Determining Your Car’s Current Value: How To Sell A Car That Is Still Financed

Selling a car with an outstanding loan requires a clear understanding of its current market value. Accurately assessing this value is crucial for negotiating a fair price with a buyer and ensuring a smooth transaction. This involves considering several factors and utilizing various valuation methods.

Methods for Assessing Market Value

Several methods exist to determine your car’s market value. These methods utilize readily available online resources and consider key factors such as mileage, condition, and features. Ignoring any of these can lead to an inaccurate valuation and potentially impact your sale price. The most reliable approach often involves combining several methods to arrive at a realistic figure.

Online Valuation Tools

Numerous online tools provide estimated values for used cars. These tools typically require you to input details such as the year, make, model, trim level, mileage, and condition of your vehicle. While these tools offer a convenient starting point, it’s important to remember that they provide estimates, not definitive values. The accuracy of these estimates can vary depending on the tool and the data it uses. Consider using several tools for a more comprehensive picture.

| Tool | Pros | Cons |

|---|---|---|

| Kelley Blue Book (KBB) | Widely recognized, detailed reports, considers condition | May not reflect regional variations in pricing |

| Edmunds | Provides fair market range, considers options and features | Can be less user-friendly than some other tools |

| NADAguides | Offers trade-in and retail values, extensive database | Interface can be less intuitive for new users |

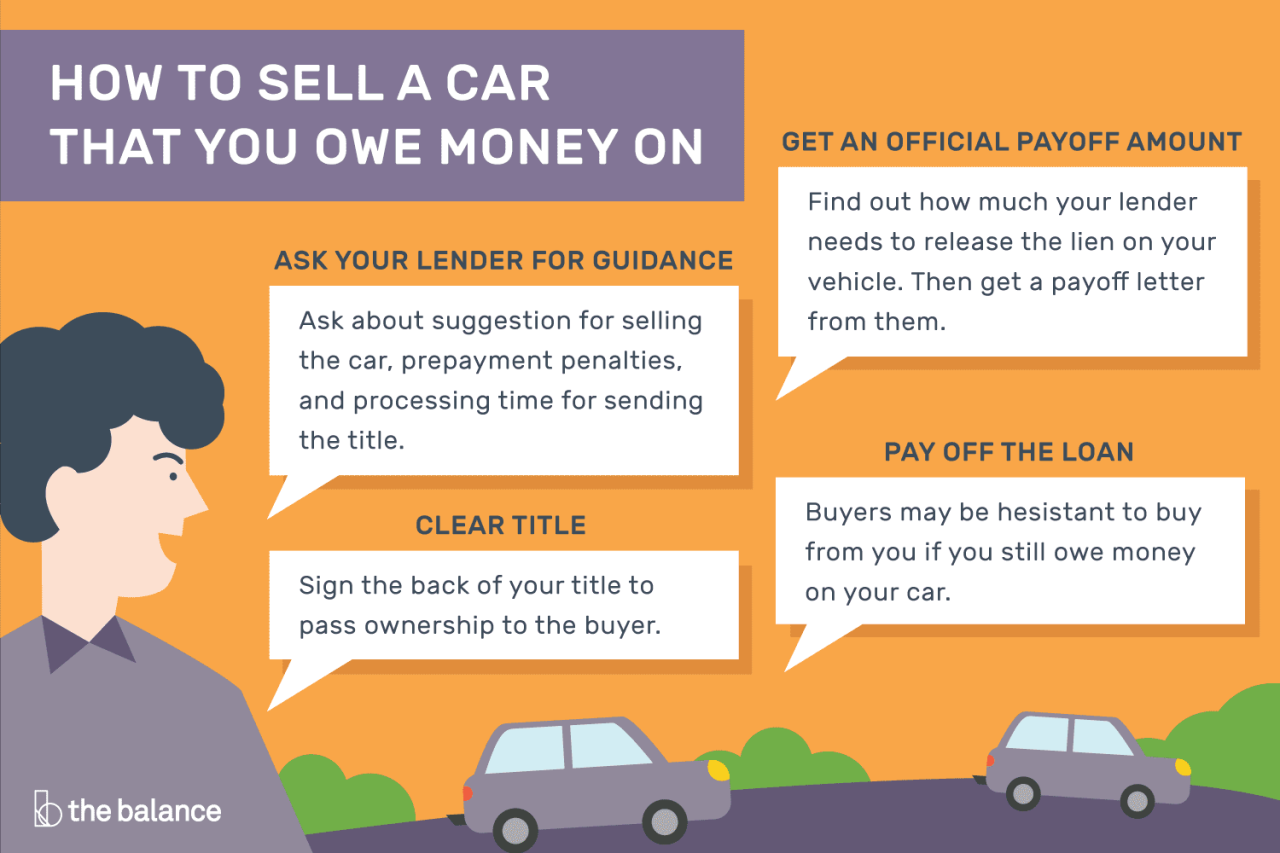

Determining Your Loan Payoff Amount

Accurately determining your loan payoff amount is equally vital. This figure represents the total amount you owe on your car loan, including principal, interest, and any applicable fees. Discrepancies between the payoff amount and the market value significantly influence your selling strategy.

Step-by-Step Guide to Determining Loan Payoff

- Check your loan documents: Your loan agreement should specify the total loan amount, interest rate, and repayment schedule. This information provides a starting point for calculating your payoff.

- Contact your lender directly: The most accurate way to determine your payoff amount is to contact your lender (bank or credit union) directly. Request a payoff quote, which will specify the exact amount needed to settle your loan in full. This typically includes any accrued interest up to the date of the request.

- Review your online account (if available): Many lenders offer online account access, where you can often find an estimate of your current loan balance and payoff amount. However, always confirm this figure with your lender for accuracy.

Understanding the Difference Between Market Value and Loan Payoff

The difference between your car’s market value and your loan payoff amount is crucial. If the market value is higher than the payoff amount, you have positive equity. This means you can potentially profit from the sale after paying off the loan. Conversely, if the payoff amount exceeds the market value, you have negative equity (also known as being “underwater”). In this scenario, you’ll need to cover the difference out of pocket to pay off the loan. Understanding this difference is essential for making informed decisions about selling your car.

Knowing the difference between your car’s market value and your loan payoff amount is critical for determining your financial position and negotiating a fair sale price.

Exploring Sale Options

Selling a financed car presents unique challenges, requiring careful consideration of your options. Primarily, you’ll need to decide between selling privately or trading it in at a dealership. Both methods have their own set of advantages and disadvantages, influencing your potential profit and the overall convenience of the process. Understanding these differences is crucial for making an informed decision.

Private Sale Versus Dealership Trade-In

Choosing between selling your car privately or trading it in at a dealership involves weighing several factors. Each option offers distinct benefits and drawbacks that directly impact your financial outcome and the time investment required.

- Private Sale: Advantages Generally yields a higher profit due to the absence of dealership markups. Offers greater control over the selling process, allowing you to set your own price and negotiate directly with potential buyers.

- Private Sale: Disadvantages Requires more effort in advertising, showing the car, and handling negotiations. Involves a higher risk of dealing with unreliable buyers or encountering difficulties in the paperwork process. May take longer to sell the vehicle compared to a trade-in.

- Dealership Trade-In: Advantages A simpler and quicker process, eliminating the need for advertising and managing individual buyers. Often involves less paperwork and a smoother transaction. Provides a more immediate return on your investment.

- Dealership Trade-In: Disadvantages Typically results in a lower selling price compared to a private sale, as dealerships aim to profit from reselling the vehicle. Less control over the final sale price and terms. May require accepting a lower offer to expedite the process of purchasing a new vehicle from the dealership.

Selling Your Car Privately

Selling your car privately involves several key steps, from advertising to handling negotiations and finalizing the sale. Effective strategies can significantly improve your chances of achieving a favorable outcome.

Advertising your car effectively is paramount. Consider using online classifieds websites (such as Craigslist, Facebook Marketplace, or specialized automotive websites), and potentially local newspapers or community bulletin boards. High-quality photos showcasing the car’s condition are essential. Your advertisement should include detailed information about the vehicle, including its year, make, model, mileage, features, and any relevant maintenance history. Be upfront about the existing financing. Clearly state the payoff amount and your preferred method of payment (cash, cashier’s check, certified funds).

Negotiations are an inherent part of the private sale process. Research comparable vehicles to determine a fair asking price. Be prepared to negotiate but avoid drastically lowering your price unless absolutely necessary. It’s advisable to have a clear understanding of your minimum acceptable price before engaging in negotiations. Verify the buyer’s identity and payment method before transferring ownership.

Maximizing Profit in a Private Sale, How to sell a car that is still financed

To maximize your profit when selling privately, meticulous preparation is key. Thoroughly detail and document any repairs or maintenance performed on the vehicle. This transparency builds trust and can justify a higher asking price. Consider professional detailing to enhance the car’s appearance and appeal to potential buyers. A well-maintained car with a clean history is more likely to command a higher price. Remember that presenting a meticulously cleaned and detailed car increases its perceived value. For example, a car detailed to a showroom standard might fetch a higher price than one that is merely clean. This added perceived value can easily outweigh the cost of professional detailing. Finally, be patient and persistent. Finding the right buyer may take time, but it’s worth the effort to achieve the best possible price.

Negotiating with Buyers and Dealers

Selling a car with an outstanding loan requires skillful negotiation, whether you’re dealing with individual buyers or dealerships. Understanding your leverage and employing effective strategies can significantly impact the final sale price and overall experience. This section Artikels tactics for successful negotiations in both scenarios.

Negotiating with Private Buyers

Negotiating with private buyers often involves a more personal approach. Effective communication and a willingness to compromise are crucial. Remember that the buyer’s perception of value is key. Setting a fair price based on your car’s condition and market value is the foundation for a successful negotiation. You should also be prepared to address any concerns or questions the buyer might have thoroughly and honestly. Transparency builds trust and increases the likelihood of a successful sale.

Handling Lowball Offers and Counteroffers

Lowball offers are common. Instead of immediately rejecting them, consider the offer’s context. Is it significantly below market value, or just slightly less than your asking price? A polite but firm response is essential. For example, you might say, “I appreciate your offer, but based on the car’s condition and current market prices, I’m aiming for [your counteroffer price]. I’m open to reasonable negotiation, but this price reflects the value I’ve assessed.” Counteroffers should be well-reasoned and justified, referencing comparable vehicles or recent sales. Avoid emotional responses; maintain a professional demeanor throughout the process.

Negotiating a Trade-in with a Dealership

Trading in a financed vehicle at a dealership involves a different dynamic. The dealership will assess your car’s value, considering its condition, mileage, and market demand. They will likely factor in the remaining loan balance. Before going to the dealership, it is helpful to have a clear understanding of your loan payoff amount and the car’s estimated trade-in value from independent sources. This will allow you to approach the negotiation from a position of informed strength.

Sample Dealership Trade-in Conversation Script

“Hello, I’m interested in trading in my [Year] [Make] [Model] for a [Year] [Make] [Model]. I have a loan outstanding on my current vehicle, with a payoff amount of approximately [Amount]. Based on my research, I believe the trade-in value of my car is around [Amount]. I’d like to understand your appraisal of my vehicle and discuss how we can proceed with the trade-in, considering the outstanding loan.”

This approach is direct and provides the dealership with the necessary information upfront. Be prepared to discuss the car’s features, maintenance history, and any relevant details. Listen attentively to the dealership’s appraisal and be ready to negotiate within a reasonable range, but remember to advocate for your car’s fair value. Don’t be afraid to walk away if the offer is unsatisfactory; other dealerships may be willing to offer a better deal.

Preparing Your Car for Sale

Presenting your car in the best possible light significantly increases its appeal to potential buyers. A clean, well-maintained vehicle commands a higher price and inspires greater confidence. Thorough preparation demonstrates your care and attention to detail, making a positive first impression crucial for a successful sale.

How to sell a car that is still financed – Preparing your car for sale involves a multi-step process encompassing cleaning, detailing, and addressing any necessary repairs. This preparation not only enhances the car’s visual appeal but also allows potential buyers to focus on its mechanical soundness and overall condition. A well-prepared car shows that you’ve taken pride in its ownership, increasing the likelihood of a faster and more profitable sale.

Pre-Sale Car Preparation Checklist

This checklist Artikels essential steps to maximize your car’s presentation and marketability. Completing each item will significantly improve your chances of a quick and successful sale.

- Exterior Cleaning: Wash the entire car thoroughly, paying attention to wheels, tires, and undercarriage. Use a quality car wash soap and avoid harsh chemicals.

- Interior Cleaning: Vacuum thoroughly, clean all surfaces (dashboard, door panels, etc.), and shampoo carpets and upholstery if necessary. Remove any personal belongings.

- Minor Repairs: Address any small dents, scratches, or broken parts. These minor imperfections can be easily fixed and significantly impact the overall impression.

- Mechanical Check: Ensure all lights, wipers, and other mechanical components are functioning correctly. A smooth test drive is essential.

- Detailing: Consider professional detailing for a showroom-ready finish. This includes polishing, waxing, and potentially paint correction.

- Documentation: Gather all necessary documents, including the title, maintenance records, and any relevant paperwork.

Professional Car Detailing Services and Costs

Professional detailing services offer a range of options, from basic washes to comprehensive packages addressing paint correction, interior restoration, and engine detailing. The cost varies greatly depending on the service chosen, the vehicle’s size, and the location.

A basic wash and wax might cost between $50 and $150, while a full detail including paint correction and interior restoration can range from $200 to $800 or more. Specialty services like ceramic coating add to the overall cost. It’s advisable to obtain quotes from several detailers before making a decision.

Taking High-Quality Photographs of Your Car

High-quality photographs are crucial for attracting potential buyers online. Well-lit images showcasing the car’s best features can significantly increase interest and ultimately lead to a quicker sale. Consider these aspects when taking pictures:

- Lighting: Shoot outdoors on a bright, overcast day to avoid harsh shadows. Avoid direct sunlight, which can create glare and wash out colors.

- Angles: Take multiple photos from various angles, including front, side, rear, and interior shots. Highlight key features and avoid distracting backgrounds.

- Cleanliness: Ensure the car is impeccably clean before taking photos. Even minor imperfections will be magnified in the images.

- Editing: Use photo editing software to enhance the images slightly, correcting brightness, contrast, and sharpness. Avoid over-editing, which can make the car look unnatural.

Tim Redaksi