Methods for Selling a Financed Car

Selling a car with an outstanding loan requires careful planning and understanding of the available options. The primary methods involve selling through a dealership or privately to an individual buyer. Each approach presents unique advantages, disadvantages, and logistical considerations.

Selling a Financed Car Through a Dealership

Dealerships offer a streamlined process for selling a financed vehicle. You’ll typically bring your car to the dealership for an appraisal, where they assess its value considering its make, model, year, mileage, and condition. If they’re interested, they’ll make you an offer. The dealership handles the paperwork, including paying off your loan directly from the sale proceeds. This eliminates the need for you to manage the loan payoff yourself. However, dealerships generally offer lower prices than private sales because they need to factor in their profit margin and reconditioning costs.

Advantages and Disadvantages of Private Party Sales

Selling your financed car privately offers the potential for a higher sale price compared to a dealership. You retain more control over the negotiation process and can potentially receive an offer closer to the car’s market value. However, private sales require more effort. You’ll be responsible for advertising the vehicle, managing inquiries from potential buyers, arranging test drives, negotiating the sale price, and handling the paperwork, including the payoff of your loan. You’ll also need to be cautious about security and managing the transaction safely.

Comparison of Dealership and Private Buyer Sales

Selling to a dealership is faster and simpler, with less hassle involved in the sales process. The dealership handles much of the paperwork and the loan payoff, providing a more convenient experience. However, you’ll likely receive a lower selling price. Selling privately requires more effort and time but allows for potentially higher returns. The trade-off lies between convenience and maximizing your profit.

Necessary Documentation for Both Sales Methods

For both dealership and private sales, you will need the car’s title (showing the lienholder), proof of insurance, and vehicle maintenance records. For private sales, you’ll also need to prepare a bill of sale and possibly handle the transfer of ownership paperwork. Dealerships usually manage these aspects themselves. Additionally, you’ll need to provide your loan details, including the payoff amount, to the dealership or buyer, so the loan can be settled.

Fees and Timelines Comparison

| Method | Fees | Timelines | Advantages |

|---|---|---|---|

| Dealership Sale | Dealership fees (varies), potentially lower sale price. | Typically faster, often within a few days to a week. | Convenience, streamlined process, no direct loan payoff management. |

| Private Sale | Advertising costs (if any), potential for higher sale price. | Can take several weeks or even months depending on market conditions and buyer interest. | Potentially higher sale price, more control over the sale process. |

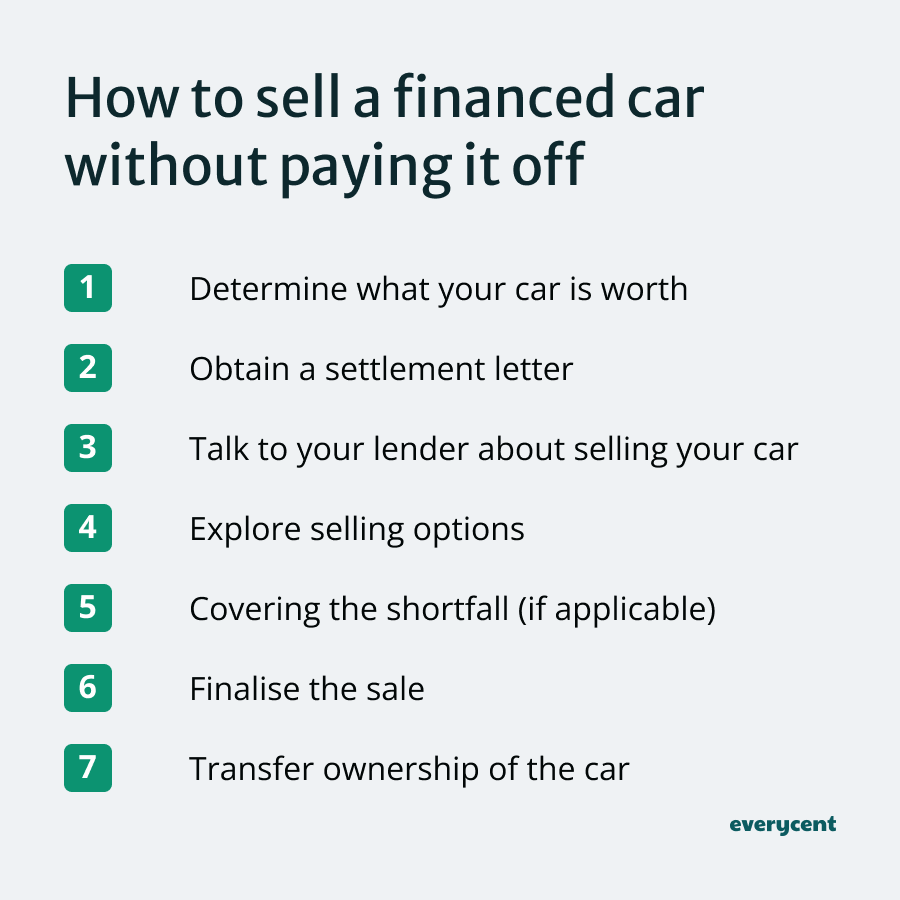

Negotiating with the Lender: How To Sell A Financed Car Without Paying It Off

Negotiating a payoff amount with your lender when selling a financed car requires a strategic approach. Understanding your options and communicating effectively are key to a successful outcome. This section will explore strategies for negotiating a payoff, determining financial feasibility, and handling potential lender restrictions.

Negotiating a Payoff Amount with the Lender

Successfully negotiating a lower payoff amount is challenging but possible. It often hinges on your creditworthiness, the car’s current market value, and your lender’s willingness to compromise. A strong negotiating position is built on demonstrating a clear understanding of the vehicle’s market value and your financial situation.

Determining Financial Feasibility of a Buyout

Before initiating negotiations, assess the financial viability of buying out the loan. This involves comparing the remaining loan balance to the car’s market value. A positive difference indicates potential profit after selling; a negative difference suggests a potential loss. For example, if the remaining loan balance is $10,000 and the car’s market value is $12,000, you stand to make $2,000 after paying off the loan. Conversely, a $10,000 loan balance and an $8,000 market value mean a $2,000 loss.

Effective Communication Techniques with Lenders

Clear, concise, and respectful communication is crucial. Begin by requesting a payoff quote in writing (see sample letter below). Then, present your case calmly and professionally, highlighting the car’s market value and your intention to sell. Avoid aggressive tactics; a collaborative approach is more likely to yield positive results. For instance, if the market value is significantly higher than the payoff amount, you can politely suggest a mutually beneficial agreement.

Potential Scenarios and Responses to Lender Restrictions

Lenders may impose restrictions, such as requiring the payoff be made directly to them or specifying payment methods. Understanding these restrictions beforehand prevents delays and ensures a smooth transaction. For example, if a lender requires a cashier’s check, prepare this in advance. If they only accept payments directly, you’ll need to coordinate the sale and payment accordingly. Always confirm the lender’s exact requirements in writing to avoid misunderstandings.

Sample Letter Requesting Payoff Quote

To [Lender Name],

I am writing to request a payoff quote for loan account number [Loan Account Number] secured by my vehicle, [Vehicle Year, Make, and Model], VIN [Vehicle Identification Number]. I intend to sell the vehicle and require the exact payoff amount to finalize the transaction. Please provide this quote in writing, including any applicable prepayment penalties or fees. I can be reached at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

[Your Address]

Financial Implications and Considerations

Selling a financed car without paying it off involves several financial complexities. Understanding these implications is crucial to making an informed decision and avoiding unexpected costs. Failure to properly assess these factors can lead to significant financial losses.

Potential Financial Penalties for Early Payoff

Many auto loans include prepayment penalties, which are fees charged for paying off the loan early. These penalties can vary significantly depending on the lender and the terms of the loan agreement. Some lenders may charge a percentage of the remaining loan balance, while others might have a fixed fee. It’s essential to carefully review your loan contract to determine if such a penalty applies and how it’s calculated. For example, a loan with a 2% prepayment penalty on a remaining balance of $10,000 would result in a $200 penalty. This penalty should be factored into your overall calculation of the profit from the sale.

Implications of Negative Equity

Negative equity, also known as being “upside down” on your loan, occurs when you owe more on your car loan than the vehicle is currently worth. This is a common scenario, especially in the early years of a loan. If you sell your car for less than what you owe, you’ll still be responsible for the difference. For instance, if you owe $15,000 on your car but it only sells for $12,000, you’ll still owe the lender $3,000. This amount may need to be paid immediately or rolled into a new loan, potentially increasing your overall debt.

Calculating the Total Cost of Selling a Financed Vehicle, How to sell a financed car without paying it off

Calculating the total cost involves several steps. First, determine the sale price of your vehicle. Then, subtract any selling fees, such as those charged by a dealership or online marketplace. Next, deduct the remaining loan balance, including any prepayment penalties. Finally, subtract any negative equity. The result is your net profit (or loss). For example: Sale Price: $12,000 – Selling Fees: $500 – Remaining Loan Balance: $10,000 – Prepayment Penalty: $200 = Net Profit: $1300.

Potential Tax Implications Related to the Sale

Selling a car can have tax implications, particularly if you make a profit. The profit from the sale (the difference between the sale price and your adjusted basis – the original purchase price minus depreciation) may be considered a capital gain, subject to income tax. However, if the sale results in a loss, you generally can’t deduct that loss from your income taxes. Consult a tax professional for personalized advice based on your specific situation and applicable tax laws.

Potential Hidden Costs Associated with Selling a Financed Car

Several hidden costs can unexpectedly impact your profit.

- Early termination fees: Beyond prepayment penalties, some lenders charge additional fees for early loan termination.

- Gap insurance repayment: If you have gap insurance, you might need to repay a portion or the full amount upon selling the vehicle.

- Document preparation fees: These fees can be associated with transferring the title and handling paperwork.

- Advertising and marketing costs: Selling privately may involve expenses for advertising your vehicle.

- Vehicle preparation costs: Costs associated with cleaning, detailing, or minor repairs to increase the vehicle’s appeal.

Tim Redaksi