Required Education and Certifications

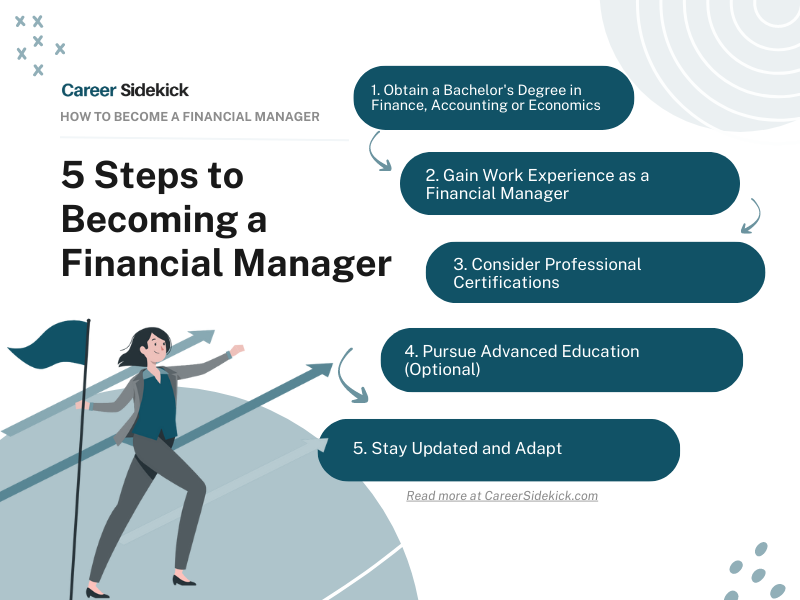

Aspiring finance managers typically need a strong educational foundation and may choose to pursue additional certifications to enhance their career prospects. The path to becoming a finance manager isn’t a one-size-fits-all approach; various educational routes lead to success in this field. Understanding the advantages and disadvantages of each path is crucial for making an informed decision.

How to become a finance manager – Several educational paths can prepare individuals for a career in finance management. These range from undergraduate degrees focusing on finance or accounting to postgraduate programs like MBAs or specialized Master’s degrees in finance. Further professional certifications can significantly boost one’s credentials and marketability.

Educational Paths for Finance Managers

The most common educational routes to becoming a finance manager are detailed below. Each option offers a unique set of benefits and drawbacks, which should be carefully considered based on individual circumstances and career goals.

| Degree Type | Required Time Commitment | Cost | Career Prospects |

|---|---|---|---|

| Bachelor’s Degree in Finance/Accounting | 4 years | Varies widely by institution; generally less expensive than postgraduate degrees | Entry-level finance roles, potential for advancement with experience and further education |

| Master of Business Administration (MBA) | 2 years (full-time); variable for part-time programs | Significantly more expensive than a bachelor’s degree | Strong career advancement opportunities, access to senior management roles |

| Master of Science in Finance (MSF) | 1-2 years | Comparable to an MBA, but may vary | Specialized finance roles, particularly in investment banking, portfolio management, or financial analysis |

Coursework and Skills Gained

The specific coursework and skills gained in each educational path are tailored to prepare graduates for different aspects of finance management. This section highlights the key areas of focus for each degree type.

A Bachelor’s Degree in Finance or Accounting typically covers foundational topics such as financial accounting, managerial accounting, corporate finance, investments, and financial modeling. Students develop skills in financial statement analysis, budgeting, forecasting, and basic financial modeling. These skills are essential for entry-level finance positions.

An MBA provides a broader business perspective, incorporating courses in strategy, marketing, operations, and human resources alongside finance-specific modules. This holistic approach equips graduates with the leadership and management skills necessary for senior finance roles. Students often engage in case studies and simulations, honing their strategic thinking and decision-making abilities.

An MSF offers a more specialized and in-depth exploration of finance topics. Common coursework includes advanced corporate finance, financial markets, portfolio management, derivatives, and quantitative finance. Students develop advanced analytical and modeling skills, making them highly sought after for roles requiring specialized financial expertise.

Relevant Certifications

While not always mandatory, professional certifications can significantly enhance the credentials of finance managers. Two prominent examples are the Chartered Financial Analyst (CFA) and the Certified Public Accountant (CPA) designations.

The CFA charter is globally recognized and highly valued in the investment management industry. The rigorous curriculum covers investment analysis, portfolio management, and ethical considerations. Obtaining the CFA charter demonstrates a commitment to professional excellence and a deep understanding of investment principles.

The CPA designation is primarily focused on accounting and auditing. While not directly required for all finance management roles, it is highly beneficial for those working in roles with significant accounting responsibilities. The CPA credential signifies competence in financial reporting, auditing, and tax compliance.

Necessary Skills and Experience

Becoming a successful finance manager requires a blend of hard and soft skills, coupled with relevant practical experience. This section details the key competencies needed and provides a roadmap for acquiring them. A strong foundation in both areas is crucial for navigating the complexities of financial management and achieving career advancement.

Finance managers need a diverse skillset to succeed. This includes both the technical abilities to analyze financial data and the interpersonal skills to lead and collaborate effectively within a team. The ability to effectively communicate complex financial information to both financial and non-financial audiences is also paramount.

Essential Soft Skills

Strong soft skills are critical for effective leadership and team management within a finance department. These skills enhance collaboration, communication, and overall team performance, directly impacting the success of financial strategies and projects.

- Leadership: Finance managers guide and motivate teams, delegating tasks effectively and providing constructive feedback. They create a positive and productive work environment.

- Communication: Clearly and concisely conveying complex financial information to various stakeholders (senior management, team members, clients) is essential. This includes written and verbal communication, as well as data visualization.

- Problem-solving: Analyzing financial problems, identifying root causes, and developing effective solutions are vital. This often involves creative thinking and a systematic approach to decision-making.

- Teamwork and Collaboration: Finance managers work closely with other departments, requiring strong collaboration and interpersonal skills to achieve shared goals. Effective teamwork leads to more efficient and effective financial processes.

- Decision-making: Making timely and informed decisions based on financial data and analysis is crucial. This involves weighing risks and rewards, and considering various perspectives.

Essential Hard Skills

Technical expertise forms the bedrock of a finance manager’s capabilities. Proficiency in these areas allows for accurate financial analysis, planning, and control, leading to better decision-making and improved financial performance.

- Financial Modeling: Building and using financial models (e.g., discounted cash flow analysis, valuation models) to forecast future performance and assess investment opportunities. This often involves using software like Excel or specialized financial modeling programs.

- Budgeting and Forecasting: Creating and managing budgets, forecasting future revenues and expenses, and monitoring actual performance against forecasts. This requires strong analytical skills and attention to detail.

- Accounting Principles: A solid understanding of generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) is crucial for accurate financial reporting and analysis. This often involves experience with accounting software.

- Financial Analysis: Analyzing financial statements (balance sheets, income statements, cash flow statements) to assess financial health, identify trends, and make informed decisions. Ratio analysis and trend analysis are key techniques.

- Investment Analysis: Evaluating investment opportunities, assessing risk and return, and making recommendations based on financial analysis. This may involve understanding different asset classes and investment strategies.

Acquiring Hard Skills

Hard skills are often developed through formal education, professional certifications, and on-the-job training. There are many avenues to gain the necessary expertise.

- Formal Education: A bachelor’s or master’s degree in finance, accounting, or a related field provides a strong foundation. Many universities offer specialized finance courses and programs.

- Professional Certifications: Certifications such as the Chartered Financial Analyst (CFA) or Certified Management Accountant (CMA) demonstrate advanced knowledge and skills, enhancing career prospects.

- Online Courses and Workshops: Numerous online platforms offer courses and workshops on specific finance topics, allowing for targeted skill development.

- On-the-Job Training: Practical experience is invaluable. Many finance roles offer opportunities to learn and develop skills through mentorship and hands-on projects.

Gaining Practical Experience

Practical experience is crucial for applying theoretical knowledge and developing essential skills. A structured approach to gaining experience is key to building a strong resume and demonstrating competency to potential employers.

- Internships: Seek internships in finance departments of companies or financial institutions. These provide valuable hands-on experience and networking opportunities.

- Entry-Level Positions: Consider entry-level roles such as financial analyst or accounting assistant. These roles offer a stepping stone to more senior positions.

- Volunteer Work: Volunteer positions with non-profit organizations can provide exposure to financial management in a different context, building relevant skills.

- Networking: Attend industry events, connect with professionals on LinkedIn, and build relationships within the finance community. Networking can lead to valuable opportunities.

Career Progression and Advancement

A career in finance management offers a clear path for professional growth, with opportunities for increased responsibility, higher earning potential, and greater influence within an organization. Progression often involves taking on more complex roles and managing larger budgets or teams. The specific trajectory, however, can vary based on individual skills, experience, and career goals.

A finance manager’s career can follow several distinct paths, depending on their interests and the opportunities available within their company or industry. Advancement frequently involves increased scope and responsibility, moving from managing specific functions to overseeing broader financial operations. Salary expectations naturally increase with experience and seniority.

Potential Career Paths for Finance Managers

The career path of a finance manager is not linear; it’s often shaped by individual skills and company needs. However, a common progression might involve starting as a financial analyst, moving to a budget manager role, and eventually becoming a senior finance manager or even a CFO. Lateral moves into specialized areas like investment management or risk management are also possible. For instance, a skilled budget manager might move into a senior role overseeing multiple departments’ budgets, demonstrating expertise in financial planning and analysis. Alternatively, a strong financial analyst with a knack for investment could transition into portfolio management.

Types of Finance Management Roles

Several distinct roles exist within the broader field of finance management. Each requires a unique skillset and level of experience.

- Budget Manager: Responsible for creating, monitoring, and managing an organization’s budget. This involves forecasting revenue and expenses, tracking performance against budget, and identifying areas for cost savings. A budget manager at a large corporation might oversee millions of dollars in annual spending, requiring strong analytical and communication skills to effectively present financial data to senior management.

- Financial Analyst: Analyzes financial data to provide insights for strategic decision-making. This involves financial modeling, forecasting, and valuation. A financial analyst in the investment banking sector might be responsible for conducting due diligence on potential investments, requiring a deep understanding of financial statements and valuation techniques. They may work on mergers and acquisitions, preparing financial models and presentations for potential buyers or sellers.

- Investment Manager: Responsible for managing investment portfolios, selecting and monitoring investments, and maximizing returns. An investment manager at a mutual fund company, for example, would need to understand market trends, risk management, and investment strategies to build and maintain a diverse portfolio aligned with the fund’s objectives. This role often requires a strong understanding of financial markets and investment vehicles.

- Controller: Oversees the accounting function of an organization, ensuring accurate financial reporting and compliance with regulations. A controller at a publicly traded company might be responsible for preparing financial statements in accordance with Generally Accepted Accounting Principles (GAAP), interacting with external auditors, and managing a team of accountants.

Salary Expectations and Benefits, How to become a finance manager

Salary expectations for finance managers vary widely based on factors such as experience, location, industry, company size, and specific role. However, it’s possible to provide a general overview. Entry-level finance roles like financial analysts typically start in a lower salary range, often between $50,000 and $80,000 annually, depending on location and education. As experience grows and individuals move into managerial positions, salaries can increase significantly. A mid-career finance manager can expect a salary range of $80,000 to $150,000 or more, while senior finance managers and CFOs can earn significantly higher salaries, potentially exceeding $200,000 annually, sometimes reaching millions depending on the size and performance of the company. Benefits packages typically include health insurance, retirement plans, paid time off, and other perks. Senior roles often include stock options or bonuses tied to company performance. For instance, a CFO of a large, publicly traded company might receive a substantial bonus based on the company’s annual earnings.

Industry Trends and Future Outlook: How To Become A Finance Manager

The finance management profession is undergoing a rapid transformation driven by technological advancements and evolving business needs. Understanding these trends is crucial for aspiring and current finance managers to remain competitive and relevant in the dynamic landscape of the modern business world. The increasing complexity of financial markets, coupled with the rise of data-driven decision-making, necessitates a new set of skills and approaches.

The integration of emerging technologies like artificial intelligence (AI) and big data analytics is significantly impacting the finance management profession. These technologies are automating routine tasks, improving accuracy, and enabling more sophisticated financial analysis and forecasting. This shift is not just about technological adoption; it requires a fundamental change in how finance managers approach their work, focusing more on strategic thinking, data interpretation, and risk management in a rapidly changing environment.

Impact of Emerging Technologies on Finance Management

AI and big data analytics are reshaping the finance function in several key ways. AI-powered tools are automating tasks such as invoice processing, reconciliation, and financial reporting, freeing up finance managers to focus on higher-value activities like strategic planning and financial modeling. Big data analytics provides insights into market trends, customer behavior, and risk factors, allowing for more informed decision-making. For example, AI-driven fraud detection systems are becoming increasingly sophisticated, reducing financial losses and enhancing security. Similarly, predictive analytics helps businesses forecast future financial performance with greater accuracy, leading to better resource allocation and investment strategies. The use of Robotic Process Automation (RPA) is streamlining many repetitive tasks, increasing efficiency and reducing human error. This technological shift demands that finance managers develop proficiency in data analysis, interpretation of algorithms and understanding the limitations of AI-driven tools.

Evolving Demands and Skills for Future Finance Managers

The future finance manager will need a diverse skillset that blends traditional financial expertise with technological proficiency and strategic thinking. Beyond core accounting and finance principles, proficiency in data analytics, programming languages (like Python or R), and cloud computing platforms (like AWS or Azure) will be increasingly essential. Strong communication and interpersonal skills remain vital for collaboration and stakeholder management. Critical thinking and problem-solving abilities are paramount, particularly in navigating the complexities of the modern financial environment. Adaptability and a continuous learning mindset are also crucial, as the technological landscape continues to evolve. The demand for professionals with expertise in areas like cybersecurity and regulatory compliance will also grow significantly. For instance, a finance manager in the fintech industry needs to be well-versed in blockchain technology and its implications for financial transactions.

A Day in the Life of a Finance Manager in the Technology Industry

A finance manager in a rapidly growing technology company might begin their day reviewing key performance indicators (KPIs) from the previous day, focusing on revenue, expenses, and cash flow. They would then participate in a cross-functional meeting with sales, marketing, and product development teams to discuss budgeting and forecasting for upcoming projects. A significant portion of the day could be dedicated to analyzing financial data using specialized software, identifying trends, and preparing reports for senior management. This could involve building financial models to evaluate the feasibility of new product launches or acquisitions. They might also be involved in managing the company’s investment portfolio and exploring opportunities for strategic investments. Throughout the day, they would be responding to ad-hoc requests from various departments, providing financial guidance, and addressing any urgent financial issues. Challenges might include managing rapid growth, dealing with complex financial regulations, and ensuring accurate and timely financial reporting in a fast-paced, dynamic environment. They would need to constantly adapt to changing market conditions and technological advancements, while effectively communicating financial information to both financial and non-financial stakeholders.

Continuing Professional Development

The finance management field is constantly evolving, driven by technological advancements, shifting regulatory landscapes, and dynamic market conditions. Therefore, continuous learning and professional development are not merely beneficial; they are essential for maintaining competitiveness and career advancement. A commitment to ongoing learning demonstrates dedication, adaptability, and a proactive approach to professional growth, significantly enhancing a finance manager’s value to their organization.

Staying abreast of current trends, regulations, and best practices is crucial for effective decision-making and risk mitigation. Failure to do so can lead to outdated strategies, compliance issues, and missed opportunities. Furthermore, continuous learning allows finance managers to refine existing skills, acquire new ones, and adapt to the changing demands of the profession. This adaptability ensures long-term career success and positions them as leaders in their field.

Resources for Ongoing Professional Development

Numerous resources exist to support continuous professional development for finance managers. These options cater to diverse learning styles and schedules, offering flexibility and accessibility. Strategic selection of resources based on individual needs and career goals is key to maximizing the impact of professional development efforts.

- Professional Organizations: Organizations such as the Association for Financial Professionals (AFP), the Chartered Institute of Management Accountants (CIMA), and the Institute of Internal Auditors (IIA) offer a wealth of resources, including conferences, webinars, and online courses tailored to finance professionals. Many provide access to professional journals and networking opportunities.

- Online Learning Platforms: Platforms like Coursera, edX, and Udemy offer a wide array of finance-related courses, from introductory modules to advanced specializations. These platforms often provide certifications upon course completion, adding value to a professional’s resume.

- University Continuing Education Programs: Many universities offer executive education programs and short courses focused on specific areas of finance, such as financial modeling, risk management, or data analytics. These programs provide structured learning experiences and opportunities for interaction with faculty and peers.

- Industry Conferences and Seminars: Attending industry-specific conferences and seminars provides access to the latest trends, research, and best practices. These events also offer excellent networking opportunities with other professionals in the field.

- Books and Journals: Staying current with industry publications through books and professional journals is vital. These resources offer in-depth analysis and insights into current financial issues and best practices.

Maintaining Professional Certifications

Maintaining professional certifications, such as the Chartered Financial Analyst (CFA) charter or Certified Management Accountant (CMA) designation, requires ongoing commitment to continuing education. These certifications often necessitate regular completion of continuing professional education (CPE) credits to remain valid. This requirement ensures that professionals stay updated on industry standards and best practices.

Strategies for maintaining certifications include actively participating in relevant professional development activities, such as attending conferences, completing online courses, and engaging in self-directed learning. Many organizations offer CPE credits for participation in their programs. Careful tracking of CPE credits is essential to avoid lapses in certification.

Staying Updated with Financial Regulations and Best Practices

The financial landscape is subject to constant change, driven by regulatory updates and evolving industry standards. Finance managers must actively monitor these changes to ensure compliance and leverage best practices. This includes understanding and adapting to new accounting standards, tax regulations, and risk management frameworks.

Effective strategies for staying updated include subscribing to relevant regulatory newsletters, attending industry webinars and conferences, and actively participating in professional organizations. Regular review of industry publications and legal updates is also crucial. Furthermore, staying informed about emerging technologies and their impact on the financial sector is paramount for maintaining a competitive edge.

Tim Redaksi