Salary Range of Dealership Finance Managers: How Much Does A Finance Manager At A Dealership Make

Dealership finance managers play a crucial role in the profitability of automotive dealerships, negotiating financing options and securing profitable deals for the dealership. Their compensation reflects this importance, varying significantly based on several key factors. Understanding these factors helps clarify the broad salary spectrum for this position.

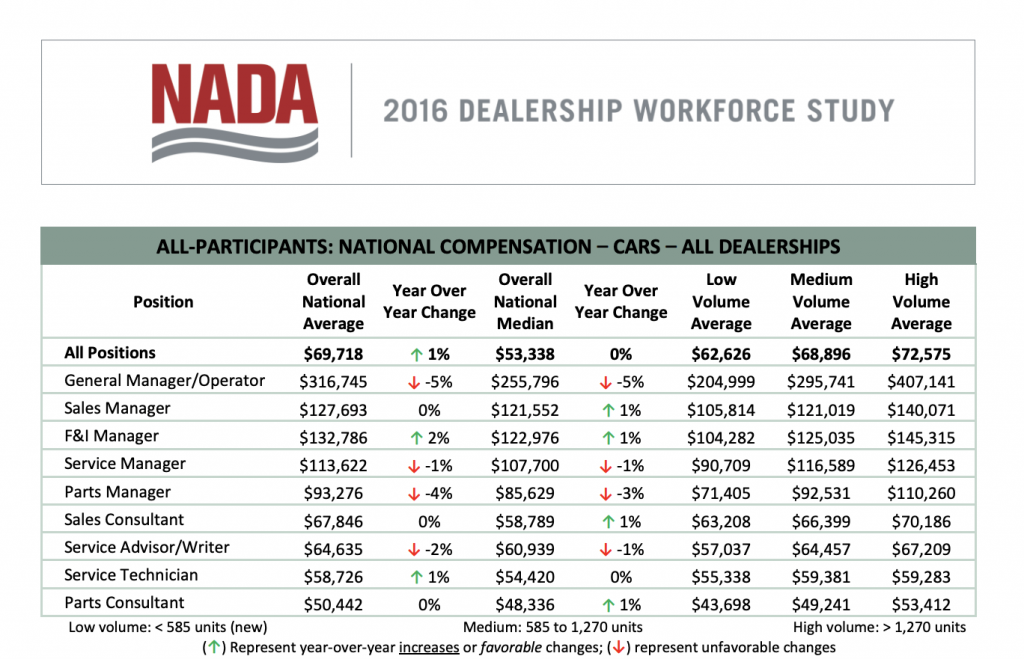

How much does a finance manager at a dealership make – Several factors contribute to the wide range of salaries earned by finance managers at dealerships. Dealership size directly impacts revenue and thus the potential compensation offered. Geographic location influences both the cost of living and the overall demand for qualified finance managers. Experience level, naturally, plays a significant role, with more experienced managers commanding higher salaries. Finally, the performance of the dealership itself – its sales volume and profitability – significantly affects the compensation pool available for its employees, including the finance manager.

Salary Ranges by Dealership Size and Other Factors

The following table provides a general overview of salary ranges for dealership finance managers. It’s important to note that these are estimates, and actual salaries can vary considerably based on the specific factors mentioned above. These figures are based on industry reports and salary surveys, and may not represent every situation.

| Dealership Size | Location Type | Experience Level | Salary Range (USD Annual) |

|---|---|---|---|

| Small (Under 500 units sold annually) | Rural | Entry-Level (0-2 years) | $40,000 – $60,000 |

| Small (Under 500 units sold annually) | Urban | Entry-Level (0-2 years) | $45,000 – $65,000 |

| Medium (500-1500 units sold annually) | Rural | Mid-Level (3-7 years) | $60,000 – $90,000 |

| Medium (500-1500 units sold annually) | Urban | Mid-Level (3-7 years) | $70,000 – $100,000 |

| Large (Over 1500 units sold annually) | Rural | Senior-Level (7+ years) | $90,000 – $150,000 |

| Large (Over 1500 units sold annually) | Urban | Senior-Level (7+ years) | $100,000 – $180,000+ |

Compensation Structure Beyond Base Salary

Dealership finance managers rarely rely solely on a base salary for their income. Their overall compensation package is typically a blend of base pay, commissions, and bonuses, often structured to incentivize performance and profitability. Understanding these additional components is crucial for accurately assessing the potential earnings of this role.

A significant portion of a finance manager’s income often stems from various commission structures. These commissions are designed to reward their success in securing financing deals and maximizing profits for the dealership. The specific structure can vary widely depending on the dealership’s size, location, and overall business strategy. Dealerships frequently use a combination of different performance metrics to calculate commissions, ensuring that the compensation plan aligns with the dealership’s overarching goals.

Commission Structures Based on Performance Metrics

Commission structures for dealership finance managers are usually multifaceted and tailored to the dealership’s needs. A common approach is to tie commissions to the volume of financing deals secured. For example, a finance manager might receive a percentage of the finance income generated from each successful loan application. Another approach involves rewarding higher profit margins. This might entail a tiered commission structure, where the commission rate increases as the profit margin on each deal improves. Finally, some dealerships incorporate customer satisfaction scores into the commission calculation, incentivizing excellent customer service and building strong customer relationships. This holistic approach promotes not only sales but also customer loyalty and positive word-of-mouth marketing.

For instance, one dealership might offer a base commission of 2% of the finance income for each deal, increasing to 3% if the profit margin exceeds a predetermined target. Another dealership could structure its commission plan around a points-based system, where points are earned for each completed financing deal, with additional points awarded for higher profit margins and positive customer feedback. These points are then converted into a monetary commission. The complexity of these commission structures reflects the importance of the finance manager’s role in the dealership’s profitability.

Benefits Packages for Finance Managers

Dealerships typically offer competitive benefits packages to attract and retain skilled finance managers. These packages often include a variety of options designed to enhance the overall compensation and support the well-being of their employees. The specific benefits offered can vary based on the dealership’s size, location, and financial performance. However, several common elements frequently appear in these packages.

- Health insurance (medical, dental, vision): Comprehensive health coverage is a standard benefit, often including options for family coverage.

- Retirement plan (401k, pension): Many dealerships offer retirement savings plans with employer matching contributions to encourage long-term employee commitment.

- Paid time off (vacation, sick leave): Dealerships typically provide paid time off for vacations, sick days, and personal needs.

- Life insurance: Providing life insurance demonstrates the dealership’s concern for employee well-being and financial security for their families.

- Disability insurance: This insurance protects the employee’s income in case of illness or injury preventing them from working.

- Professional development opportunities: Some dealerships invest in their employees’ professional growth by offering training courses, certifications, or tuition reimbursement programs.

- Vehicle discounts: Employees often receive discounts on purchasing vehicles from the dealership they work for.

Impact of Dealership Type and Brand

A finance manager’s compensation is significantly influenced by the type of dealership they work for and the brand it represents. Factors like the dealership’s sales volume, the average transaction price of vehicles, and the overall profitability directly impact the potential earnings of the finance manager. Luxury dealerships, for example, tend to offer higher earning potential due to the higher profit margins on luxury vehicles.

Dealership brand reputation and market share also play a crucial role. A well-established, high-volume dealership with a strong brand reputation often attracts more customers and generates higher profits, allowing for more generous compensation packages for its finance managers. Conversely, a smaller dealership with a less recognized brand might offer lower base salaries and smaller commission structures.

Dealership Type and Brand Influence on Finance Manager Compensation

The following table compares average salaries for finance managers across different dealership types and brands. It’s important to note that these are average figures, and actual compensation can vary significantly based on individual performance, location, and specific dealership policies. The figures presented are estimates based on industry data and may not represent every dealership or situation.

| Dealership Type | Brand | Average Salary (USD) | Notable Compensation Differences |

|---|---|---|---|

| New Car Dealership (Volume Brand) | Toyota, Honda, Chevrolet | $70,000 – $100,000 | Higher volume of transactions, but lower profit margins per vehicle compared to luxury brands. Compensation often relies heavily on commissions. |

| New Car Dealership (Luxury Brand) | BMW, Mercedes-Benz, Lexus | $100,000 – $150,000+ | Higher profit margins per vehicle lead to greater earning potential. Base salaries are often higher, and commission structures are typically more lucrative. |

| Used Car Dealership (Independent) | Various | $50,000 – $80,000 | Lower average transaction prices and potentially less consistent sales volume compared to new car dealerships. Compensation may be more heavily reliant on commissions and performance bonuses. |

| Used Car Dealership (Franchise) | CarMax, etc. | $60,000 – $90,000 | Potentially higher volume and more structured compensation compared to independent used car dealerships. Benefits packages may also be more comprehensive. |

Educational Background and Experience Requirements

Becoming a successful dealership finance manager requires a blend of formal education, practical experience, and specialized skills. While a specific degree isn’t always mandatory, a strong foundation in finance and business principles significantly enhances career prospects and earning potential. Years of experience, coupled with demonstrable success in sales and customer relations, are equally crucial.

Dealership finance managers typically possess a bachelor’s degree, often in finance, business administration, or a related field. However, individuals with extensive experience in sales, particularly within the automotive industry, can sometimes compensate for a lack of formal education. This experience provides invaluable knowledge of the sales process, customer interaction, and dealership operations, all of which are critical to success in this role. Furthermore, strong analytical and problem-solving skills are essential for managing financial aspects of the dealership and effectively addressing customer financing needs.

Skills and Certifications Enhancing Earning Potential, How much does a finance manager at a dealership make

Possessing relevant certifications and skills significantly increases a finance manager’s value and, consequently, their earning potential. These credentials demonstrate a commitment to professional development and expertise in the field, making candidates more attractive to dealerships. For example, certifications from organizations like the National Automotive Finance Association (NAFA) are highly regarded within the industry. These certifications often involve rigorous training and testing, covering areas such as finance principles, regulatory compliance, and ethical practices. Completing management training programs further strengthens a candidate’s leadership abilities and strategic thinking, enabling them to effectively manage teams and optimize dealership profitability. Proficiency in financial software and analytical tools is also highly valued, as is a strong understanding of credit scoring and risk assessment.

Career Progression Paths and Salary Expectations

The career path for a dealership finance manager can vary depending on individual ambition and the size of the dealership. However, a common progression might look like this:

- Entry-Level Finance Associate/Sales Associate: This role often involves assisting experienced finance managers, learning dealership operations, and developing sales skills. Salary expectations typically range from $35,000 to $50,000 annually, with potential for commissions based on sales performance.

- Senior Finance Associate/Finance Manager Trainee: With increased experience and responsibility, individuals may progress to a senior associate role, handling more complex transactions and taking on additional responsibilities. Salary typically increases to $50,000 to $70,000, with increased commission potential.

- Finance Manager: In this role, individuals manage the entire finance department, overseeing staff, negotiating deals, and maximizing profitability. Salaries for experienced finance managers range from $70,000 to $150,000 or more annually, with significant potential for bonus and commission income based on dealership performance.

- Finance Director/General Manager: Highly successful finance managers can progress to leadership positions with broader responsibilities, overseeing multiple departments or the entire dealership. Salaries at this level can reach $150,000+ annually, with significant bonus structures and benefits.

It’s important to note that these salary ranges are estimates and can vary widely depending on factors such as dealership size, location, brand, and individual performance. Dealerships in larger metropolitan areas or those representing luxury brands often offer higher compensation packages. Similarly, high-performing finance managers consistently exceeding targets will typically earn significantly more than their peers.

Geographic Variations in Compensation

Dealership finance manager salaries, like many professional roles, are significantly influenced by geographic location. This variation stems primarily from differences in cost of living, market demand for skilled finance professionals, and the overall economic health of the region. Areas with higher costs of living and stronger economies tend to offer higher compensation packages to attract and retain qualified candidates.

Geographic location plays a crucial role in determining the salary of a dealership finance manager. The cost of living, including housing, transportation, and everyday expenses, directly impacts the required compensation to maintain a comparable standard of living across different regions. Furthermore, areas with a higher concentration of dealerships and a greater demand for finance managers will typically see increased salaries to remain competitive in the hiring process. Conversely, regions with lower costs of living and less competitive markets may offer lower salaries.

Regional Salary Differences

Major metropolitan areas in states with strong economies, such as California, New York, and Illinois, generally offer higher average salaries for dealership finance managers compared to smaller cities or rural areas in states with lower costs of living. For instance, a finance manager in a large dealership in Los Angeles might earn significantly more than a counterpart in a smaller dealership located in a rural area of the Midwest. Conversely, regions with lower costs of living, such as parts of the South and Midwest, tend to have lower average salaries for this role, though the difference is often offset by a lower cost of living. The specific salary range varies widely, influenced by factors beyond just geography, including the size of the dealership, the brand it represents, and the individual’s experience and performance.

Illustrative Map of Salary Variations

Imagine a map of the United States. The color scheme would represent salary ranges for dealership finance managers. Deep red would indicate the highest salary ranges, concentrated primarily in major metropolitan areas along the coasts, especially in California, New York, Florida, and parts of the Northeast. These regions would represent areas with high costs of living and robust automotive markets. Gradually transitioning to orange, yellow, and then light green, the map would visually depict a decrease in average salaries as one moves toward the interior of the country. Light green would represent the lowest salary ranges, primarily concentrated in smaller cities and rural areas of the Midwest and South. This color gradient would effectively illustrate the geographical disparity in compensation for this role, reflecting the interplay between cost of living and market demand. Areas with a high concentration of luxury dealerships might show pockets of deeper red even within lower-cost-of-living regions, highlighting the impact of dealership type on compensation.

Tim Redaksi