Average Salary of Finance Graduates

The earning potential for finance graduates is a significant factor influencing career choices. Salaries vary considerably based on several key factors, including the level of education attained, years of experience, specialization within the finance field, and the employing institution’s location and prestige. This section will delve into these variables to provide a clearer picture of potential earnings.

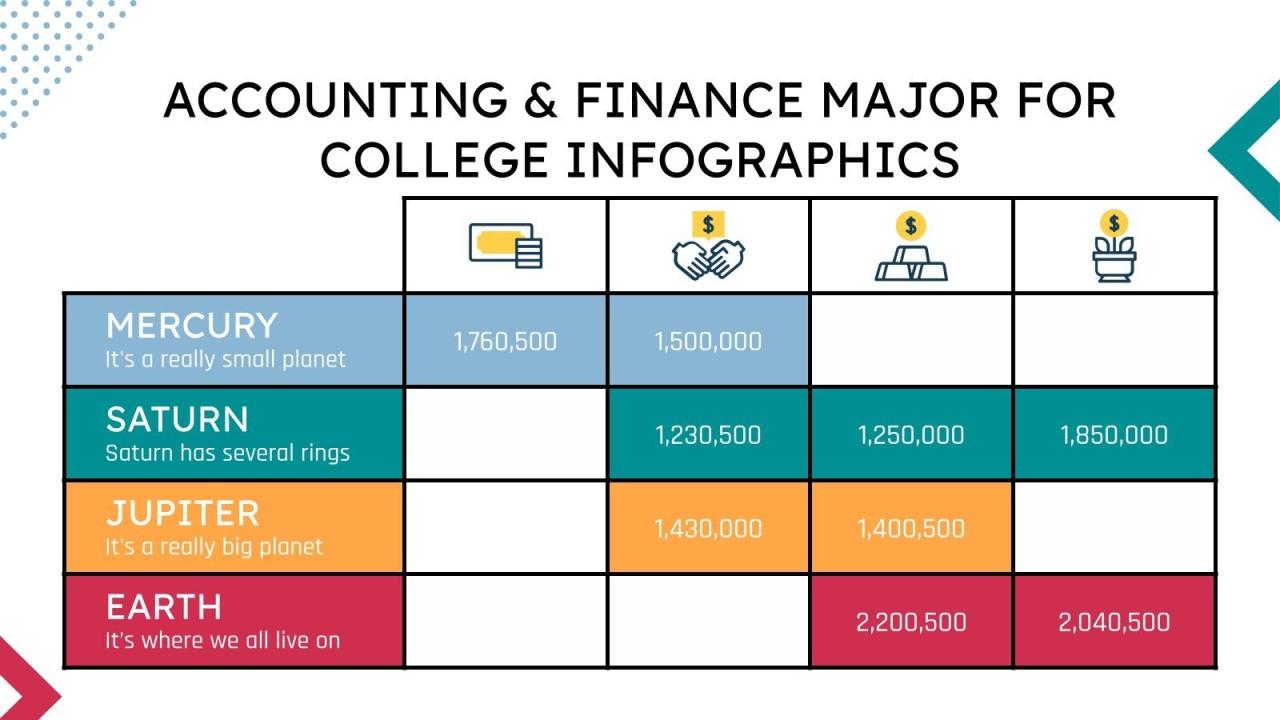

Average Starting Salaries by Degree and Experience

The following table presents estimated average starting salaries for finance graduates, categorized by degree type (Bachelor’s, Master’s, MBA) and years of experience. These figures are approximations and can fluctuate based on the factors mentioned above. It’s important to note that these are averages and individual salaries may vary significantly.

| Degree/Experience | 0-5 Years | 5-10 Years | 10+ Years |

|---|---|---|---|

| Bachelor’s | $60,000 – $75,000 | $80,000 – $100,000 | $100,000+ |

| Master’s | $70,000 – $90,000 | $95,000 – $120,000 | $120,000+ |

| MBA | $85,000 – $110,000 | $120,000 – $150,000 | $150,000+ |

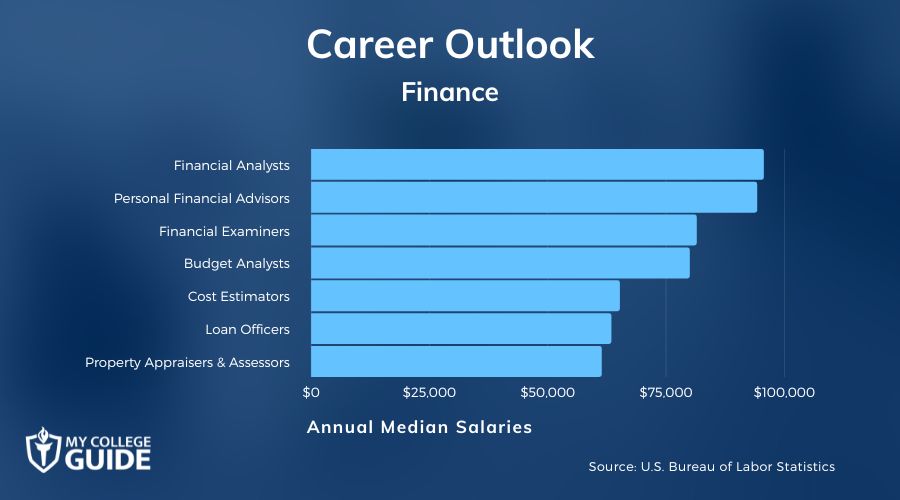

Salary Comparison Across Finance Specializations

Compensation in the finance industry varies significantly depending on the chosen specialization. Certain areas command higher salaries due to factors such as higher demand, greater responsibility, and risk involved.

How much does finance major make – The following bullet points illustrate the average salary differences across several common finance specializations. These figures are estimates and can fluctuate based on experience, location, and employer.

- Investment Banking: Often boasts the highest starting salaries, particularly for entry-level analysts, due to the demanding nature of the work and potential for significant bonuses. Expect salaries in the range of $80,000 – $150,000+ for entry-level positions, increasing substantially with experience and seniority.

- Corporate Finance: Generally offers competitive salaries, though typically lower than investment banking. Starting salaries range from $60,000 to $100,000+, depending on company size, location, and experience.

- Financial Analysis: Salaries are generally competitive and vary widely depending on the industry and the size of the company. Entry-level positions might range from $55,000 to $85,000+, with potential for significant growth with experience.

- Portfolio Management: Salaries are typically high, especially for those managing large portfolios. Compensation models often include base salaries plus performance-based bonuses.

Factors Influencing Starting Salaries

Several factors significantly impact a finance graduate’s starting salary. Understanding these factors can help individuals make informed decisions to maximize their earning potential.

The following are key elements influencing compensation:

- University Reputation: Graduates from prestigious universities often receive higher starting offers due to the perceived quality of their education and network opportunities.

- Location: Major financial centers like New York City, London, and Hong Kong tend to offer higher salaries than smaller cities due to higher demand and cost of living.

- Internship Experience: Relevant internships provide valuable experience and skills, making graduates more competitive in the job market and often leading to higher starting salaries. A successful internship can act as a strong stepping stone into a full-time role with the same company, offering a salary advantage over those without such experience.

- Skills and Certifications: Possessing in-demand skills such as data analysis, programming (Python, R), and relevant certifications (CFA, CAIA) can significantly boost earning potential.

Geographic Variations in Finance Salaries: How Much Does Finance Major Make

Finance professionals can expect significant salary variations depending on their location. Major financial centers worldwide offer diverse opportunities, but compensation packages reflect the cost of living, market demand, and the specific industry niche. This section explores these geographic disparities in more detail.

The compensation of finance professionals is heavily influenced by the geographic location of their employment. Several factors contribute to these differences, leading to a wide range of salaries across various financial hubs globally.

Average Finance Salaries in Major Financial Centers

The following table presents a comparison of average finance salaries in some of the world’s leading financial centers. Note that these figures are averages and can vary significantly based on experience, specific role, and company size. Data is approximate and based on industry reports and salary surveys from reputable sources in recent years. Precise figures fluctuate annually.

| City | Average Annual Salary (USD) | Currency | Notes |

|---|---|---|---|

| New York City, USA | 150,000 – 250,000 | USD | High cost of living; strong competition; wide range of opportunities. |

| London, UK | 120,000 – 200,000 | GBP (converted to USD) | High cost of living; significant financial sector; Brexit impact considered. |

| Hong Kong | 100,000 – 180,000 | HKD (converted to USD) | High cost of living; strong Asian market presence; fluctuating exchange rates. |

| Singapore | 80,000 – 150,000 | SGD (converted to USD) | High cost of living; growing Asian financial hub; competitive talent pool. |

Factors Contributing to Salary Differences

Several key factors contribute to the observed differences in finance salaries across geographical locations. These factors interact in complex ways to shape compensation packages.

- Cost of Living: Cities like New York and London have exceptionally high costs of living, impacting both the salary needed to maintain a comparable lifestyle and the overall compensation offered by employers to attract and retain talent. This necessitates higher base salaries to compensate for increased housing, transportation, and daily expenses.

- Market Demand: Financial centers with a high concentration of financial institutions and a strong demand for skilled professionals, such as New York, tend to offer higher salaries to attract and retain talent in a competitive market. Conversely, areas with less demand may offer lower compensation.

- Taxation and Benefits: Tax rates and the availability of benefits (health insurance, retirement plans) vary significantly between countries and cities, influencing the overall compensation package’s attractiveness. Tax advantages in certain locations can effectively increase the net income received by employees.

- Industry Specialization: Specific financial niches within a city may command higher salaries. For example, hedge fund managers in New York might earn significantly more than those in smaller financial centers.

- Economic Conditions: The overall economic health and growth of a region significantly impact salaries. Booming economies typically translate to higher compensation packages.

Comparison of Benefits and Drawbacks of Working in Different Financial Hubs

Choosing a financial hub involves weighing the benefits and drawbacks carefully, with salary being a major consideration.

Working in established financial centers like New York or London offers higher earning potential and exposure to larger, more complex deals. However, these locations also present a higher cost of living and intense competition for jobs. Conversely, emerging hubs might offer a better work-life balance and lower cost of living, but at the potential expense of lower salaries and fewer opportunities for career advancement. The optimal choice depends on individual career goals and personal preferences.

Illustrative Examples of Finance Professionals’ Earnings

Understanding the earning potential in finance requires looking beyond average salaries. The following profiles illustrate the diverse career paths and compensation packages achievable within the field, highlighting the impact of experience, education, and skillset on income. These examples are illustrative and should not be considered definitive salary guarantees.

Entry-Level Financial Analyst

This profile represents a recent graduate entering the finance industry. Sarah, a 24-year-old with a Bachelor’s degree in Finance from a reputable state university, secured a position as a Financial Analyst at a mid-sized asset management firm. Her starting salary is $65,000 annually, including a standard benefits package encompassing health insurance, paid time off, and a 401(k) with employer matching. Sarah’s strong academic record, coupled with relevant internship experience at a smaller financial institution, significantly contributed to securing this role. Her key skills include proficiency in financial modeling software (Excel, Bloomberg Terminal), data analysis, and strong communication skills.

Mid-Career Portfolio Manager

David, a 38-year-old with an MBA from a top-tier business school and ten years of experience, works as a Portfolio Manager at a large investment bank. His total compensation package exceeds $250,000 annually. This includes a base salary of $180,000, a substantial performance-based bonus (typically representing 40-60% of his base salary, depending on portfolio performance), and additional benefits like company stock options and a generous retirement plan. David’s career progression involved starting as a Financial Analyst, then moving to roles with increasing responsibility such as Associate Portfolio Manager before achieving his current senior position. His expertise in investment strategies, risk management, and client relationship management are key factors in his high earning potential. He consistently demonstrates strong analytical skills and a deep understanding of market dynamics.

Senior-Level Chief Financial Officer (CFO), How much does finance major make

This profile illustrates the earning potential at the highest levels of finance. Maria, a 50-year-old with a CPA designation and over 25 years of experience, serves as the CFO of a publicly traded company. Her total compensation package is highly variable and includes a base salary of approximately $400,000, a substantial annual bonus potentially exceeding $200,000, and stock options that can significantly increase her overall compensation based on the company’s performance. Maria’s extensive experience in financial planning, analysis, and reporting, coupled with her strategic leadership and strong understanding of corporate finance, are vital to her success and substantial earnings. Her educational background includes a Bachelor’s degree in Accounting and an MBA. She also holds several professional certifications and has a proven track record of successfully navigating complex financial situations.

Tim Redaksi