Understanding Finance Charges

Finance charges represent the cost of borrowing money. They’re the fees lenders add to the principal amount you borrow, essentially the price you pay for the convenience of using credit. Understanding these charges is crucial for responsible financial management, allowing you to make informed decisions about borrowing and repayment.

Types of Finance Charges

Finance charges encompass various fees associated with credit products. These charges vary depending on the type of credit used and the lender’s policies. Common types include interest, late payment fees, annual fees, balance transfer fees, and cash advance fees. Interest is the most prevalent component, calculated on the outstanding balance, while the others are typically fixed amounts or percentages.

Finance Charge Calculation for Credit Cards

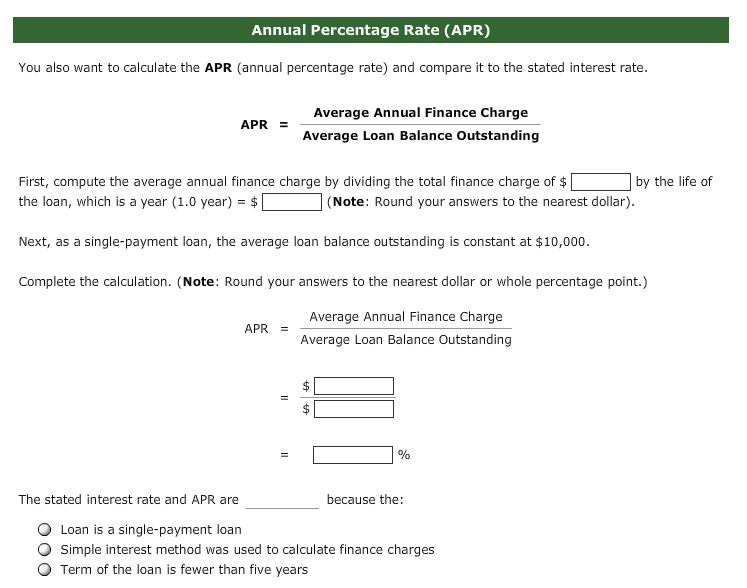

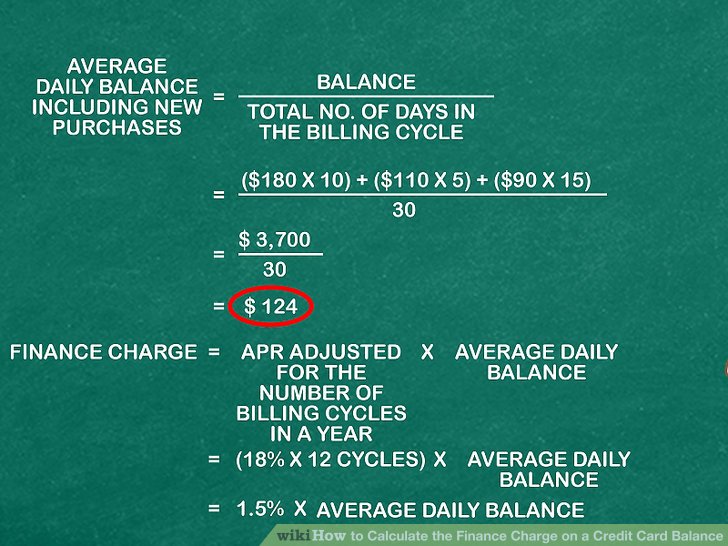

Credit card finance charges are primarily based on the Annual Percentage Rate (APR). The APR represents the yearly interest rate charged on your outstanding balance. The calculation often involves the average daily balance method, where the balance is calculated daily and averaged over the billing cycle. The interest is then calculated on this average daily balance. For example, if your average daily balance is $1000 and your APR is 18%, your monthly interest charge would be approximately $15 ($1000 x 0.18 / 12). This doesn’t include other potential fees like late payment fees or balance transfer fees.

Finance Charge Calculation for Loans

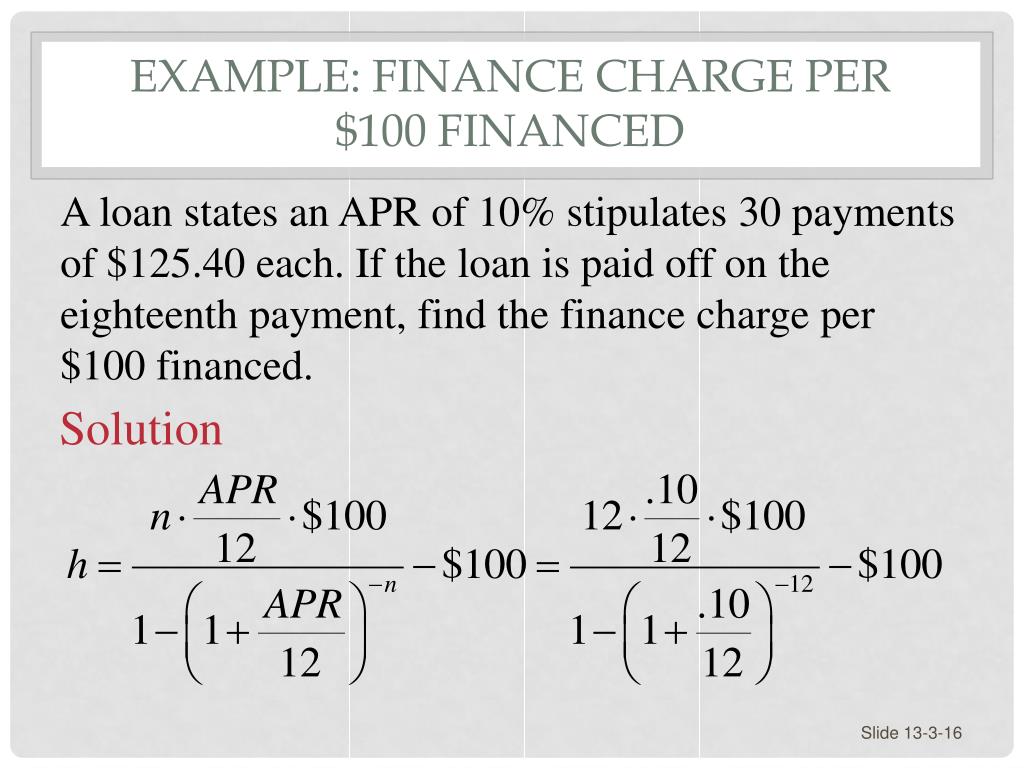

Loan finance charges depend on the loan type (e.g., personal loan, mortgage, auto loan) and the repayment schedule. For fixed-rate loans, the interest is calculated based on the loan amount, interest rate, and loan term. Amortization schedules detail the breakdown of each payment into principal and interest. For example, a $10,000 loan at 5% interest over 5 years might have a monthly payment including both principal and interest. The initial payments are predominantly interest, with the principal portion increasing over time. Variable-rate loans, on the other hand, have fluctuating interest rates, resulting in varying monthly payments.

Common Scenarios Involving Finance Charges

Finance charges apply in numerous everyday financial situations. Carrying a balance on a credit card, missing loan payments, transferring balances between credit cards, and taking out cash advances all incur finance charges. Even seemingly minor fees, like late payment fees, can significantly add up over time. For example, consistently paying late on a credit card can lead to substantial increases in the total cost of borrowing.

Finance Charge Comparison Across Lending Institutions

The following table illustrates how finance charges can vary across different lenders. It is important to note that these are illustrative examples and actual rates and fees can change.

| Lender | Product | APR | Late Payment Fee |

|---|---|---|---|

| Bank A | Credit Card | 18% | $35 |

| Bank B | Personal Loan | 7% | $25 |

| Credit Union C | Credit Card | 15% | $20 |

| Online Lender D | Personal Loan | 9% | $0 |

Identifying Finance Charges on Statements

Understanding where to find and how to interpret finance charges on your billing statements is crucial for managing your finances effectively. Misinterpreting this information can lead to unexpected costs and difficulties in budgeting. This section will provide clear strategies for locating and understanding these charges across different types of statements.

How to figure finance charge – Finance charges are typically clearly labeled on most billing statements, but their exact location can vary depending on the issuer. Credit card statements, for example, often present this information prominently, while loan statements may require a bit more searching. Regardless of the statement type, consistent attention to detail is key to accurate identification.

Locating Finance Charges on Various Billing Statements

Different financial institutions employ varying formats for their statements. However, common locations for finance charges include a dedicated line item within the summary section, a detailed breakdown within the transactions section, or a separate section dedicated to fees and charges. For credit card statements, the finance charge is often listed alongside the previous balance, payments made, and the new balance. Loan statements might present it as a separate entry within a schedule of payments, alongside the principal and interest payments. Always refer to the statement’s glossary or legend if unsure about the meaning of specific terms.

Interpreting Finance Charge Information on a Credit Card Statement

A step-by-step guide to understanding the finance charge on a credit card statement involves carefully examining several key areas. First, locate the “Finance Charge” or “Interest Charge” line item. This figure represents the total interest accrued on your outstanding balance during the billing cycle. Next, identify the “Average Daily Balance.” This is the average amount you owed throughout the billing cycle, used to calculate the finance charge. Then, check the “Annual Percentage Rate (APR).” This is the annual interest rate applied to your outstanding balance. Finally, compare the calculated finance charge with the stated amount on the statement. Any discrepancies should be investigated immediately with the card issuer. For example, if your average daily balance was $1000 and your APR was 18%, the monthly interest would be approximately $15 (1000 * 0.18 / 12).

Differentiating Finance Charges from Other Fees and Interest

It’s crucial to differentiate finance charges from other fees, such as late payment fees, over-limit fees, or annual fees. Finance charges are specifically related to the interest accrued on your outstanding balance, while other fees are separate charges for specific actions or services. For instance, a late payment fee is assessed for paying your bill after the due date, while a finance charge reflects the cost of borrowing money. Understanding this distinction is essential for accurate budgeting and financial planning. The statement usually provides clear descriptions of each fee, allowing for easy differentiation.

Checklist for Reviewing Statements for Finance Charges

Before concluding your statement review, utilize this checklist to ensure you haven’t overlooked any crucial details:

Reviewing your statement thoroughly is essential for effective financial management. This checklist provides a structured approach to ensure all aspects of your finance charges are understood and accounted for.

- Locate the “Finance Charge” or similar line item on the statement.

- Verify the calculation of the finance charge against your average daily balance and APR.

- Identify any other fees and charges listed separately from the finance charge.

- Compare the current finance charge with previous months’ charges to identify any unusual increases.

- Contact your financial institution if you have any questions or discrepancies.

Factors Influencing Finance Charges

Understanding the factors that influence finance charges is crucial for managing debt effectively and making informed borrowing decisions. Several key elements interact to determine the total amount you’ll pay in interest and fees. This section will explore these factors in detail.

Interest Rates and Finance Charges

The interest rate is the most significant factor determining the size of your finance charge. A higher interest rate directly translates to a larger finance charge over the life of the loan or credit agreement. For example, a $10,000 loan with a 5% interest rate will accrue significantly less interest over five years than the same loan with a 10% interest rate. The difference can amount to thousands of dollars in additional finance charges. The impact of interest rate fluctuations is especially noticeable on longer-term loans.

Repayment Methods and Finance Charges

Different repayment methods significantly affect the total finance charges. Faster repayment, such as making extra payments or paying bi-weekly instead of monthly, leads to lower finance charges because you’re reducing the principal balance more quickly, thereby reducing the amount of interest accrued. Conversely, minimum payments only cover the interest, leaving the principal balance largely untouched, resulting in significantly higher finance charges over the loan’s duration. A shorter loan term, even with a slightly higher interest rate, often results in lower total finance charges than a longer term with a lower rate.

Factors Considered by Lenders

Lenders use a variety of factors to assess risk and determine the interest rate, and consequently, the finance charges they apply. These include the borrower’s credit score, debt-to-income ratio, the loan amount, the loan term, and the type of credit being used. Lenders view a higher credit score as an indicator of lower risk, often leading to more favorable interest rates and lower finance charges. A low debt-to-income ratio, demonstrating responsible financial management, also contributes to securing better loan terms. The type of credit (e.g., secured vs. unsecured) also plays a role; secured loans typically have lower interest rates due to the reduced risk for the lender.

Credit Scores and Finance Charges

Credit scores are a powerful predictor of the finance charges a borrower will face. A higher credit score (typically 700 or above) usually qualifies a borrower for lower interest rates and therefore lower finance charges. Conversely, a lower credit score (below 600) indicates higher risk to lenders, resulting in higher interest rates and substantially increased finance charges. For instance, a person with a 750 credit score might qualify for a car loan with a 4% interest rate, while someone with a 600 credit score might receive the same loan with an 8% or even higher interest rate. This difference in interest rates can dramatically impact the total finance charge paid over the loan’s lifespan. Building and maintaining a good credit score is therefore essential for minimizing finance charges.

Minimizing Finance Charges: How To Figure Finance Charge

High finance charges can significantly impact your financial health. Understanding how these charges are calculated and employing effective strategies to minimize them is crucial for responsible credit management. This section explores practical methods to reduce and avoid excessive finance charges.

Effective Strategies for Reducing Finance Charges on Credit Cards

Reducing finance charges on credit cards involves a multifaceted approach focusing on both responsible spending and proactive debt management. The most effective method is to consistently pay more than the minimum payment due. Even small increases in your payments can significantly reduce the total interest paid over time. Additionally, exploring balance transfer options to a card with a lower APR (Annual Percentage Rate) can provide temporary relief, allowing you to pay down your debt more efficiently. However, remember to factor in any balance transfer fees before making a decision. Finally, maintaining a low credit utilization ratio (the amount of credit you use compared to your total available credit) is crucial for improving your credit score and potentially securing lower interest rates in the future.

Negotiating Lower Finance Charges

Negotiating lower finance charges is possible, but requires a proactive approach. Contacting your lender directly and explaining your financial situation, demonstrating a commitment to responsible repayment, may lead to a reduction in your interest rate. Highlighting a history of on-time payments or a recent improvement in your financial standing strengthens your negotiating position. Be prepared to present a plan for paying off your debt more quickly to demonstrate your commitment to resolving the situation. While not guaranteed, this strategy can sometimes result in a more manageable finance charge.

Benefits of Paying Off Debt Quickly

The most straightforward method to minimize finance charges is to pay off your debt as quickly as possible. Every dollar paid beyond the minimum payment directly reduces the principal balance, lessening the amount of interest accrued. For example, if you have a $10,000 balance with a 15% APR, paying an extra $100 each month will significantly shorten the repayment period and reduce the total interest paid compared to only paying the minimum. This accelerates the reduction of your debt and limits the total finance charges you incur. The quicker the repayment, the less the interest charges will accumulate.

Practical Steps to Avoid High Finance Charges

Avoiding high finance charges requires a proactive and disciplined approach to credit management. The following steps can help you stay on track:

- Budget carefully: Track your spending meticulously to ensure you can afford your credit card payments without relying on minimum payments.

- Pay in full and on time: This is the most effective way to avoid finance charges altogether.

- Avoid cash advances: Cash advances typically carry higher interest rates than regular purchases.

- Shop around for credit cards: Compare APRs and fees from different lenders to find the most favorable terms.

- Read the fine print: Understand the terms and conditions of your credit card agreement, including any fees or penalties.

- Use credit responsibly: Only borrow what you can comfortably repay.

- Monitor your credit report: Regularly check your credit report for errors that could affect your interest rates.

Finance Charge Disclosure and Regulations

Accurate and transparent disclosure of finance charges is crucial for consumer protection. Legal frameworks mandate specific information be provided to borrowers, ensuring informed decision-making and preventing predatory lending practices. Failure to comply can result in significant penalties for lenders.

Legal Requirements for Disclosing Finance Charges

Laws governing finance charge disclosure vary by jurisdiction but generally require lenders to clearly state the total finance charge in a prominent and easily understandable manner. This often includes the annual percentage rate (APR), which represents the yearly cost of borrowing, expressed as a percentage. Other required disclosures may include the method of calculating the finance charge, any fees included, and the total amount payable. The Truth in Lending Act (TILA) in the United States, for example, sets forth detailed requirements for disclosing finance charges in consumer credit transactions. These regulations aim to provide consumers with a comprehensive understanding of the true cost of credit before they commit to a loan or credit agreement. Failure to meet these disclosure standards can lead to legal action and substantial fines.

Implications of Inaccurate Finance Charge Disclosure

Inaccurate or misleading disclosure of finance charges can have serious consequences for lenders. Consumers who feel they have been misled may file lawsuits, leading to significant financial losses for the lender, including compensation for damages and legal fees. Regulatory bodies can also impose substantial penalties for non-compliance, potentially impacting the lender’s reputation and ability to operate. Furthermore, inaccurate disclosures can erode consumer trust, damaging the lender’s long-term business prospects. The severity of the penalties depends on the nature and extent of the inaccuracy and the jurisdiction’s regulatory framework.

Examples of Misleading Finance Charge Information

Misleading finance charge information can take many forms. For instance, a lender might bury the APR in fine print or use confusing terminology to obscure the true cost of borrowing. They might advertise a low initial interest rate without disclosing significant fees or increases in the rate after a promotional period. Another tactic involves highlighting only the monthly payment, without clearly stating the total amount payable over the loan’s lifetime. These tactics can make it difficult for consumers to compare loan offers accurately and make informed decisions. For example, a loan might advertise a low monthly payment but have a significantly higher APR than a competitor’s loan with a slightly higher monthly payment, resulting in substantially more interest paid over the life of the loan.

Comparison of Finance Charge Regulations Across Different Jurisdictions, How to figure finance charge

Finance charge regulations vary considerably across different jurisdictions, reflecting differing levels of consumer protection and enforcement. The following table provides a simplified comparison, focusing on key aspects:

| Jurisdiction | Key Regulatory Act | APR Disclosure | Other Key Disclosures |

|---|---|---|---|

| United States | Truth in Lending Act (TILA) | Mandatory | Finance charge, total amount payable, payment schedule |

| European Union | Consumer Credit Directive (CCD) | Mandatory | Total cost of credit, representative APR, fees, charges |

| Canada | Provincial legislation varies | Generally mandatory | Details vary by province, often including total cost of credit |

| Australia | National Consumer Credit Protection Act | Mandatory | Comparison rate (similar to APR), fees, charges, total amount payable |

Tim Redaksi