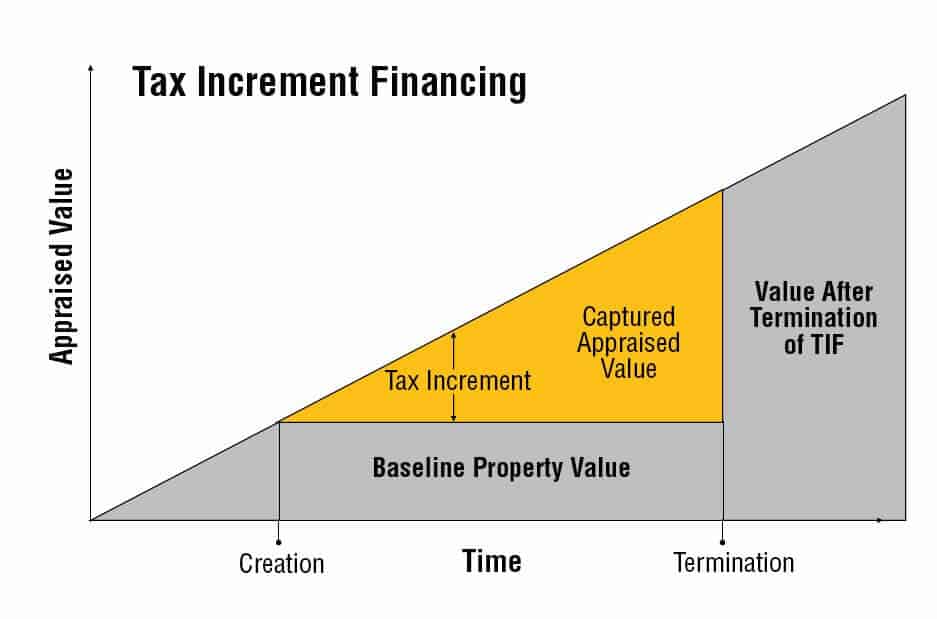

Tax Increment Financing (TIF) districts channel increased property tax revenue generated by development within the district to fund specific projects aimed at stimulating economic growth and addressing community needs. Understanding which projects qualify for TIF funding and how those funds are allocated is crucial to evaluating the effectiveness and fairness of these programs.

The eligible uses of TIF funds are typically defined by state and local laws, and vary considerably depending on the jurisdiction. However, a common thread is that projects must demonstrably contribute to the increased tax base that funds the TIF district in the first place. This means projects are chosen for their ability to generate new tax revenue, often through attracting new businesses or increasing property values. The selection process often involves a detailed review of potential projects against established criteria, including financial feasibility and community benefit.

Eligible Project Categories, How does tax increment financing work

The types of projects funded by TIF are diverse and often address infrastructure deficits, stimulate private development, and improve the quality of life within the designated area. The aim is to leverage public funds to catalyze private investment and create a positive multiplier effect on the local economy.

- Infrastructure Improvements: This is a frequently funded category, encompassing road construction and repair, utility upgrades (water, sewer, electricity), public transportation enhancements, and the development of parks and green spaces. For example, a TIF district might fund the widening of a major thoroughfare to improve traffic flow and attract businesses, or the construction of a new water treatment plant to support increased development density.

- Public Facilities: TIF funds can support the construction or renovation of public buildings, such as schools, libraries, community centers, and fire stations. These projects often enhance the attractiveness of the area for residents and businesses alike. A hypothetical example might be the renovation of a dilapidated community center, transforming it into a modern facility that attracts residents and boosts property values.

- Affordable Housing: Addressing the affordable housing shortage is a growing use of TIF funds in many areas. These projects may involve the construction of new affordable housing units or the rehabilitation of existing ones. An example would be a TIF district providing funding for the development of a new apartment complex with a percentage of units reserved for low-income families.

- Economic Development Initiatives: This broad category includes projects designed to attract businesses, create jobs, and stimulate economic activity. Examples include business incubators, job training programs, marketing campaigns to promote the district, and infrastructure improvements that support businesses (such as improved broadband access).

- Environmental Remediation: Cleaning up contaminated sites or implementing environmental improvements can be eligible uses of TIF funds. This is especially important in areas with a history of industrial activity or environmental challenges. An example might be the cleanup of a former industrial site to prepare it for redevelopment as a commercial or residential area.

Criteria for Determining Eligible Projects

The selection of projects eligible for TIF funding is a rigorous process, often involving multiple stages of review and public input. Key criteria commonly include:

* Alignment with the TIF Plan: Projects must align with the goals and objectives Artikeld in the TIF district’s plan, which is typically approved by the local governing body.

* Financial Feasibility: Projects must demonstrate financial viability and the potential to generate sufficient incremental tax revenue to repay the TIF bonds. Detailed financial projections and analyses are typically required.

* Community Benefit: Projects should demonstrably benefit the community, either through job creation, improved infrastructure, enhanced quality of life, or other positive impacts.

* Environmental Impact: Environmental considerations are increasingly important, with many jurisdictions requiring environmental reviews and mitigation measures for TIF projects.

Limitations and Restrictions on TIF Fund Usage

While TIF offers flexibility, there are typically restrictions on how the funds can be used. These restrictions often aim to prevent misuse and ensure that funds are used for their intended purpose.

* Prohibited Uses: TIF funds are generally not allowed to be used for operating expenses, such as salaries or routine maintenance. They are typically restricted to capital projects that create lasting improvements.

* Matching Funds: Some jurisdictions require matching funds from private sources, ensuring that public funds are leveraged to maximize the impact of the investment.

* Transparency and Accountability: TIF programs are subject to transparency and accountability requirements, often involving regular reporting and audits to ensure proper use of public funds. This can include public hearings and community input opportunities.

Transparency and Accountability in TIF

Tax Increment Financing (TIF) districts, while intended to stimulate economic growth, can be susceptible to misuse if transparency and accountability mechanisms are weak. Public trust and the effective use of taxpayer dollars depend heavily on open and verifiable processes throughout the life of a TIF district. A lack of transparency can lead to public skepticism and ultimately undermine the intended benefits of the program.

Transparency and accountability are crucial for ensuring that TIF funds are used effectively and ethically, fostering public trust and preventing potential abuses. Without robust mechanisms in place, there’s a risk that TIF projects could benefit a select few rather than the broader community. This can manifest as favoritism in project selection, inflated costs, or a lack of demonstrable community benefit.

Mechanisms for Ensuring Transparency and Accountability

Several mechanisms can be implemented to ensure transparency and accountability in TIF programs. These measures promote public understanding and allow for scrutiny of the process, fostering confidence in the responsible use of public funds. A multi-faceted approach is generally required for optimal effectiveness.

- Public Hearings and Meetings: Regularly scheduled public hearings and meetings provide opportunities for community members to voice their concerns, ask questions, and provide input on proposed TIF projects. These meetings should be well-advertised and easily accessible to the public. Minutes from these meetings should be meticulously recorded and made publicly available.

- Independent Audits: Independent financial audits of TIF funds should be conducted annually by qualified and unbiased third-party auditors. These audits should thoroughly examine all aspects of TIF finances, including revenue collection, expenditure tracking, and project performance. The audit reports should be made publicly available and should include detailed findings and recommendations.

- Publicly Accessible Data: All TIF-related data, including project proposals, budgets, contracts, and financial statements, should be readily accessible to the public online. This ensures that anyone can scrutinize the use of TIF funds and assess the effectiveness of TIF projects. A user-friendly online portal is ideal for this purpose.

- Performance Reporting: Regular performance reports should be published that clearly Artikel the progress of TIF projects, including key metrics such as job creation, property value increases, and tax revenue generated. These reports should compare actual results to projected outcomes, highlighting any discrepancies and providing explanations.

Challenges in Ensuring Transparency and Accountability

Despite the importance of transparency and accountability, several challenges can hinder their effective implementation in TIF programs. Addressing these challenges proactively is essential for maintaining public trust and ensuring the program’s integrity.

- Complexity of TIF Regulations: The complex nature of TIF regulations can make it difficult for the public to understand how the program works and to effectively monitor its activities. Simplified explanations and easily accessible information are crucial for overcoming this challenge.

- Lack of Public Awareness: Many citizens are unaware of TIF programs and their implications, limiting their ability to participate in the process and hold officials accountable. Public education campaigns can help address this.

- Political Influence: Political influence can sometimes lead to decisions that prioritize the interests of certain stakeholders over the broader community’s needs. Strong ethical guidelines and independent oversight mechanisms are essential to mitigate this risk.

- Data Limitations: Accurate and comprehensive data may not always be readily available, making it difficult to assess the effectiveness of TIF projects. Improved data collection and reporting practices are needed.

Best Practices for Promoting Transparency and Accountability

Implementing best practices can significantly enhance transparency and accountability in TIF programs. These practices are crucial for ensuring the program’s long-term success and maintaining public trust.

- Establish a Clear and Concise TIF Policy: A well-defined policy that Artikels clear guidelines for project selection, funding allocation, and performance evaluation is essential. This policy should be publicly available and easily understandable.

- Independent Oversight Board: An independent oversight board, composed of community members and experts, can provide valuable scrutiny of TIF activities and ensure that decisions are made in the best interests of the community.

- Citizen Participation Initiatives: Actively engaging the public through surveys, focus groups, and other participatory methods can help ensure that TIF projects align with community priorities.

- Technology for Data Accessibility: Utilizing technology to make TIF data easily accessible to the public, such as through user-friendly online portals and interactive data dashboards, can significantly enhance transparency.

Tim Redaksi