Average Salaries in Finance: How Much Does Finance Make

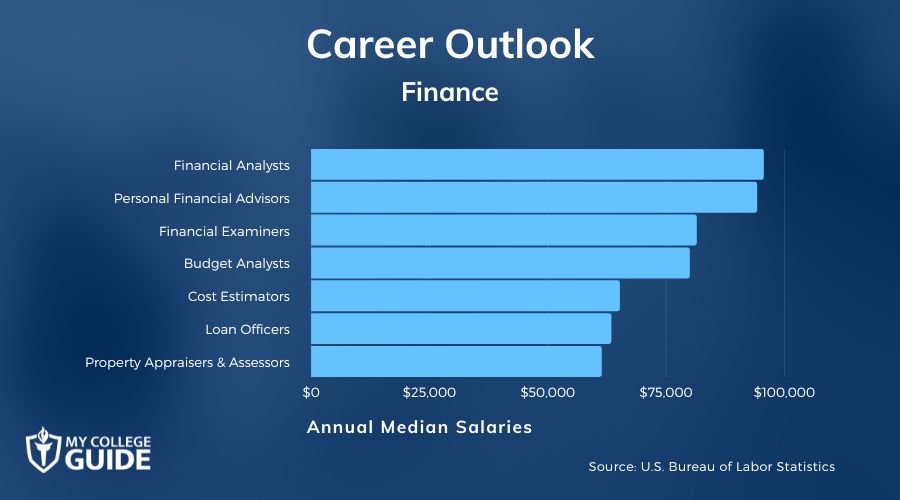

The finance industry offers a wide range of career paths, each with its own unique salary expectations. Compensation varies significantly based on factors such as experience, location, employer type, and educational background. Understanding these variations is crucial for anyone considering a career in finance.

Salary Ranges Across Finance Roles and Experience Levels

The following table provides an estimated average salary range for various finance roles at different experience levels. It’s important to note that these figures are averages and can fluctuate considerably based on the previously mentioned factors. Specific salary data should be researched based on your target location and employer.

| Role | Entry-Level (0-3 years) | Mid-Level (3-7 years) | Senior-Level (7+ years) |

|---|---|---|---|

| Financial Analyst | $60,000 – $80,000 | $80,000 – $120,000 | $120,000 – $180,000+ |

| Investment Banker | $80,000 – $120,000 | $150,000 – $250,000 | $250,000 – $500,000+ |

| Actuary | $65,000 – $90,000 | $90,000 – $130,000 | $130,000 – $200,000+ |

Factors Influencing Finance Compensation

Several key factors significantly impact compensation within the finance sector. Location plays a crucial role, with major financial hubs like New York City, London, and Hong Kong generally offering higher salaries than smaller cities. Company size also influences compensation, with larger, multinational corporations often paying more than smaller firms. Educational attainment is another significant factor; advanced degrees such as MBAs or PhDs can command higher salaries. Finally, performance-based bonuses and stock options can substantially increase overall compensation, particularly in roles such as investment banking.

Public vs. Private Sector Compensation

Compensation in the public and private sectors of finance differs considerably. Private sector finance roles, particularly in investment banking and hedge funds, tend to offer significantly higher salaries, often including substantial bonuses and benefits packages. Public sector finance roles, such as those in government agencies or non-profit organizations, typically offer lower salaries but often provide greater job security and benefits such as pensions. The difference in compensation often reflects the higher risk and performance-based incentives associated with the private sector.

Factors Affecting Finance Professionals’ Earnings

Beyond years of experience and job title, several key factors significantly influence the earning potential of finance professionals. These factors interact in complex ways, and understanding their interplay is crucial for anyone aiming to maximize their compensation in the financial world. This section will explore some of the most impactful elements.

How much does finance make – Education, certifications, and demonstrable skills all play a vital role in determining salary levels. A prestigious MBA from a top-tier university, for instance, can significantly boost earning potential compared to a degree from a less-renowned institution. Similarly, professional certifications like the Chartered Financial Analyst (CFA) designation or the Financial Risk Manager (FRM) certification often command higher salaries due to the specialized knowledge and expertise they represent. Furthermore, specific in-demand skills, such as advanced data analysis using Python or proficiency in specific financial modeling software, can lead to higher compensation packages.

The Influence of Education and Certifications

Possessing advanced degrees and relevant professional certifications significantly impacts a finance professional’s earning capacity. A Master of Business Administration (MBA) from a top-ranked program is often a prerequisite for senior roles in investment banking, private equity, and asset management. Furthermore, specialized master’s degrees in financial engineering or quantitative finance can open doors to lucrative careers in areas like algorithmic trading and risk management. Professional certifications, such as the CFA charter, demonstrate a high level of competency and commitment to the profession, often leading to higher salaries and increased career opportunities. The value of these credentials is consistently demonstrated in salary surveys and compensation data across the industry.

The Impact of Skills and Performance

Technical proficiency and demonstrable performance are key drivers of compensation in the finance industry. Strong analytical skills, coupled with proficiency in financial modeling software (e.g., Bloomberg Terminal, Excel), are highly valued. Furthermore, expertise in programming languages like Python or R, used extensively in quantitative finance and data analysis, can significantly increase earning potential. Performance metrics, such as deal flow in investment banking or portfolio returns in asset management, directly impact bonus structures and overall compensation. Consistent high performance leads to significant rewards, while underperformance can negatively impact compensation.

Geographic Location and Compensation

Compensation for finance professionals varies significantly based on geographic location. Major financial hubs tend to offer higher salaries due to the concentration of financial institutions and the competitive demand for skilled professionals. The cost of living in these areas also plays a role in determining overall compensation packages.

The following is a list of some high-paying cities for finance jobs:

- New York City, NY

- San Francisco, CA

- London, UK

- Hong Kong

- Singapore

- Tokyo, Japan

- Chicago, IL

- Boston, MA

Compensation Across Different Financial Sectors

Compensation packages differ considerably across various financial sectors. Investment banking typically offers the highest base salaries and bonuses, particularly for junior to mid-level professionals, driven by the high-pressure, deal-driven nature of the work. Asset management offers a more variable compensation structure, with significant potential for high earnings based on investment performance. Corporate finance roles generally provide more stable base salaries but may offer lower bonus potential compared to investment banking. The specific compensation structure within each sector also varies depending on factors like company size, performance, and individual contributions.

Career Progression and Compensation

A career in finance offers significant earning potential, but the trajectory is heavily influenced by factors such as specialization, experience, education, and professional development. Understanding the typical career path and the impact of various factors on compensation is crucial for aspiring finance professionals. This section will explore a hypothetical career progression for a financial analyst, the influence of professional development, and the salary trajectories across different finance specializations.

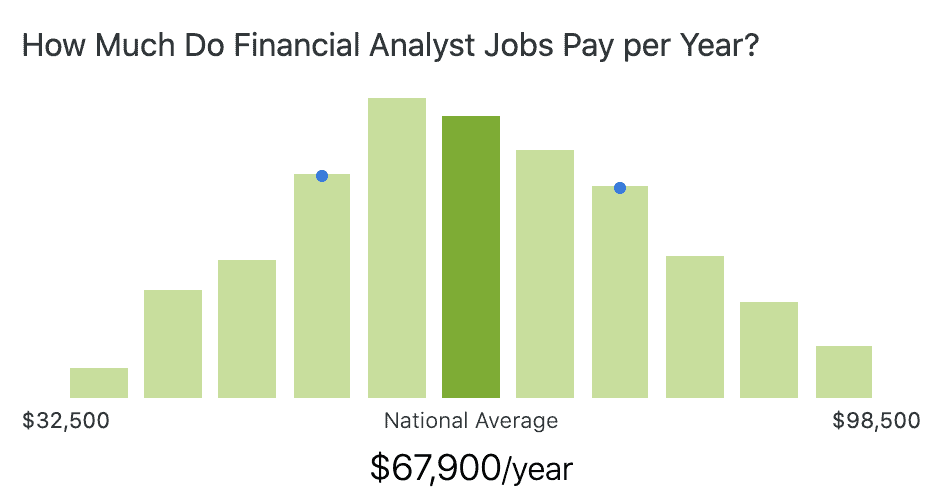

Hypothetical Career Path of a Financial Analyst

The following table illustrates a possible career progression for a financial analyst, showcasing potential salary increases at each stage. These figures are estimates and can vary significantly based on location, company size, performance, and market conditions. It’s important to note that these are averages and individual experiences may differ.

| Position | Years of Experience | Education/Certifications | Estimated Annual Salary (USD) |

|---|---|---|---|

| Financial Analyst | 0-2 | Bachelor’s Degree | $60,000 – $80,000 |

| Senior Financial Analyst | 3-5 | CFA Level I/II | $85,000 – $120,000 |

| Financial Manager/Associate Portfolio Manager | 6-10 | CFA Level III/MBA | $120,000 – $180,000 |

| Portfolio Manager/Director of Finance | 10+ | Extensive experience, potential additional certifications | $180,000+ |

Impact of Professional Development and Certifications

Professional development and certifications significantly impact long-term earning potential in finance. Earning a Chartered Financial Analyst (CFA) charter, for example, demonstrates a high level of competency and commitment to the profession, often leading to higher salaries and increased career opportunities. Similarly, obtaining a Master of Business Administration (MBA) can open doors to more senior roles and higher compensation. Continuing education through professional development courses and workshops keeps professionals up-to-date with industry trends and best practices, enhancing their value to employers. These investments in oneself often translate to substantial returns in the form of higher earning potential and career advancement. For instance, a CFA charter holder might command a 10-20% salary premium compared to a similarly experienced analyst without the certification.

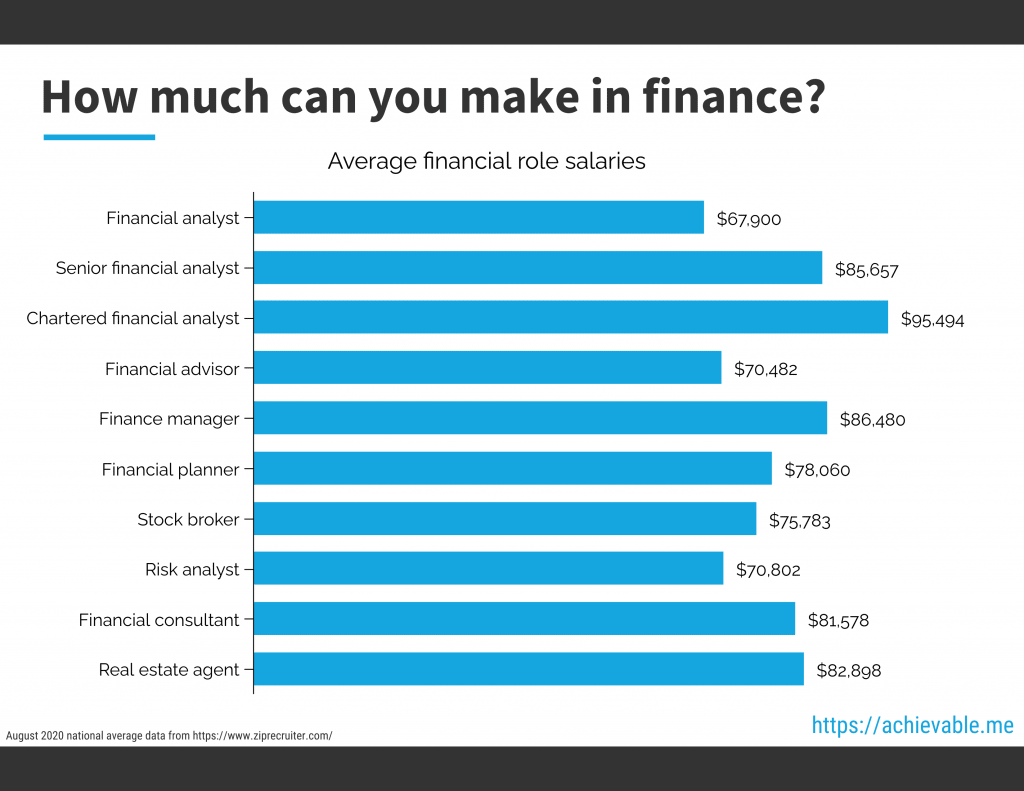

Salary Trajectories Across Finance Specializations, How much does finance make

Salary trajectories vary considerably across different finance specializations. Portfolio managers in high-performing funds, for example, often earn significantly more than financial planners or risk managers, reflecting the higher levels of responsibility and potential for substantial returns. However, risk management roles, particularly in the banking sector, can also command high salaries, especially with significant experience and expertise. Financial planning often has a lower initial salary but can see strong growth as client bases expand and financial advisors develop specialized expertise. The following is a general overview and should not be considered precise figures, as actual salaries depend on many factors.

Portfolio Management: Entry-level positions may start around $70,000, with experienced portfolio managers earning $200,000 or more. Exceptional performance can lead to multi-million dollar compensation packages through bonuses and performance-based incentives.

Risk Management: Starting salaries can range from $65,000 to $90,000, increasing to $150,000 or more for senior risk managers with specialized expertise in areas like quantitative analysis or regulatory compliance.

Financial Planning: Entry-level financial planners might earn $50,000 to $70,000 annually. Experienced advisors with a strong client base can earn significantly more, often exceeding $100,000 per year through commissions and fees.

Bonuses and Incentives in Finance

Financial bonuses and incentives are a significant component of total compensation in the finance industry, often exceeding base salary, especially at senior levels. These rewards are crucial for attracting and retaining top talent, driving performance, and aligning individual goals with firm objectives. The structure and calculation of these incentives vary considerably depending on the specific role, company, and performance.

Bonuses in finance are typically performance-based, meaning the amount received is directly tied to individual or team achievements against pre-defined targets. These targets can be quantitative, such as exceeding sales goals or managing a specific portfolio to a certain level of return, or qualitative, such as demonstrating exceptional leadership or successfully navigating a complex transaction. Calculations often involve a complex formula considering multiple factors, and sometimes incorporate subjective assessments.

Types of Bonuses and Incentive Calculations

Finance professionals receive a variety of bonuses, each with its own calculation method. Common examples include annual performance bonuses, which are typically paid out at the end of the year and are based on individual and/or company performance. Profit sharing plans distribute a portion of the firm’s profits among employees, often based on seniority and contribution. Transaction bonuses reward the successful completion of specific deals, with the amount often tied to the size and complexity of the transaction. Stock options and restricted stock units (RSUs) provide equity ownership in the company, rewarding long-term contributions and aligning employee interests with shareholder value. The calculation of these bonuses varies widely, but generally involves a combination of predetermined formulas, management discretion, and performance metrics. For instance, a sales bonus might be calculated as a percentage of sales exceeding a target, while a performance bonus for a portfolio manager might consider factors such as risk-adjusted returns, portfolio growth, and client retention.

Bonus Structures Across Roles and Seniority

Bonus structures differ significantly across various finance roles and seniority levels. Entry-level analysts might receive smaller, performance-based bonuses tied to team performance, while senior managers and executives could receive significantly larger bonuses based on their individual performance and the firm’s overall profitability. Investment bankers, for example, often receive substantial transaction-based bonuses, while portfolio managers might receive bonuses based on their investment performance. The percentage of total compensation attributable to bonuses also increases with seniority. A junior analyst might receive a bonus representing 10-20% of their base salary, while a managing director might receive a bonus that is several times their base salary.

Examples of Bonus Structures

| Role | Bonus Type | Performance Metrics | Potential Payout (USD) |

|---|---|---|---|

| Junior Analyst | Annual Performance Bonus | Team performance, individual contributions | $5,000 – $15,000 |

| Associate | Annual Performance Bonus + Transaction Bonus | Individual and team performance, successful deal closures | $10,000 – $50,000 |

| VP, Portfolio Management | Annual Performance Bonus + Profit Sharing | Portfolio performance (risk-adjusted returns), client retention, firm profitability | $50,000 – $250,000 |

| Managing Director | Annual Performance Bonus + Profit Sharing + Stock Options | Firm profitability, strategic initiatives, individual leadership | $250,000 – $1,000,000+ |

Illustrative Examples of Compensation Packages

Understanding the complete compensation picture in finance requires looking beyond base salary. Bonuses, benefits, and overall package value significantly impact total earnings and vary considerably based on role, experience, and employer. The following examples illustrate typical compensation packages for different finance professionals. Note that these are illustrative and actual figures can vary significantly based on location, company size, performance, and market conditions.

Compensation Package Examples for Finance Professionals

Below are three examples showcasing compensation packages for different finance roles and experience levels. These examples include salary, bonus potential, and a breakdown of typical benefits. Remember that these are representative and not exhaustive.

| Role | Experience Level | Annual Base Salary | Bonus Potential (Target) | Benefits |

|---|---|---|---|---|

| Financial Analyst | Entry-Level (1-3 years) | $65,000 – $85,000 | 5-10% of base salary | Health insurance (medical, dental, vision), 401(k) with employer matching (e.g., 50% up to 6% of salary), paid time off (PTO), life insurance, short-term and long-term disability insurance. |

| Portfolio Manager | Mid-Level (5-10 years) | $150,000 – $250,000 | 15-30% of base salary (performance-based) | Comprehensive health insurance (including higher premiums and deductibles options), 401(k) with employer matching (e.g., 100% up to 6% of salary), generous PTO, life insurance, short-term and long-term disability insurance, potential for company car or car allowance, professional development budget. |

| Chief Financial Officer (CFO) | Senior-Level (15+ years) | $300,000 – $500,000+ | 20-50% of base salary (highly performance-based, often including stock options) | Executive-level health insurance (potentially including family coverage), 401(k) with significant employer matching, generous PTO, life insurance, short-term and long-term disability insurance, company car, executive benefits (e.g., supplemental retirement plans, health savings accounts), potential for stock options and other equity-based compensation. |

Typical Benefits Packages in Finance

Finance firms typically offer comprehensive benefits packages to attract and retain top talent. These packages often exceed those offered in other industries, reflecting the competitive nature of the field and the high demand for skilled professionals.

Health insurance is a standard benefit, usually covering medical, dental, and vision care. The level of coverage and employee contribution can vary based on the plan selected and the employee’s position. Many firms offer multiple plan options to cater to different needs and budgets. Retirement plans, often in the form of 401(k) plans, are also common, with employers frequently providing matching contributions up to a certain percentage of the employee’s salary. The matching rate and contribution limits vary significantly across companies and positions. Other common benefits include paid time off (PTO), life insurance, short-term and long-term disability insurance, and professional development opportunities.

Senior-level positions often receive more extensive benefits packages, including perks such as company cars, executive health plans, supplemental retirement plans, and stock options. The value of these additional benefits can substantially increase the overall compensation package, making a significant difference in total earnings.

Tim Redaksi