Refinancing Your Car Loan: How To Get Rid Of A Financed Car

Refinancing your car loan involves replacing your existing auto loan with a new one, typically from a different lender. This can be a strategic move to potentially lower your monthly payments, reduce the overall interest paid, or shorten the loan term. Understanding the process and its implications is crucial before making a decision.

Refinancing a car loan is a relatively straightforward process, but requires careful consideration of several factors. It involves applying to a new lender, providing documentation, and undergoing a credit check. Once approved, the new lender pays off your existing loan, and you begin making payments on the new loan.

The Process of Refinancing a Car Loan

The process generally begins with comparing interest rates from multiple lenders. You’ll need to gather your financial information, including your credit score, income, and the details of your current auto loan. Then, you’ll submit applications to several lenders, each providing a pre-qualification or pre-approval, outlining the terms they offer. Once you’ve selected a lender and loan terms, you’ll finalize the paperwork, and the new lender will pay off your existing loan. Finally, you’ll begin making payments under the new loan agreement.

Benefits of Refinancing a Car Loan

Refinancing can offer several significant advantages. Lower interest rates are a primary benefit, leading to reduced monthly payments and lower overall interest paid over the life of the loan. A shorter loan term can also accelerate the process of paying off the loan, saving on interest. Finally, refinancing can consolidate debt, simplifying your finances if you have multiple loans. For example, if you initially secured a loan with a 7% interest rate and refinance to a 4% interest rate, you’ll significantly reduce your total interest payments.

Drawbacks of Refinancing a Car Loan

While refinancing offers potential benefits, it’s important to be aware of the potential drawbacks. Application fees and closing costs can eat into any savings. A credit check is required, which can temporarily lower your credit score. Also, if you refinance into a longer loan term, while reducing your monthly payment, you will end up paying more interest over the life of the loan. For instance, extending a 36-month loan to 60 months will result in significantly higher total interest costs, despite lower monthly payments.

Comparing Interest Rates from Different Lenders

Interest rates vary significantly between lenders, depending on factors like your credit score, the loan amount, and the loan term. Online lenders often offer competitive rates, but it’s crucial to compare offers from multiple banks and credit unions as well. Shopping around for the best rate is vital to maximizing the benefits of refinancing. For example, one lender might offer a 4.5% interest rate, while another might offer 5.5% for the same loan amount and term. A seemingly small difference in interest rates can result in substantial savings over the life of the loan.

Step-by-Step Guide on Applying for Car Loan Refinancing

1. Check your credit report: Review your credit report for accuracy and identify any potential issues that could impact your interest rate.

2. Gather necessary documents: Compile documents such as your driver’s license, proof of income, and your current loan details.

3. Compare lenders and rates: Shop around and compare offers from various lenders to find the best interest rate and terms.

4. Apply for pre-qualification or pre-approval: Submit applications to several lenders to receive pre-qualification or pre-approval offers.

5. Select a lender and finalize the paperwork: Once you’ve chosen the best offer, complete the necessary paperwork and sign the loan agreement.

6. The lender pays off your existing loan: The new lender will handle the process of paying off your existing auto loan.

7. Begin making payments on your new loan: Start making payments according to the terms of your new loan agreement.

Surrendering the Car to the Lender

Surrendering your car to the lender, often referred to as voluntary repossession, is a significant financial decision with lasting consequences. It’s a last resort when you can no longer afford your car payments, and understanding the implications is crucial before taking this step. While it might seem like a way to escape debt, it comes with serious drawbacks that significantly impact your financial future.

This process involves relinquishing ownership of your vehicle to the lender, relieving you of the responsibility of making further payments. However, it’s not a debt-free solution. You’ll likely still owe money, a debt known as a deficiency balance, and this will negatively impact your credit.

Consequences of Voluntary Repossession

Voluntary repossession severely impacts your credit score. A repossession remains on your credit report for seven years, significantly lowering your credit rating and making it harder to secure loans, mortgages, or even rent an apartment in the future. The negative impact is comparable to a bankruptcy filing, making it challenging to rebuild your creditworthiness. For example, a credit score of 700 might drop to below 600, significantly limiting your borrowing power and potentially increasing interest rates on future loans. The deficiency balance, the amount you still owe after the sale of your repossessed vehicle, also negatively affects your credit report and is often pursued by the lender through legal channels.

Steps Involved in Voluntary Repossession

The process usually begins with contacting your lender directly. Explain your financial situation and your intention to voluntarily surrender the vehicle. The lender will likely have a specific procedure to follow, which may involve paperwork, inspections, and potentially a final payment to cover any remaining fees or charges before they take possession of the car. They may also require you to provide the vehicle’s title and keys. It is crucial to obtain written confirmation from the lender outlining the terms of the surrender and any remaining debt. This documentation will be vital for managing your finances moving forward and understanding your future credit implications.

Preparing for Voluntary Repossession

Before surrendering your car, gather all relevant documents, including your loan agreement, insurance information, and any maintenance records. This documentation helps streamline the process and ensures a clear understanding of your financial obligations. Additionally, take photos and videos of the vehicle’s condition to document its state before surrendering it. This can be helpful in case of any disputes regarding the vehicle’s value. Finally, explore all other options before resorting to voluntary repossession. Contacting your lender to discuss potential payment plans, seeking credit counseling, or considering selling the vehicle privately are all viable alternatives that should be explored before surrendering the car. Remember, voluntary repossession is a last resort, and its consequences are far-reaching.

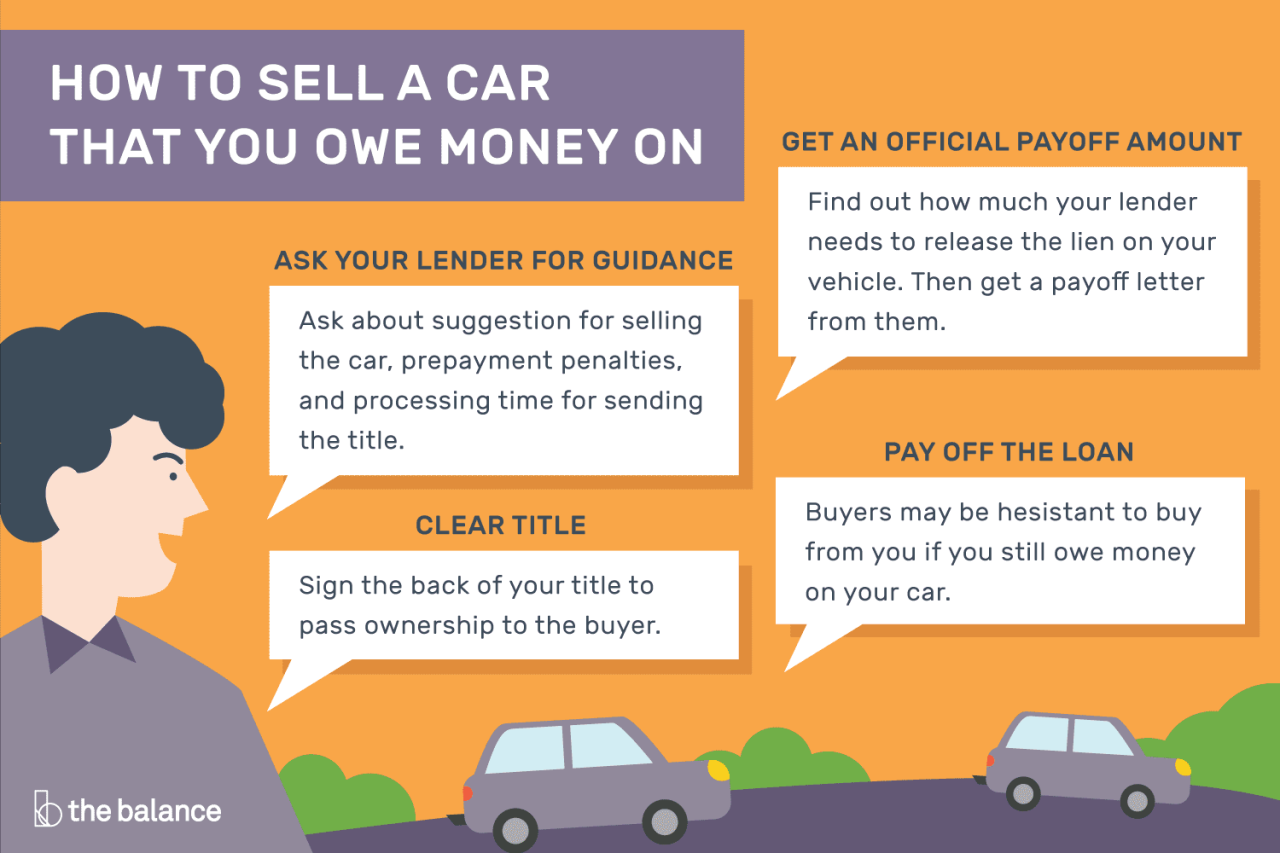

Illustrating the Process

Understanding the emotional and financial implications of each method for getting rid of a financed car is crucial for making an informed decision. The process can be stressful, so a clear understanding of the potential outcomes is vital. Each option presents a unique set of challenges and rewards, impacting your financial situation and overall well-being.

Emotional and Financial Aspects of Each Option

Selling your car privately can be emotionally rewarding, offering a sense of control and potentially maximizing your profit. However, it’s also time-consuming and carries the risk of dealing with difficult buyers or negotiating lower prices. Financially, it offers the highest potential return but requires more effort and carries a higher risk of loss. Trading in your car at a dealership is a faster, less stressful process, but you’ll likely receive a lower price than selling privately. Emotionally, it’s often the most convenient option. Financially, it’s simpler but less lucrative. Refinancing your loan might offer lower monthly payments or a shorter loan term, easing the financial burden. Emotionally, it can provide a sense of relief and improved financial outlook. However, it involves fees and may not always be approved. Surrendering your car to the lender is the easiest option emotionally, as it eliminates the responsibility of the car and its associated payments. Financially, it results in a negative equity situation, impacting your credit score and potentially costing you more in the long run.

A Successful Private Sale Narrative, How to get rid of a financed car

Sarah, burdened by a large monthly payment on her financed SUV, decided to sell it privately. She felt overwhelmed by the financial pressure and the looming threat of repossession. After carefully researching her car’s value using online resources and checking prices of similar vehicles in her area, she set a fair price that reflected the car’s condition and market value. She meticulously cleaned and detailed her vehicle, taking high-quality photos showcasing its best features. She listed her car on several online classifieds and social media platforms, writing a detailed description highlighting its key features and mileage. She was upfront about the loan details, encouraging serious inquiries only. After several viewings and negotiations, Sarah successfully sold her SUV to a reliable buyer. The process took a few weeks, but the relief of successfully selling her car privately and being free from the financial burden was immense. The extra money she made compared to trading it in significantly helped her financial situation.

Effective Car Advertisement Visual Elements

An effective car advertisement needs to capture attention quickly. The main image should be high-resolution, professionally taken, and showcase the car in its best light, ideally in a scenic location. The car should be clean and well-lit, preferably from an angle that highlights its curves and features. The background should be uncluttered and not distract from the vehicle. The color scheme should be consistent and visually appealing; using colors that complement the car’s color is important. The text should be concise, easy to read, and strategically placed, avoiding clutter. Key information like the make, model, year, mileage, and price should be prominently displayed. A strong call to action, such as “Call now!” or “Schedule a test drive today!”, should be included. The overall aesthetic should be clean, modern, and professional, conveying trustworthiness and quality. Think of a magazine advertisement for a luxury car: clean lines, minimal text, and a focus on a single, stunning image of the vehicle.

Tim Redaksi