Understanding Your Loan and Car Value

Selling a financed car requires a clear understanding of your loan and the car’s current market value. This knowledge is crucial for negotiating a fair price and avoiding financial pitfalls. Accurate assessment of these factors will ensure a smooth and profitable transaction.

Determining the current market value of your car involves several steps. Understanding your equity—the difference between the car’s value and what you owe—is equally important.

Determining Your Car’s Market Value

Several methods exist for determining your car’s market value. Online appraisal tools, dealership quotes, and private party sales listings offer varying perspectives, each with its own strengths and weaknesses. It’s advisable to use multiple methods to obtain a well-rounded estimate.

Online appraisal tools, such as Kelley Blue Book (KBB) and Edmunds, provide estimates based on your car’s make, model, year, mileage, condition, and features. These tools are convenient and readily accessible, offering a quick starting point for valuation. However, they may not account for unique features or specific regional market conditions. Dealerships, on the other hand, will often offer a trade-in value, which tends to be lower than the market value to ensure their profit margin. Finally, checking listings of similar vehicles for sale in your area provides a more localized view of market prices, reflecting current demand and competition. This approach requires more research but provides a potentially more accurate valuation.

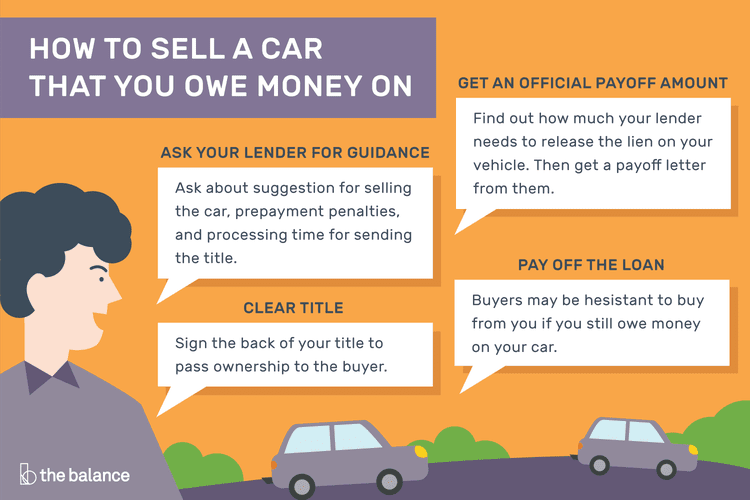

Obtaining a Payoff Quote from Your Lender

To accurately calculate your equity, you’ll need the precise payoff amount from your lender. This figure includes the remaining loan principal, accrued interest, and any other fees. Contacting your lender directly via phone or through their online portal is the most reliable method to obtain this information. Request a payoff quote in writing, specifying the date for which the quote is valid, as the payoff amount changes daily due to accruing interest. Keep in mind that prepayment penalties may apply, so be sure to inquire about these as well.

Calculating Your Equity

Calculating your equity is a straightforward process once you have the car’s market value and the payoff amount. The formula is:

Equity = Market Value – Loan Payoff Amount

For example, if your car’s market value is $15,000 and your loan payoff amount is $10,000, your equity is $5,000. This means you have $5,000 in ownership of the vehicle. This equity is your potential profit after settling the loan. Remember that this calculation is an estimate, and the final amount may vary slightly depending on the actual payoff amount and any fees involved in the sale.

Exploring Sales Options: How Do You Sell A Car You Are Financing

Selling a car you’re still financing requires careful consideration of your options. Primarily, you’ll need to decide between selling privately or trading it in at a dealership. Each method presents unique advantages and disadvantages that significantly impact your financial outcome and the overall selling process. Understanding these differences is crucial for maximizing your return and minimizing potential headaches.

Private Sale versus Dealership Trade-In

Selling your car privately and trading it in at a dealership represent two distinct approaches, each with its own set of benefits and drawbacks. A private sale offers the potential for higher profit, but it demands more time and effort. Conversely, trading in at a dealership is quicker and less demanding but typically results in a lower payout.

Comparison of Sales Methods

The following table provides a direct comparison of selling privately versus trading in at a dealership, considering speed, profit potential, and effort involved.

| Method | Speed of Sale | Potential Profit | Effort Required |

|---|---|---|---|

| Private Sale | Slow (can take weeks or months) | High (potentially significantly more than trade-in value) | High (advertising, showing the car, handling paperwork, managing negotiations) |

| Dealership Trade-In | Fast (usually completed within a single visit) | Low (typically less than market value) | Low (minimal paperwork and negotiation) |

Paperwork Involved in Each Sales Option

The paperwork associated with selling a financed car differs depending on your chosen method. A private sale involves more extensive documentation. You’ll need to complete a bill of sale, obtain a release of lien from your lender (proving the loan is paid off), and transfer the title to the buyer. The buyer will likely require a vehicle history report (like a Carfax) for reassurance. Trading in at a dealership simplifies this process; the dealership handles most of the paperwork, including the title transfer and payoff of your loan. However, you’ll still need to provide necessary identification and potentially sign various documents related to the trade-in and purchase of a new vehicle.

Potential Challenges of Each Sales Method, How do you sell a car you are financing

Selling privately presents several challenges. Finding a suitable buyer can be time-consuming, and you’ll need to manage all aspects of the sale independently, including advertising, showing the car, negotiating the price, and handling the paperwork. There’s also the risk of encountering dishonest buyers or dealing with difficult negotiations. Dealing with potential mechanical issues or hidden problems discovered post-sale is another significant risk. Trading in at a dealership simplifies the process but usually results in a lower sale price than a private sale. The dealership will assess the vehicle’s value, and this value is typically lower than the market value to account for their profit margin. You may also have less negotiating power compared to a private sale. Furthermore, you are bound by the dealership’s offer and often have limited options to explore other offers.

Negotiating and Finalizing the Sale

Selling a financed car requires careful negotiation to achieve a fair price while ensuring you can pay off your loan. This process involves understanding your loan details, the car’s market value, and effectively communicating with potential buyers. Successful negotiation hinges on clear communication, realistic expectations, and a preparedness to walk away if necessary.

Negotiating a fair price is crucial for a successful sale. This involves balancing your desire to recoup your investment with the buyer’s willingness to pay. Effective strategies involve research to determine a fair market price for your car, considering its condition, mileage, and features. Presenting this research to buyers strengthens your position during negotiations.

Negotiation Strategies and Tactics

Understanding common negotiation tactics is essential. Buyers might attempt to lowball offers, citing minor imperfections or comparing your car to significantly cheaper listings. A counter-strategy involves remaining calm, highlighting the car’s positive attributes, and justifying your asking price based on your research. Be prepared to compromise, but avoid significantly reducing your price unless absolutely necessary. For example, if a buyer offers $5,000 below your asking price, you might counter with a price $2,000 below your asking price, justifying the price difference by highlighting features or recent maintenance. If the buyer’s offer is too low, be prepared to walk away.

Transferring Ownership

Transferring ownership legally and securely is vital. This involves completing the necessary paperwork, including the title transfer and bill of sale. The buyer will need to provide proof of insurance, and you should ensure the loan is paid off before transferring the title. State laws vary, so checking your local Department of Motor Vehicles (DMV) website for specific requirements is crucial. A bill of sale should clearly state the vehicle’s identification number (VIN), sale price, date of sale, and signatures from both buyer and seller. This document serves as proof of the transaction. Failing to complete the transfer correctly can lead to legal complications for both parties.

Paying Off the Loan

Once the sale is complete and the funds are secured, paying off the loan is the next step. Contact your lender to determine the exact payoff amount, which might include any outstanding interest or fees. Ensure you have sufficient funds to cover the payoff amount before transferring the title. You’ll typically need the payoff amount and the title to complete the loan payoff. Obtain a payoff letter from the lender as proof of payment. This letter confirms that the loan has been settled, protecting you from future liability. It is important to verify the payoff amount with the lender before the sale to avoid unexpected costs. For instance, if the payoff amount is $10,000, ensure you have at least $10,000 available before finalizing the sale.

Handling Potential Complications

Selling a financed car presents unique challenges beyond those encountered when selling an outright owned vehicle. Understanding potential pitfalls and having strategies in place to address them is crucial for a smooth and legally sound transaction. Failing to plan for complications can lead to significant financial and legal repercussions.

Potential problems during the sale of a financed car are numerous and can range from simple misunderstandings to complex legal disputes. Effective preemptive measures and a clear understanding of your legal obligations are vital to mitigate these risks. This section will Artikel common complications, strategies for addressing them, and the legal framework governing the sale of financed vehicles.

Buyer Disputes

Disputes with buyers can arise from various issues, including disagreements over the car’s condition, the accuracy of the advertised information, or the terms of the sale. For example, a buyer might claim the car has hidden mechanical problems not disclosed during the sale, leading to a dispute over the purchase price or a request for a refund. To mitigate this, thorough pre-sale inspections, detailed written descriptions of the vehicle’s condition (including known defects), and a comprehensive sales contract are essential. The contract should clearly Artikel the “as-is” condition of the vehicle, or any specific warranties offered. Maintaining clear and documented communication throughout the sales process is also critical to avoid misunderstandings. Should a dispute arise, consider mediation or, as a last resort, legal action.

Loan Payoff Issues

Difficulties with paying off the existing loan are another significant potential problem. Delays in receiving funds from the buyer or complications with the lending institution can lead to delays in transferring ownership and potential penalties for the seller. To avoid this, it’s crucial to contact your lender well in advance of the sale to obtain the payoff amount and understand the process for transferring the title once the loan is settled. Secure the payoff amount from the buyer before releasing the vehicle. Always obtain a written confirmation from the lender confirming the loan payoff before transferring the title to the buyer. A failure to do so could leave you liable for further loan payments even after selling the car.

Legal Implications of Selling a Financed Car

Selling a financed car involves legal considerations beyond a typical private sale. The primary legal concern is ensuring that the loan is paid off in full before transferring the title to the buyer. Failure to do so could result in legal action from the lender. Furthermore, accurate disclosure of the car’s condition and the terms of the sale are crucial to avoid disputes and potential legal liabilities. State laws vary regarding the disclosure requirements, so it’s important to familiarize yourself with the specific regulations in your jurisdiction. Consult with a legal professional if you are unsure about any aspect of the legal process. Improperly handling the sale can result in legal battles and financial penalties.

Buyer Failure to Complete Purchase

If a buyer fails to complete the purchase after agreeing to the terms, several steps can be taken to mitigate the loss. First, review the sales contract to determine the buyer’s obligations and any remedies available to you. If the contract includes a deposit, you may be able to retain it as compensation for the buyer’s breach. If the contract doesn’t specify remedies, you might need to pursue legal action to recover any losses.

Tim Redaksi