Salary Ranges for Finance Managers at Car Dealerships

Finance managers at car dealerships play a crucial role in the profitability of the business, negotiating financing options for customers and managing the dealership’s financial operations. Their compensation reflects this importance and varies considerably depending on several key factors. Understanding these salary ranges and influencing factors is crucial for both aspiring finance managers and dealership owners.

How much do finance managers at car dealerships make – The salary of a finance manager at a car dealership is significantly influenced by the size of the dealership, its location, the manager’s experience, and the overall performance of the dealership. Dealership size directly correlates with volume of sales and thus, potential earnings. Similarly, location impacts the cost of living and the average price of vehicles sold, affecting both the manager’s base salary and potential commission earnings.

Salary Ranges by Dealership Size

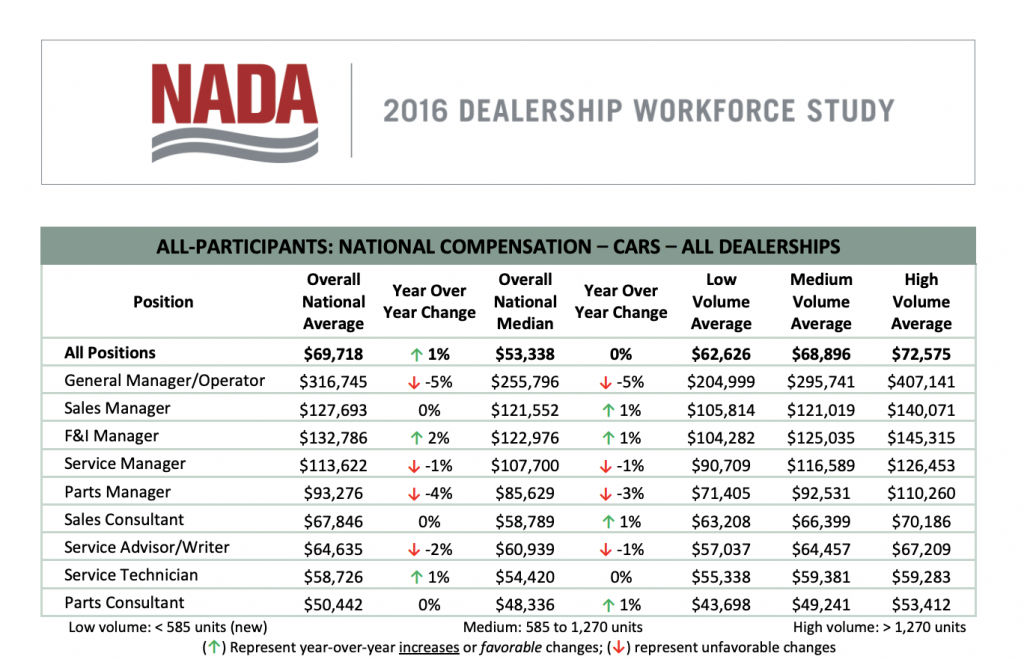

The following table provides estimated salary ranges for finance managers based on dealership size. These figures are averages and may vary significantly based on the factors mentioned previously. It’s important to remember that these are estimates, and actual salaries can differ considerably depending on individual circumstances and market conditions.

| Dealership Size | Salary Range (Low) | Salary Range (Median) | Salary Range (High) |

|---|---|---|---|

| Small (Under 500 units sold annually) | $50,000 – $65,000 | $65,000 – $80,000 | $80,000 – $95,000 |

| Medium (500-1500 units sold annually) | $70,000 – $90,000 | $90,000 – $110,000 | $110,000 – $130,000 |

| Large (Over 1500 units sold annually) | $90,000 – $120,000 | $120,000 – $150,000 | $150,000 – $200,000+ |

Factors Influencing Salary Variations

Several factors contribute to the wide range of salaries observed among finance managers. Understanding these factors provides a clearer picture of what influences compensation.

Location: Dealerships in high-cost-of-living areas typically offer higher base salaries to attract and retain qualified professionals. A finance manager in New York City will likely earn more than one in a smaller rural town, even if the dealership sizes are comparable. The higher cost of living necessitates a higher compensation to maintain a similar standard of living.

Experience Level: More experienced finance managers command higher salaries due to their expertise in negotiating deals, managing risk, and understanding complex financial products. A finance manager with 10 years of experience will generally earn significantly more than a recent graduate entering the field.

Dealership Performance: A dealership’s profitability directly impacts the finance manager’s compensation, especially regarding bonuses and commissions. High-performing dealerships with strong sales figures and high customer satisfaction scores tend to reward their finance managers more generously.

Compensation Packages Beyond Base Salary

Beyond the base salary, finance managers often receive additional compensation in the form of bonuses, commissions, and benefits. These components can significantly increase overall earnings.

Bonuses: Bonuses are often tied to dealership performance, individual sales targets, and customer satisfaction metrics. They provide an incentive to maximize profitability and improve customer experience. A common bonus structure might reward exceeding a predetermined monthly or annual profit target.

Commissions: Commissions are typically earned on each financed vehicle, representing a percentage of the finance profit. The commission rate can vary depending on the dealership’s policies and the manager’s performance. Highly skilled finance managers who consistently secure profitable financing deals will earn significantly more through commissions.

Benefits: Standard employee benefits such as health insurance, paid time off, retirement plans, and life insurance are common in dealership finance manager positions. The comprehensiveness of the benefits package can vary between dealerships.

Geographic Variations in Compensation: How Much Do Finance Managers At Car Dealerships Make

Finance manager salaries at car dealerships, like many other professions, aren’t uniform across the country. Several interconnected factors influence the significant pay discrepancies observed between different geographic locations. Understanding these factors provides a clearer picture of the earning potential for finance managers based on their location.

Regional differences in compensation for finance managers at car dealerships are primarily driven by economic conditions and lifestyle factors. These influence both the supply and demand for skilled professionals and the overall cost of living.

Factors Contributing to Regional Salary Differences

Several key factors contribute to the disparities in finance manager salaries across different regions. These factors interact in complex ways to shape the overall compensation landscape.

- Cost of Living: Areas with a high cost of living, such as major metropolitan areas in California or New York, typically require higher salaries to attract and retain qualified candidates. The expense of housing, transportation, and everyday necessities directly impacts the necessary compensation to maintain a comparable standard of living.

- Market Demand: Regions experiencing rapid economic growth or a booming automotive industry often have higher demand for finance managers. This increased demand drives up salaries as dealerships compete to attract the best talent. Conversely, areas with slower economic growth may have lower demand and consequently lower salaries.

- State and Local Regulations: Differences in state and local regulations, including those related to automotive sales and finance, can influence compensation. Some states may have stricter regulations that impact profitability, potentially affecting the amount dealerships can afford to pay their finance managers.

- Dealership Size and Profitability: Larger and more profitable dealerships generally have greater financial capacity to offer higher salaries to attract and retain top talent. Smaller dealerships in less profitable markets may have more limited budgets.

- Competition Among Dealerships: Highly competitive markets, where numerous dealerships vie for customers, may see higher salaries offered to attract and retain experienced finance managers who can contribute to increased sales and profitability.

Hypothetical Salary Comparison, How much do finance managers at car dealerships make

Consider two hypothetical finance managers with similar experience and skills. One works in a dealership in a high-cost-of-living city like San Francisco, California, while the other works in a dealership in a smaller city like Wichita, Kansas.

The San Francisco finance manager might earn an annual salary in the range of $150,000 to $200,000, reflecting the high cost of living and competitive market. This salary is necessary to compensate for the significantly higher expenses associated with living in San Francisco. The Wichita finance manager, on the other hand, might earn a salary in the range of $80,000 to $120,000. This lower salary reflects the lower cost of living and potentially less competitive market in Wichita. The difference highlights how geographic location significantly impacts compensation, even for professionals with similar qualifications and experience. This disparity is not indicative of a difference in skill level but rather a reflection of market forces and cost of living adjustments.

Skills and Responsibilities Impacting Earnings

A finance manager’s earning potential at a car dealership is significantly influenced by a combination of their skillset and the responsibilities they shoulder. While base salary plays a role, performance-based incentives and the complexity of their role often contribute more substantially to overall compensation. Proficiency in certain areas can elevate a finance manager from a competent employee to a highly sought-after professional commanding a higher salary.

The most impactful skills and responsibilities directly correlate to increased revenue generation and risk mitigation for the dealership. These factors are carefully considered by dealership owners when determining compensation packages. Strong negotiation skills, coupled with adept financial modeling and a keen understanding of risk management, are particularly valuable. Similarly, the scope of responsibilities, such as managing a larger team or overseeing a substantial budget, directly impacts the compensation offered.

Negotiation and Salesmanship

Exceptional negotiation skills are paramount in automotive finance. Finance managers proficient in this area consistently secure higher profits for the dealership through advantageous financing deals for customers and effective negotiations with lenders. This translates directly into higher commissions and bonuses, significantly impacting their overall earnings. A finance manager who consistently exceeds sales targets through skillful negotiation will naturally command a higher salary than one who struggles to close deals. For example, a finance manager who consistently secures higher-than-average finance and insurance (F&I) product penetration rates demonstrates significant value and can expect a correspondingly higher compensation package.

Financial Modeling and Analysis

The ability to accurately forecast financial performance and model various scenarios is crucial. Finance managers who can expertly analyze market trends, predict customer behavior, and manage financial risks effectively contribute to the dealership’s overall profitability. This expertise is highly valued, leading to higher salaries and bonus structures. For instance, a finance manager who develops a sophisticated financial model that accurately predicts monthly revenue and expenses is significantly more valuable than one who relies on simpler, less accurate methods. This demonstrable value translates directly into higher compensation.

Risk Management and Compliance

Effective risk management is vital in the automotive finance industry, involving adherence to regulatory compliance and minimizing potential financial losses. Finance managers who demonstrate a thorough understanding of regulatory requirements and employ effective strategies to mitigate risk are highly sought after. This expertise reduces the dealership’s exposure to financial and legal liabilities, directly increasing their value to the company and leading to higher salaries and bonuses. A proven track record of maintaining compliance and minimizing losses will significantly impact earning potential.

Team Management and Budgetary Oversight

Managing a larger team and overseeing a significant budget demonstrates leadership and organizational skills. Finance managers with these responsibilities often receive higher salaries to reflect the increased demands and accountability associated with their role. The ability to effectively manage personnel, allocate resources, and control costs contributes directly to the dealership’s profitability and justifies a higher compensation package. For example, a finance manager responsible for a team of five and a budget exceeding $1 million will earn substantially more than a finance manager with a smaller team and a significantly smaller budget.

Proficiency in Automotive Finance Software

Proficiency in industry-specific software and systems is a critical factor. Familiarity with Dealer Management Systems (DMS), Customer Relationship Management (CRM) software, and other automotive finance platforms directly impacts efficiency and productivity. Finance managers proficient in these systems can process transactions faster, analyze data more effectively, and manage customer relationships more efficiently. This translates into increased revenue and profitability for the dealership, leading to higher compensation. For example, expertise in a particular DMS, known for its streamlined financing processes, could significantly boost a finance manager’s earning potential compared to someone less familiar with the system.

Industry Trends and Future Outlook

The automotive finance industry is experiencing significant transformation, impacting the compensation and career trajectory of finance managers. Technological advancements, fluctuating market conditions, and evolving consumer preferences are reshaping the landscape, creating both challenges and opportunities for professionals in this field. Understanding these trends is crucial for anyone seeking to succeed and thrive in this dynamic environment.

Technological advancements are significantly altering the finance manager’s role. The increasing use of digital tools, including sophisticated CRM systems, online credit applications, and automated valuation models, streamlines processes and enhances efficiency. This requires finance managers to adapt quickly and develop proficiency in these technologies, enhancing their value and potentially increasing their earning potential. Conversely, automation may also lead to some task displacement, necessitating the development of higher-level analytical and strategic skills. Market fluctuations, particularly interest rate changes and economic downturns, directly influence the profitability of dealerships and, consequently, the compensation packages offered to finance managers. During periods of economic uncertainty, dealerships may reduce bonuses or limit salary increases, while periods of growth often lead to improved compensation opportunities.

Technological Advancements and Skill Development

The integration of artificial intelligence (AI) and machine learning (ML) into automotive finance is accelerating. AI-powered tools can analyze vast datasets to predict customer behavior, optimize loan offerings, and detect fraudulent activities. Finance managers who can effectively utilize and interpret data generated by these systems will be highly sought after. This necessitates a shift in skill requirements, favoring candidates with strong analytical skills, data literacy, and the ability to translate complex data into actionable insights. For example, a finance manager proficient in using AI-driven risk assessment tools can significantly improve the dealership’s profitability by minimizing loan defaults, thus justifying a higher salary.

Projected Growth and Future Salary Expectations

The automotive finance industry is projected to experience moderate growth in the coming years, driven by factors such as increasing vehicle sales (though subject to economic conditions) and the expansion of financing options. This growth, however, may not translate directly into uniform salary increases across all positions. Finance managers with specialized skills and experience, particularly those adept at navigating the complexities of technological advancements and regulatory changes, will likely command higher salaries. For instance, dealerships may offer significantly higher compensation to managers proficient in managing complex financing options, such as lease buyouts or refinancing, particularly in a competitive market. The demand for individuals with expertise in these areas is expected to outpace the supply, driving up their earning potential.

In-Demand Skills and Qualifications

Future success in automotive finance management will hinge on a combination of traditional skills and emerging competencies. While strong sales and negotiation skills remain essential, data analysis, financial modeling, and technological proficiency are becoming increasingly critical. Regulatory compliance is also a significant factor; a deep understanding of relevant laws and regulations will be essential to avoid legal issues and maintain a strong reputation. Furthermore, strong communication and interpersonal skills remain paramount for effective collaboration with sales teams, customers, and lenders. A finance manager who demonstrates expertise in all these areas will be well-positioned to secure a competitive salary and advance their career within the industry.

Tim Redaksi