What is Seller Financing?: How Does Seller Financing Work

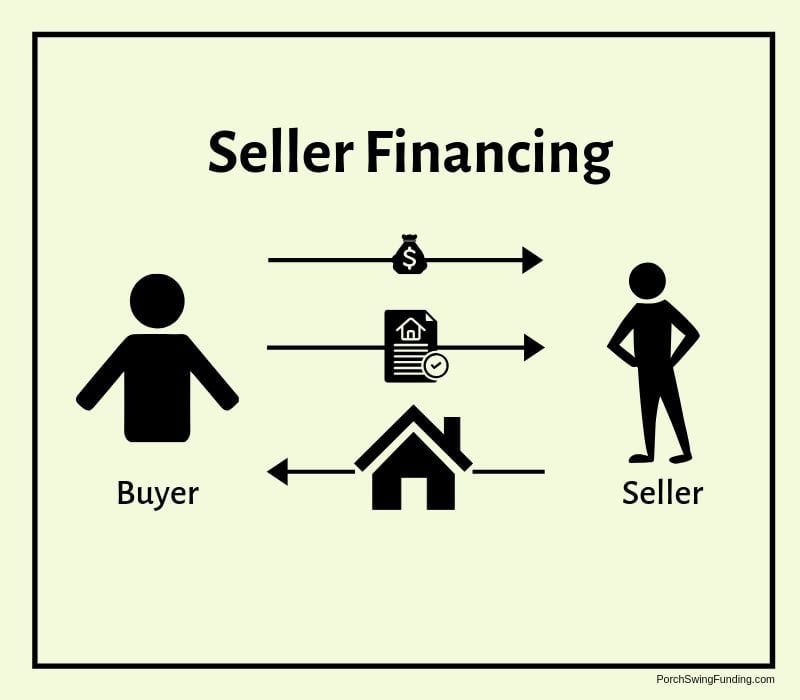

Seller financing is a way to buy a home where the seller acts as the lender, providing the buyer with the financing instead of a traditional bank or mortgage company. It’s a less conventional route to homeownership, often appealing to buyers who may have difficulty qualifying for a traditional mortgage. This arrangement can be beneficial for both the buyer and the seller, but it’s crucial to understand the terms and implications before entering into such an agreement.

Seller financing encompasses several different arrangements, each with its own unique features and risks. Essentially, it’s a direct loan from the seller to the buyer, secured by the property itself. The seller retains some ownership or control over the property until the loan is repaid. This offers flexibility not always found in traditional mortgage processes.

Types of Seller Financing Arrangements

Seller financing can take various forms. Two common examples are land contracts and lease-options. A land contract, also known as a contract for deed, involves the buyer making payments directly to the seller over a set period. The seller retains legal title to the property until the buyer completes all payments. A lease-option agreement allows the buyer to lease the property with an option to purchase it at a predetermined price within a specific timeframe. This option is typically purchased upfront, giving the buyer the right, but not the obligation, to buy the property. Other less common methods might include a wraparound mortgage, where the seller takes on the buyer’s existing mortgage while adding their own financing on top. Each of these arrangements will have different implications for tax liabilities and legal protections.

Comparison of Seller Financing and Traditional Mortgages, How does seller financing work

The following table compares and contrasts seller financing with traditional mortgages, highlighting key differences that buyers should consider.

| Feature | Seller Financing | Traditional Mortgage |

|---|---|---|

| Loan Approval | Typically less stringent credit requirements; focus on buyer’s ability to make payments. | Stricter credit score and income verification requirements; often requires a large down payment. |

| Interest Rates | Can be higher or lower than traditional mortgages depending on market conditions and negotiation. | Interest rates are determined by market conditions and the buyer’s creditworthiness. |

| Down Payment | Often requires a smaller down payment, or none at all. | Usually requires a significant down payment (often 20% or more). |

| Closing Costs | Closing costs can be lower, but this varies depending on the specific arrangement. | Closing costs are generally higher and include various fees and charges. |

Benefits of Seller Financing for Buyers

Seller financing offers a unique pathway to homeownership, particularly appealing to buyers who might struggle to qualify for a traditional mortgage. It presents several advantages, but also carries potential drawbacks that prospective buyers should carefully consider. Understanding these aspects is crucial for making an informed decision.

Seller financing can significantly improve affordability and accessibility for buyers facing challenges in the traditional mortgage market. This is particularly true for individuals with less-than-perfect credit scores, limited savings for a down payment, or those navigating a competitive real estate market.

Affordability and Accessibility Advantages

By working directly with the seller, buyers often find more flexible terms compared to traditional mortgages. This can translate to lower down payment requirements, potentially eliminating a major hurdle for many prospective homeowners. Negotiating a longer repayment period can also reduce monthly payments, making homeownership more manageable. Furthermore, sellers may be more willing to overlook minor credit imperfections, opening doors for buyers who might be denied a conventional loan. For example, a seller might be more inclined to work with a buyer who has recently experienced a temporary dip in their credit score due to an unforeseen circumstance, rather than a bank that strictly adheres to credit score thresholds.

Potential Downsides of Seller Financing

While seller financing presents numerous benefits, buyers should also be aware of the potential disadvantages. Interest rates on seller financing can sometimes be higher than those offered by traditional lenders. Furthermore, the terms of the agreement are typically less standardized and may lack the consumer protections offered by regulated mortgage lenders. The buyer should also be prepared to navigate a potentially more complex legal process. For instance, if the seller fails to properly record the agreement, the buyer might find their ownership rights jeopardized.

Situations Favoring Seller Financing over Traditional Mortgages

Seller financing can be a superior option in specific circumstances. For buyers with credit challenges, it can provide an avenue to homeownership that might be otherwise inaccessible. In competitive markets where multiple offers are common, a seller may prefer a seller-financed deal due to its certainty and reduced reliance on external financing contingencies. This provides the seller with a faster, more reliable closing process. Also, in situations where the property is priced below market value, a seller might be more willing to offer financing to secure a sale. This might be the case for properties requiring significant repairs or located in less desirable areas.

Buyer’s Decision-Making Process for Seller Financing

The following flowchart illustrates a simplified decision-making process for buyers considering seller financing:

[Imagine a flowchart here. The flowchart would start with a “Consider Seller Financing?” box. A “Yes” branch would lead to boxes assessing creditworthiness, affordability of terms, legal understanding, and risk tolerance. A “No” branch would lead directly to exploring traditional mortgage options. Each box would have connecting arrows leading to the next stage of the decision-making process. Finally, a concluding box would summarize the decision (proceed with seller financing or explore other options).]

Benefits of Seller Financing for Sellers

Seller financing offers several compelling advantages for sellers, particularly in challenging real estate markets. By acting as the lender, sellers can achieve quicker sales, potentially higher returns, and greater control over the transaction compared to a traditional sale. This strategy can be especially beneficial when buyer demand is low, making it harder to find a suitable cash buyer.

Seller financing allows sellers to bypass the often lengthy and complex process of finding a qualified buyer who can secure traditional financing. This is especially helpful in slower markets where buyers might struggle to get approved for a mortgage. The seller essentially becomes the bank, facilitating a faster and more certain sale. Furthermore, the seller often receives a higher overall return due to the interest earned on the financing agreement. This added income stream can significantly improve the seller’s overall financial outcome.

Advantages of Seller Financing in Slow Markets

A slow market often means fewer buyers and more competition. Seller financing can create a competitive advantage, attracting buyers who may not qualify for a traditional mortgage or who are wary of the uncertainties of a slow market. By offering flexible terms, such as a lower down payment or a longer repayment period, the seller can entice buyers who might otherwise be hesitant to make an offer. This increased pool of potential buyers significantly increases the chances of a quick and profitable sale. For example, a seller might offer a 10% down payment and a 15-year loan with a slightly higher interest rate, making the property more accessible to a wider range of buyers than a cash-only sale would allow.

Risks Associated with Seller Financing

While seller financing offers significant benefits, it’s crucial to acknowledge the inherent risks. The most significant risk is the potential for default by the buyer. If the buyer fails to make payments, the seller faces the burden of foreclosure and the associated legal and financial costs. This can be time-consuming and expensive, potentially negating the initial benefits of the seller financing arrangement. Furthermore, the seller might lose out on potential appreciation of the property if the sale takes place during a period of market growth. Another risk is that the seller might tie up significant capital for an extended period, limiting their access to funds for other investments or opportunities. Finally, the seller needs to be aware of the legal and tax implications of acting as a lender.

Situations Where Seller Financing Benefits the Seller More Than a Traditional Sale

Consider a scenario where a seller owns a property in a market experiencing a downturn. Traditional sales are slow, and offers are significantly below the asking price. By offering seller financing, the seller can attract buyers who are willing to purchase but might not qualify for a bank loan. This allows the seller to achieve a sale closer to their desired price while also generating interest income. Another situation is when the seller needs a quick sale, but traditional buyers are scarce. Seller financing can incentivize a buyer to make a swift purchase, providing the seller with the liquidity they need without having to significantly reduce the price. Finally, seller financing can be beneficial when selling a unique or specialized property that may not attract many traditional buyers. By tailoring a financing plan to the specific needs of a potential buyer, the seller can increase their chances of a successful transaction.

Factors to Consider Before Offering Seller Financing

Before offering seller financing, sellers should carefully assess several key factors. This includes a thorough review of the buyer’s financial stability, including their credit history, income, and employment status. A detailed legal agreement is essential to protect the seller’s interests, including clearly defined payment terms, late payment penalties, and foreclosure procedures. Sellers should also consult with legal and financial professionals to ensure compliance with all applicable regulations and to optimize the terms of the financing agreement. Furthermore, sellers need to evaluate their own financial situation and risk tolerance. They should only offer seller financing if they can comfortably handle the potential risks of default and the implications of tying up their capital for an extended period. Finally, the seller should carefully consider the prevailing market conditions and the potential for property appreciation or depreciation during the loan term.

The Seller Financing Process

Seller financing, while offering significant advantages, involves a series of steps requiring careful planning and legal execution. Understanding this process is crucial for both buyers and sellers to ensure a smooth and legally sound transaction. This section details the key stages, necessary documentation, and payment calculations involved.

Steps in the Seller Financing Process

The seller financing process unfolds in several distinct phases, beginning with the initial agreement and culminating in the final payment. Each step necessitates careful consideration and clear communication between buyer and seller.

- Initial Negotiation and Agreement: This involves discussions regarding the purchase price, down payment, interest rate, loan term, and other crucial terms of the agreement. Both parties should clearly define their expectations and reach a mutually acceptable agreement before proceeding.

- Due Diligence: The buyer typically conducts due diligence on the property, examining its condition, title, and any potential encumbrances. The seller may also conduct due diligence on the buyer’s financial capacity to repay the loan.

- Legal Documentation: This is a critical step involving the preparation and execution of legally binding documents, including the Promissory Note, Deed of Trust (or Mortgage), and any other relevant agreements. A qualified attorney is highly recommended to ensure the documents are properly drafted and protect the interests of both parties.

- Loan Closing: This is the formal transfer of ownership of the property from the seller to the buyer, coinciding with the commencement of the seller-financed loan. The buyer receives the deed, and the seller receives the down payment and the promissory note.

- Loan Servicing: This involves the ongoing management of the loan, including the collection of monthly payments by the seller. Regular communication and clear accounting practices are vital during this phase.

- Loan Payoff: The final stage, where the buyer makes the final payment to the seller, thereby satisfying the loan obligation and concluding the seller financing arrangement.

Legal Documents in Seller Financing

The legal framework underpinning a seller financing agreement typically includes several key documents. These documents define the terms of the loan, protect the rights of both parties, and provide a legally sound basis for the transaction.

- Promissory Note: This legally binding document Artikels the loan amount, interest rate, repayment schedule, and other key terms of the agreement. It represents the buyer’s promise to repay the seller.

- Deed of Trust (or Mortgage): This document pledges the property as collateral for the loan. In case of default, it grants the seller the right to foreclose on the property to recover the outstanding loan amount. The specific document used (Deed of Trust or Mortgage) varies by state.

- Purchase Agreement: This contract Artikels the terms of the sale, including the purchase price, closing date, and other conditions of the sale. It often incorporates the seller financing terms.

- Disclosure Statements: Various disclosure statements may be required depending on the jurisdiction, including disclosures related to property conditions, potential environmental hazards, and other relevant information.

Calculating Monthly Payments in Seller Financing

Monthly payments under seller financing are calculated using standard loan amortization formulas. The exact calculation depends on the loan amount, interest rate, and loan term.

The formula for calculating monthly payments (M) is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where: P = Principal loan amount, i = Monthly interest rate (Annual interest rate / 12), n = Number of months in the loan term.

For example, a $100,000 loan at 6% annual interest over 15 years (180 months) would have a monthly payment of approximately $843.86. A longer loan term will result in lower monthly payments but higher total interest paid. A higher interest rate will also increase the monthly payments. Online mortgage calculators can assist in these calculations.

Securing Seller Financing: A Step-by-Step Guide for Sellers

Sellers considering offering seller financing should follow a structured approach to minimize risk and ensure a successful transaction.

- Assess the Buyer: Thoroughly evaluate the buyer’s financial stability and creditworthiness to assess their ability to repay the loan. Request financial documentation, such as bank statements and tax returns.

- Determine Loan Terms: Carefully determine the loan amount, interest rate, down payment, and repayment schedule. Consider factors such as prevailing market interest rates and your risk tolerance.

- Obtain Legal Counsel: Consult with a real estate attorney to draft the necessary legal documents, ensuring they protect your interests and comply with all applicable laws.

- Secure Appraisal: Obtain a professional appraisal to determine the fair market value of the property, ensuring the loan amount doesn’t exceed the property’s value.

- Manage the Loan: Establish a system for tracking payments and managing the loan throughout its term. Consider using a loan servicing platform or engaging a professional loan servicer.

Risks and Considerations for Both Parties

Seller financing, while offering attractive benefits, presents inherent risks for both buyers and sellers. Understanding these potential pitfalls and implementing appropriate safeguards is crucial for a successful transaction. A thorough understanding of the legal landscape and the potential for default is paramount.

How does seller financing work – The primary risk for both parties revolves around the possibility of default. For the buyer, default means failing to make timely payments on the agreed-upon schedule, potentially leading to foreclosure and loss of the property. For the seller, default translates to protracted legal battles to reclaim the property, potential loss of the property’s value due to market fluctuations, and significant legal and administrative costs. The potential financial consequences can be substantial for both parties, impacting credit scores and overall financial stability.

Default Risk and Mitigation Strategies

Default risk is the most significant concern in seller financing. Buyers face the risk of losing their investment if they fail to meet their financial obligations. Sellers risk losing both their property and the investment they made in financing the sale. Effective mitigation strategies include thorough due diligence on the buyer’s financial capabilities, a well-structured financing agreement with clear payment terms and penalties for default, and potentially requiring a down payment or collateral to reduce the seller’s risk. Regular communication between buyer and seller can also help to identify and address potential problems early on. For example, if the buyer experiences unexpected financial hardship, working together to create a modified payment plan might prevent default.

Legal Protections for Buyers and Sellers

Legal protections vary depending on the jurisdiction and the specifics of the seller financing agreement. Generally, sellers have recourse through legal channels to repossess the property in case of default. This process, however, can be lengthy and expensive. Buyers, on the other hand, benefit from consumer protection laws that regulate certain aspects of financing agreements, ensuring fair treatment and preventing predatory lending practices. The seller financing agreement itself serves as the primary legal document outlining the rights and obligations of both parties. Therefore, having a well-drafted contract that addresses all contingencies is crucial for both parties. This should be reviewed and negotiated with legal counsel.

Common Pitfalls to Avoid

Several common pitfalls can jeopardize a seller financing transaction. One common mistake is failing to adequately assess the buyer’s creditworthiness and financial stability. This can lead to increased risk of default. Another pitfall is neglecting to establish a clear and comprehensive financing agreement that addresses all possible scenarios, including default, late payments, and prepayment penalties. Lack of professional legal advice can also lead to complications and disputes. Finally, not regularly monitoring the buyer’s performance and addressing any issues promptly can allow small problems to escalate into major conflicts. For example, a seller might overlook early signs of financial difficulty from the buyer, resulting in a larger loss when the default eventually occurs.

Importance of Legal Counsel

Engaging legal counsel is essential throughout the seller financing process. A lawyer can help draft a legally sound and comprehensive financing agreement that protects the interests of both parties. They can also advise on compliance with all relevant laws and regulations, minimizing the risk of disputes. Legal counsel can assist in negotiating terms, reviewing documents, and ensuring that the agreement is fair and equitable. In the event of a default, a lawyer can represent the seller or buyer in legal proceedings, protecting their rights and pursuing the most advantageous outcome. The cost of legal advice is a small price to pay compared to the potential financial and emotional costs associated with a poorly structured or legally flawed seller financing agreement.

Alternatives to Seller Financing

Seller financing, while offering unique advantages, isn’t the only way to purchase a property. Several alternative financing options exist, each with its own set of pros and cons. Understanding these alternatives is crucial for buyers and sellers to make informed decisions that best suit their individual circumstances. Choosing the right financing method depends on factors like credit score, down payment amount, the property’s condition, and the overall market conditions.

Comparing seller financing to other options requires a careful assessment of several key factors. These include the interest rates, the length of the loan term, the down payment requirements, and the closing costs associated with each option. Furthermore, the qualification criteria for each financing type can vary significantly, impacting the accessibility for different buyers.

Conventional Mortgages

Conventional mortgages are loans provided by banks or other lending institutions, not backed by government agencies like FHA or VA loans. They typically require a higher credit score and a larger down payment (often 20%) compared to government-backed loans. However, they often come with lower interest rates than seller financing, particularly in a competitive lending environment. A strong credit history and stable income are essential for approval. Compared to seller financing, conventional mortgages offer greater standardization and predictability in terms of interest rates and repayment schedules. However, they may be less flexible for buyers with less-than-perfect credit or smaller down payments.

FHA and VA Loans

FHA loans, insured by the Federal Housing Administration, and VA loans, guaranteed by the Department of Veterans Affairs, are designed to help buyers with lower credit scores or smaller down payments access homeownership. These loans often require lower down payments (as low as 3.5% for FHA loans) and have more lenient credit score requirements than conventional mortgages or seller financing. However, they typically involve mortgage insurance premiums, which increase the overall cost of the loan. These loans are suitable for buyers who may not qualify for conventional financing due to credit history or down payment constraints, offering an advantage over seller financing in such situations.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance is often required for conventional loans when the down payment is less than 20%. This protects the lender in case of default. While PMI adds to the monthly mortgage payment, it allows buyers to purchase a home with a smaller down payment than they might otherwise be able to afford. Compared to seller financing, which might require a larger down payment or a higher interest rate, PMI can make conventional financing a more accessible option for buyers with limited savings.

Comparison Table

| Feature | Seller Financing | Conventional Mortgage | FHA/VA Loan |

|---|---|---|---|

| Down Payment | Variable, often lower | Typically 20%, but can be lower with PMI | As low as 3.5% (FHA) or 0% (VA) |

| Interest Rate | Variable, often higher | Variable, generally lower than seller financing | Variable, potentially higher than conventional |

| Credit Score Requirements | Variable, can be more flexible | Generally higher | More lenient than conventional |

| Loan Term | Variable, often shorter | Typically 15 or 30 years | Typically 15 or 30 years |

Tim Redaksi