Understanding Yahoo Finance’s Cash Holdings Data: How To Edit Total Cash Holdings Yahoo Finance

Yahoo Finance provides valuable insights into a company’s financial health, and a crucial aspect of this is its cash holdings. Understanding how this data is presented and its potential limitations is key to accurate financial analysis. This section will explore the different ways Yahoo Finance displays cash holdings and highlight potential discrepancies between reported figures and a company’s true liquid assets.

How to edit total cash holdings yahoo finance – Yahoo Finance typically presents cash holdings data in several ways, drawing information from a company’s financial statements. These statements, including the balance sheet and cash flow statement, offer different perspectives on a company’s cash position. The balance sheet usually shows the total cash and cash equivalents at a specific point in time, while the cash flow statement details the sources and uses of cash over a period.

Cash and Cash Equivalents on the Balance Sheet

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific date. The “Cash and Cash Equivalents” line item represents the company’s most liquid assets. This typically includes readily available cash in bank accounts, as well as short-term, highly liquid investments that can be easily converted to cash, such as treasury bills or commercial paper. It’s crucial to remember that this figure represents a point-in-time measurement, and the actual cash balance can fluctuate significantly throughout the reporting period. For example, a company might report $100 million in cash and cash equivalents on its balance sheet, but its daily operating cash flow could result in significant variations in the actual cash balance throughout the quarter.

Cash Flow from Operating Activities

The statement of cash flows provides a more dynamic view of a company’s cash position. The “Cash flow from operating activities” section reveals how much cash a company generated or used from its core business operations during a specific period. A positive cash flow from operations suggests strong profitability and cash generation capabilities, while a negative figure indicates the company may be burning through its cash reserves. For instance, a company with a consistently positive operating cash flow can be considered financially healthier than one with negative operating cash flow, even if their balance sheet shows similar levels of cash and cash equivalents. This difference highlights the importance of analyzing both the balance sheet and cash flow statement together for a complete picture.

Potential Discrepancies Between Reported Cash and Actual Liquid Assets

Reported cash holdings might not always reflect the company’s true liquid asset position. Several factors can contribute to discrepancies: Firstly, the definition of “cash equivalents” can vary slightly between companies and accounting standards. Secondly, the balance sheet reflects a specific point in time, while a company’s cash balance fluctuates constantly. Thirdly, off-balance sheet financing arrangements, such as securitizations or special purpose vehicles, might not be fully reflected in the reported cash balance. Finally, the timing of transactions can also influence the reported figures. A large payment or receipt might occur just before or after the reporting date, significantly affecting the reported cash balance without reflecting the overall liquidity of the company. Therefore, relying solely on the reported cash balance can be misleading; a thorough analysis of the financial statements is necessary.

Interpreting Cash Holdings Data Across Financial Statements

To gain a comprehensive understanding of a company’s cash position, it’s essential to analyze the cash holdings data presented in different financial statements. Comparing the cash and cash equivalents reported on the balance sheet with the cash flow from operating activities can provide valuable insights into the company’s cash generation capabilities and liquidity. For example, a company with high cash and cash equivalents on its balance sheet but negative cash flow from operations may indicate underlying financial weaknesses, suggesting that the high cash balance might be dwindling. Conversely, a company with a lower cash balance but strong positive operating cash flow demonstrates robust financial health and the ability to generate cash from its core operations. Analyzing these figures together paints a far more accurate picture than considering any single metric in isolation.

Identifying and Accessing Relevant Financial Statements

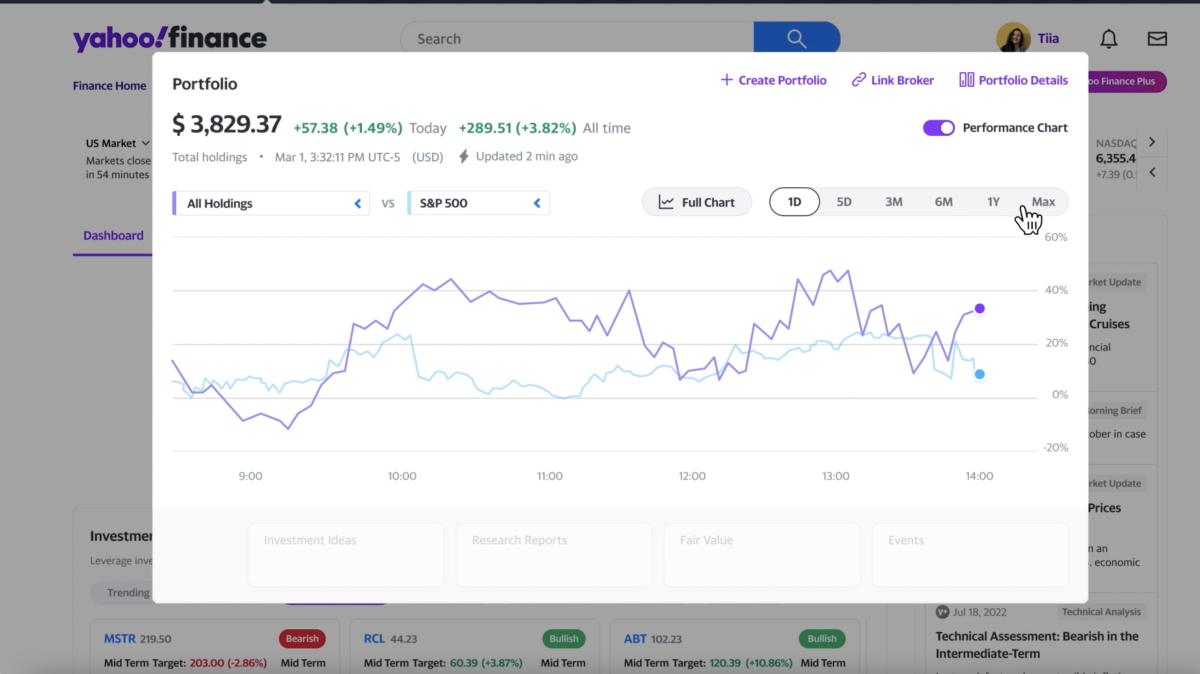

Locating precise cash holdings data on Yahoo Finance requires understanding where this information resides within the company’s financial statements. The key statements to examine are the Balance Sheet and the Statement of Cash Flows. Both provide different perspectives on a company’s cash position, making it crucial to consult both for a comprehensive understanding.

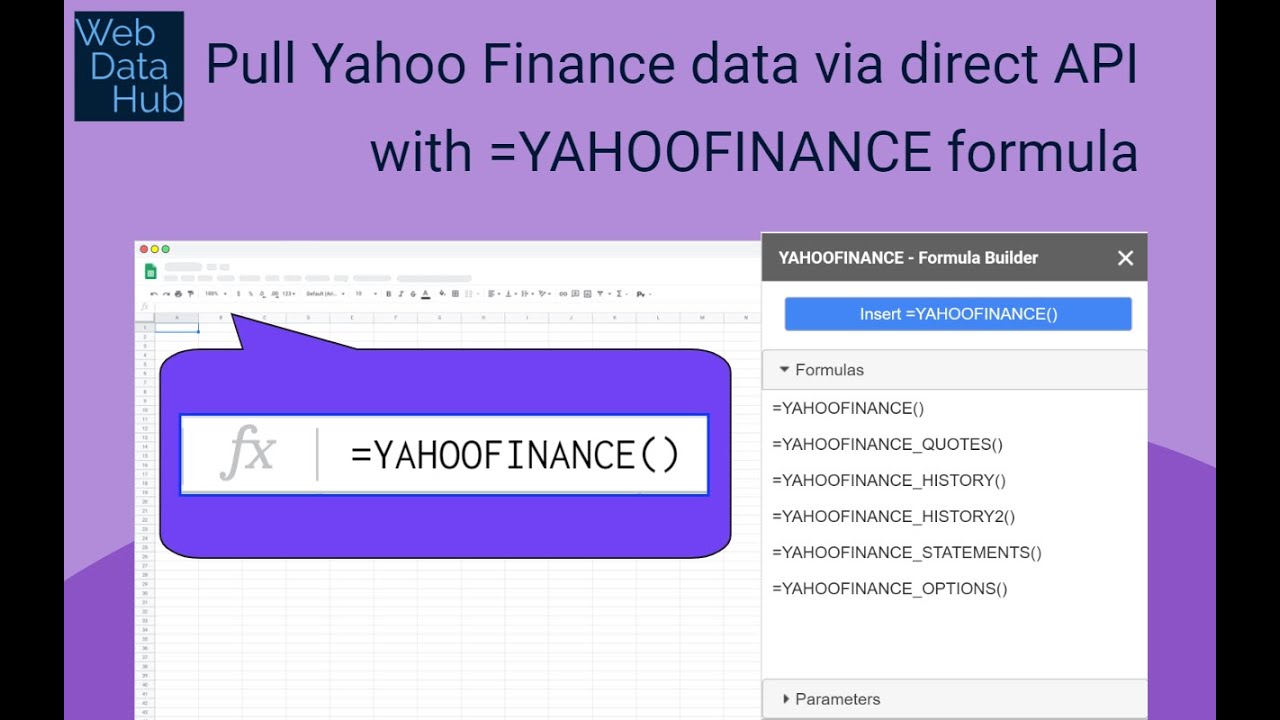

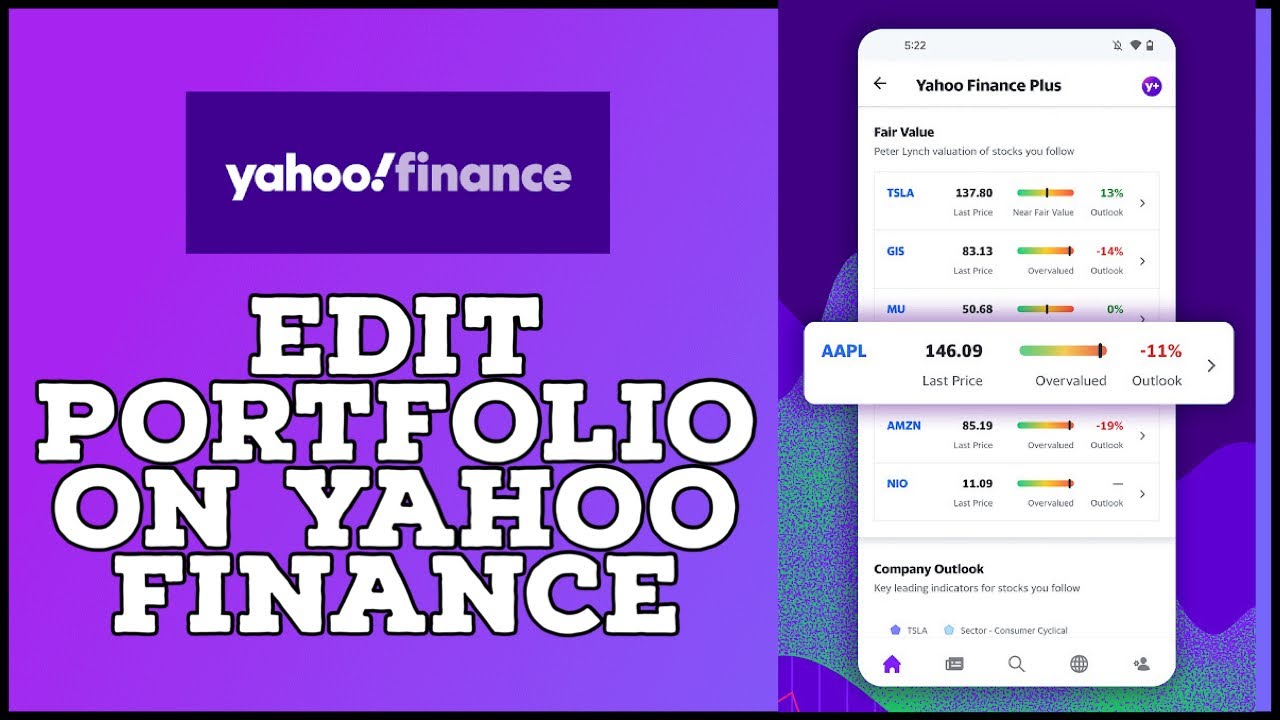

Yahoo Finance presents this information in a structured manner, making navigation relatively straightforward. However, the exact layout might vary slightly depending on the specific company and the platform’s updates.

Navigating to the Balance Sheet and Statement of Cash Flows

To access the necessary financial statements, begin by searching for the company’s ticker symbol on Yahoo Finance. Once on the company’s profile page, look for a section typically labeled “Financials.” Clicking on this section will typically present a menu with several options, including “Balance Sheet,” “Cash Flow Statement,” and “Income Statement.”

Selecting “Balance Sheet” will display the company’s assets, liabilities, and equity at a specific point in time. The “Cash and Cash Equivalents” line item within the “Assets” section represents the company’s total cash holdings. Similarly, selecting “Cash Flow Statement” will show the changes in cash over a period, providing insight into the sources and uses of cash during that time. This statement offers a dynamic view of cash movements, complementing the static snapshot offered by the Balance Sheet.

Comparison of Cash Data Presentation Across Financial Statements

The following table compares how cash data is presented in the Balance Sheet and the Statement of Cash Flows on Yahoo Finance.

| Statement Type | Data Location | Data Format | Data Reliability |

|---|---|---|---|

| Balance Sheet | Assets section; usually labeled “Cash and Cash Equivalents” or a similar term. | Single numerical value representing the total cash holdings at a specific point in time. | Generally considered highly reliable, as it’s an audited figure. However, minor discrepancies may arise due to timing differences in reporting. |

| Statement of Cash Flows | Various sections, including “Cash from Operating Activities,” “Cash from Investing Activities,” and “Cash from Financing Activities.” The “Net increase/decrease in cash” is a key figure. | Multiple numerical values showing cash inflows and outflows from different activities over a period. The net change in cash is also presented. | Generally reliable, reflecting audited data. However, the classification of cash flows can involve some judgment calls, leading to minor variations in reporting between companies. |

Interpreting Cash Holdings Data

Understanding a company’s cash holdings is crucial for assessing its financial health and future prospects. A healthy cash position indicates a company’s ability to meet its short-term obligations, invest in growth opportunities, and weather economic downturns. Conversely, insufficient cash can lead to financial distress and even bankruptcy. Analyzing cash holdings requires understanding not just the raw number, but also the context within which it exists.

Cash and cash equivalents represent a company’s most liquid assets. They are readily available to meet immediate financial needs. A strong cash position provides financial flexibility, allowing companies to seize unexpected opportunities, such as acquiring a competitor or investing in promising new technologies. Conversely, low cash levels can restrict a company’s ability to respond to market changes or unexpected events, potentially hindering its growth and competitiveness. The significance of cash is amplified during periods of economic uncertainty or industry disruption, where access to capital may be limited.

Factors Influencing Cash Holdings Fluctuations

Several factors contribute to the variation in a company’s cash holdings over time. These include changes in revenue, operating expenses, capital expenditures, debt levels, and acquisitions. For example, a company experiencing rapid growth might see its cash reserves decrease as it invests heavily in expanding its operations. Conversely, a company facing declining sales might accumulate cash as it reduces spending. Furthermore, significant acquisitions or divestitures can drastically alter a company’s cash position, leading to substantial increases or decreases in short periods. Seasonal variations in business activity can also influence cash flow, with companies often accumulating cash during peak seasons and depleting it during slower periods. Consider a retail company that experiences high sales during the holiday season; this would typically lead to an increase in cash holdings at the end of the year.

Comparative Analysis of Cash Holdings

Comparing the cash holdings of similar companies within the same industry provides valuable insights into relative financial strength and management strategies. This comparative analysis helps to contextualize a company’s cash position. For instance, a company with significantly lower cash reserves than its competitors might be facing challenges in profitability or efficiency, or it may be pursuing a more aggressive growth strategy that requires reinvesting cash flow. Conversely, a company with unusually high cash reserves might be signaling a lack of investment opportunities or a conservative financial approach. It’s important to note that simply comparing absolute cash numbers might be misleading. A more comprehensive analysis requires considering factors like company size, revenue, and profitability to normalize the cash holdings and arrive at more meaningful comparisons. For example, comparing the cash holdings of a large, established company to a smaller, rapidly growing startup would not be a fair comparison without considering other financial metrics.

Contextualizing Cash Holdings within the Broader Financial Picture

Understanding a company’s cash holdings requires more than just looking at the raw number. A comprehensive analysis necessitates integrating this figure into a broader financial framework, considering its relationship with other key performance indicators and the company’s overall strategic direction. This allows for a more nuanced understanding of the company’s financial health and future prospects.

Analyzing cash holdings in isolation provides a limited perspective. A robust evaluation demands a comparative analysis against other crucial financial metrics, allowing for a more holistic assessment of the company’s financial position and its implications for future growth. This contextualization helps to determine whether the cash on hand is sufficient, excessive, or insufficient relative to the company’s needs and risks.

Cash Holdings and Key Financial Metrics

To effectively contextualize cash holdings, we need to compare them to other vital financial metrics. This involves calculating relevant ratios and analyzing trends over time. For example, the cash ratio (Cash and Cash Equivalents / Current Liabilities) indicates a company’s ability to meet its short-term obligations. A higher ratio suggests greater liquidity and financial strength. Conversely, a low ratio might signal potential liquidity issues. Another important ratio is the cash flow to debt ratio (Operating Cash Flow / Total Debt), which reveals the company’s ability to service its debt using its cash flow from operations. A higher ratio implies better debt management and lower financial risk. Further analysis might involve comparing cash holdings to revenue (Cash and Cash Equivalents / Revenue), providing insights into the proportion of revenue held as cash. A consistently high ratio could indicate a conservative investment strategy, while a low ratio might suggest aggressive growth plans or operational inefficiencies. Analyzing these ratios over several years helps to identify trends and potential shifts in the company’s financial strategy.

Cash Holdings, Investment Strategy, and Growth Plans, How to edit total cash holdings yahoo finance

A company’s cash holdings are intrinsically linked to its investment strategy and growth plans. High cash reserves might indicate a conservative approach, prioritizing financial stability over rapid expansion. Companies might choose to accumulate cash for acquisitions, research and development, or to weather potential economic downturns. Conversely, low cash reserves could reflect an aggressive growth strategy, with the company reinvesting its earnings back into the business to fuel expansion and market share gains. For example, a technology startup with high R&D expenditure might maintain lower cash reserves compared to a mature, established company in a less dynamic industry. Analyzing a company’s capital expenditures (CAPEX) alongside its cash holdings can further illuminate its investment strategy. High CAPEX coupled with low cash reserves might indicate reliance on debt financing, whereas high cash reserves with low CAPEX might suggest a preference for organic growth or a cautious approach to investment.

Assessing the Adequacy of Cash Reserves

Determining the adequacy of a company’s cash reserves involves considering its operating needs and potential risks. This assessment is not a simple calculation but rather a qualitative judgment informed by several factors. The company’s industry, its business cycle stage, and its financial leverage all play a crucial role. A company operating in a volatile industry, for example, might need to maintain significantly higher cash reserves than a company in a stable industry to act as a buffer against unforeseen circumstances. Similarly, a company with high debt levels will need to hold more cash to ensure it can meet its debt obligations. Consider Apple Inc., a technology giant known for its significant cash holdings. This substantial reserve allows the company to withstand economic downturns, invest in innovation, and pursue acquisitions strategically. In contrast, a smaller, rapidly growing startup might have lower cash reserves, relying more on external financing to fuel its expansion, even though this strategy entails greater financial risk. Ultimately, assessing the adequacy of cash reserves requires a holistic understanding of the company’s financial position, its business model, and the inherent risks within its operating environment.

Tim Redaksi