What is Tax Increment Financing (TIF)?

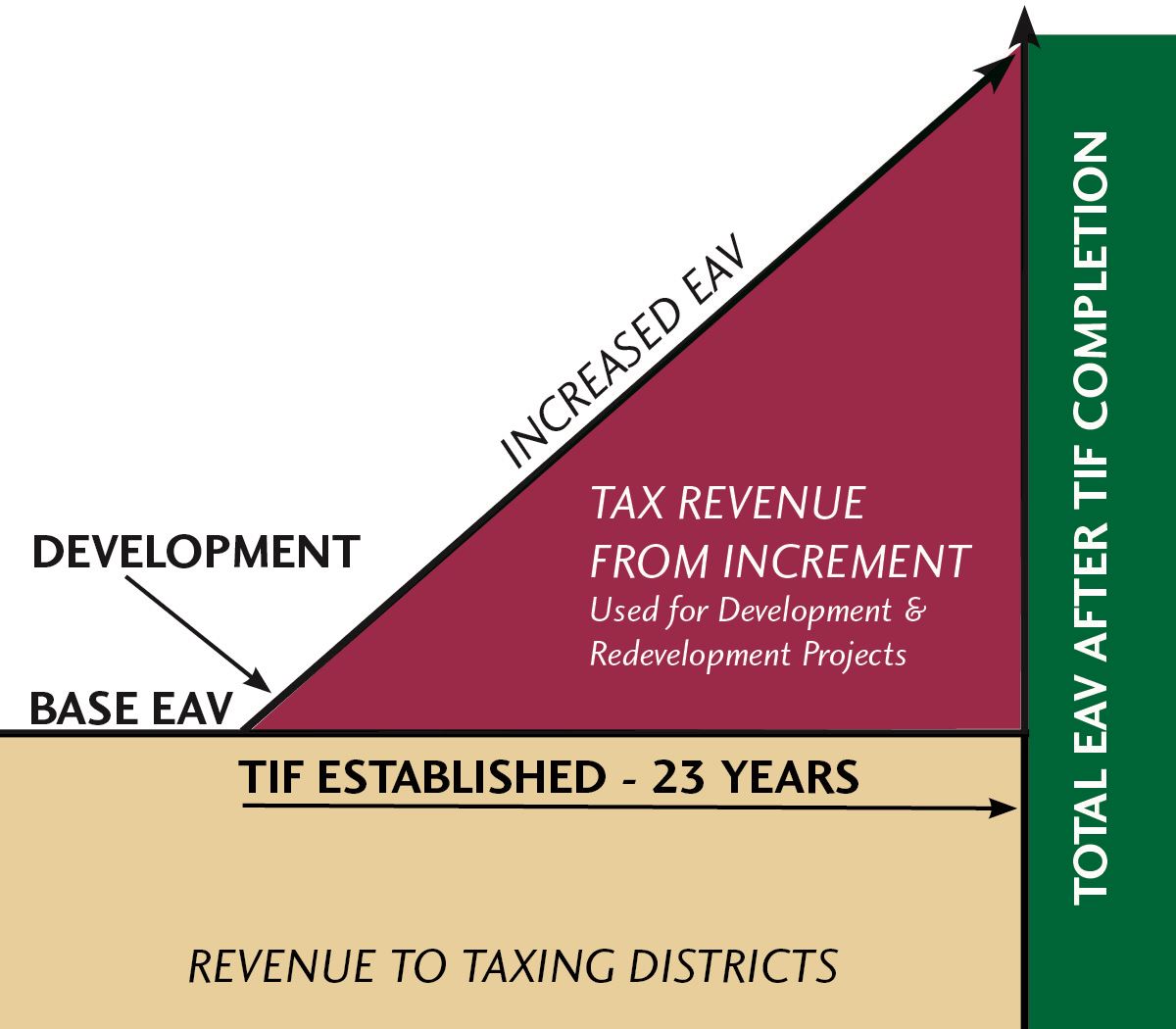

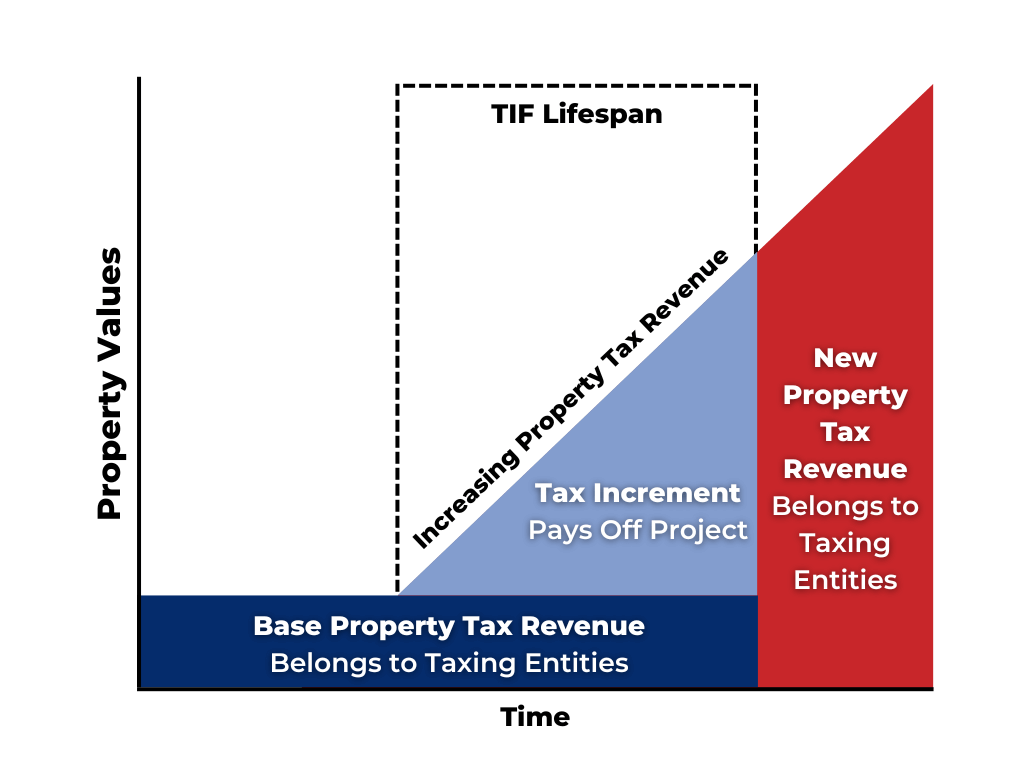

Tax Increment Financing (TIF) is a public financing method used to encourage economic development in designated areas. It works by capturing the increased property tax revenue generated by new development within a specific geographic area, a TIF district, and using that revenue to pay off bonds issued to fund the development projects themselves. Essentially, the increased tax revenue resulting from the improvements pays for the improvements.

TIF districts are established to address blight, stimulate economic growth, and attract private investment to areas that might otherwise be neglected. The process involves redirecting future property tax revenue increases, not existing revenue, towards infrastructure improvements and other development projects within the district. This mechanism incentivizes private sector investment by mitigating the financial risk associated with developing in areas perceived as high-risk or requiring significant upfront investment.

TIF District Establishment

Establishing a TIF district typically involves several key steps. First, a municipality identifies a blighted or underdeveloped area needing revitalization. A comprehensive plan outlining the goals and projected impacts of the TIF district is then developed. This plan is often accompanied by an environmental impact assessment and a detailed financial analysis. Public hearings are held to allow residents and stakeholders to provide input and address concerns. Finally, the local government, often after approval from a governing body like a city council or county commission, formally establishes the TIF district by passing an ordinance. The boundaries of the district are clearly defined, and the specific projects to be funded are Artikeld in the plan. The process can be lengthy and requires careful consideration of legal and financial aspects.

Examples of TIF-Funded Projects

TIF financing has been utilized for a wide variety of projects aimed at stimulating economic growth and community revitalization. Examples include infrastructure improvements such as road construction, utility upgrades (water, sewer, electricity), and the development of public spaces like parks and recreational facilities. It also commonly funds the construction or renovation of commercial buildings, industrial facilities, and residential housing. Specific examples could include a new shopping center built in a previously vacant lot, the rehabilitation of a historic downtown area, or the creation of a technology park attracting high-tech companies. The specific projects funded are usually those that generate significant increases in property tax values within the district, justifying the use of TIF financing.

Comparison of TIF with Other Public Financing Methods

The following table compares TIF with other common public financing methods, highlighting their key differences:

| Financing Method | Funding Source | Risk Allocation | Project Focus |

|---|---|---|---|

| Tax Increment Financing (TIF) | Increased property tax revenue within a designated district | Shared between public and private sectors | Economic development, infrastructure improvements |

| General Obligation Bonds | Tax revenue from the entire municipality | ||

| Revenue Bonds | Revenue generated by the project itself | ||

| Grants | Governmental funds |

How TIF Financing Works: How Does Tif Financing Work

Tax Increment Financing (TIF) is a powerful economic development tool, but understanding its mechanics is crucial. This section details the process involved in a typical TIF project, highlighting the municipality’s role and providing concrete examples of how property taxes are utilized within a designated TIF district.

The Steps Involved in a TIF Project

A TIF project unfolds in a series of well-defined stages. The process begins with the identification of a blighted or underdeveloped area and culminates in the eventual repayment of the bonds issued to finance the project. Each step is critical to the project’s success.

- Area Identification and Designation: A municipality identifies a specific area needing revitalization. This area is assessed for its potential for redevelopment and its eligibility for TIF designation. Factors considered include existing infrastructure, property values, and the potential for economic growth.

- TIF District Establishment: The municipality formally establishes the area as a TIF district. This involves a public process, including hearings and approvals from relevant governing bodies. The boundaries of the district are clearly defined.

- Baseline Property Tax Revenue Determination: Before any redevelopment, the municipality calculates the existing property tax revenue generated within the designated TIF district. This baseline serves as the benchmark against which future increases are measured.

- Project Implementation and Development: Public and/or private sector projects commence within the TIF district. These projects might include infrastructure improvements (roads, utilities), construction of new buildings, or business attraction initiatives.

- Tax Increment Collection: As property values within the TIF district increase due to the implemented projects, the additional tax revenue generated above the baseline is collected. This is the “tax increment.”

- Debt Service Payment: The collected tax increment is used to repay the bonds issued to finance the TIF project. This includes interest payments and principal repayment.

- TIF District Dissolution: Once the bonds are fully repaid, the TIF district is dissolved, and the full property tax revenue reverts to the municipality’s general fund.

The Municipality’s Role in TIF Projects

The municipality plays a central role throughout the entire TIF process. Their responsibilities extend from identifying suitable areas to managing the financial aspects of the project and ensuring accountability.

The municipality is responsible for:

- Identifying blighted areas and assessing their redevelopment potential.

- Establishing the TIF district and defining its boundaries.

- Developing a detailed TIF plan outlining project goals, financing mechanisms, and a timeline for implementation.

- Issuing bonds to finance the redevelopment projects.

- Collecting the tax increment and managing its disbursement for debt service.

- Overseeing the implementation of the redevelopment projects and ensuring accountability.

- Ultimately dissolving the TIF district upon completion of the debt repayment.

Examples of Property Tax Use Within a TIF District, How does tif financing work

The tax increment generated within a TIF district can fund a variety of projects designed to stimulate economic growth and improve the area’s infrastructure.

Examples include:

- Infrastructure Improvements: Construction of new roads, sidewalks, utilities (water, sewer, electricity), and public transportation systems.

- Building Construction: Subsidies or incentives for the construction of new commercial buildings, residential units, or public facilities.

- Business Attraction and Retention: Financial incentives to attract new businesses to the area or to retain existing businesses facing relocation pressures.

- Environmental Remediation: Cleaning up contaminated sites to make them suitable for redevelopment.

- Public Amenities: Development of parks, recreational facilities, or other public amenities to enhance the quality of life in the area.

TIF Project Flowchart

Imagine a flowchart starting with “Project Inception: Identifying a Blighted Area.” This flows to “TIF District Establishment: Defining Boundaries and Approvals.” Next is “Baseline Property Tax Revenue Determination: Calculating Existing Revenue.” This leads to “Project Implementation: Redevelopment Projects Begin.” Then, “Tax Increment Collection: Increased Revenue Above Baseline is Collected.” This feeds into “Debt Service Payment: Tax Increment Used to Repay Bonds.” Finally, the flowchart ends with “TIF District Dissolution: Bonds Repaid, District Dissolved.” Each stage is visually connected with arrows indicating the progression of the process.

Tim Redaksi