Salary Ranges for Car Dealership Finance Managers

Car dealership finance managers play a crucial role in the profitability of dealerships, negotiating financing options for customers and managing the financial aspects of vehicle sales. Their compensation reflects this importance, varying significantly based on several factors. Understanding these salary ranges and influencing factors is essential for both aspiring and current finance managers in the automotive industry.

Salary Ranges by Experience Level

The compensation of a car dealership finance manager is heavily influenced by their experience. Generally, entry-level positions offer lower salaries, while senior managers command significantly higher earnings. The following table provides a general overview of salary ranges based on experience level. Note that these figures are estimates and can vary widely depending on location and other factors discussed below.

| Experience Level | Salary Range (Low) | Salary Range (High) | Average Salary |

|---|---|---|---|

| Entry-Level (0-3 years) | $40,000 | $60,000 | $50,000 |

| Mid-Level (3-7 years) | $60,000 | $90,000 | $75,000 |

| Senior-Level (7+ years) | $90,000 | $150,000+ | $120,000 |

Factors Influencing Salary Variation

Several key factors contribute to the wide variation in salaries within the ranges presented above. These factors interact in complex ways, meaning that a finance manager in a high-volume dealership in a major metropolitan area might earn considerably more than a similarly experienced manager in a smaller dealership in a rural location.

- Location: Dealerships in high-cost-of-living areas, such as major cities on the coasts, typically offer higher salaries to attract and retain talent. A finance manager in New York City will likely earn more than one in rural Nebraska, even with the same experience.

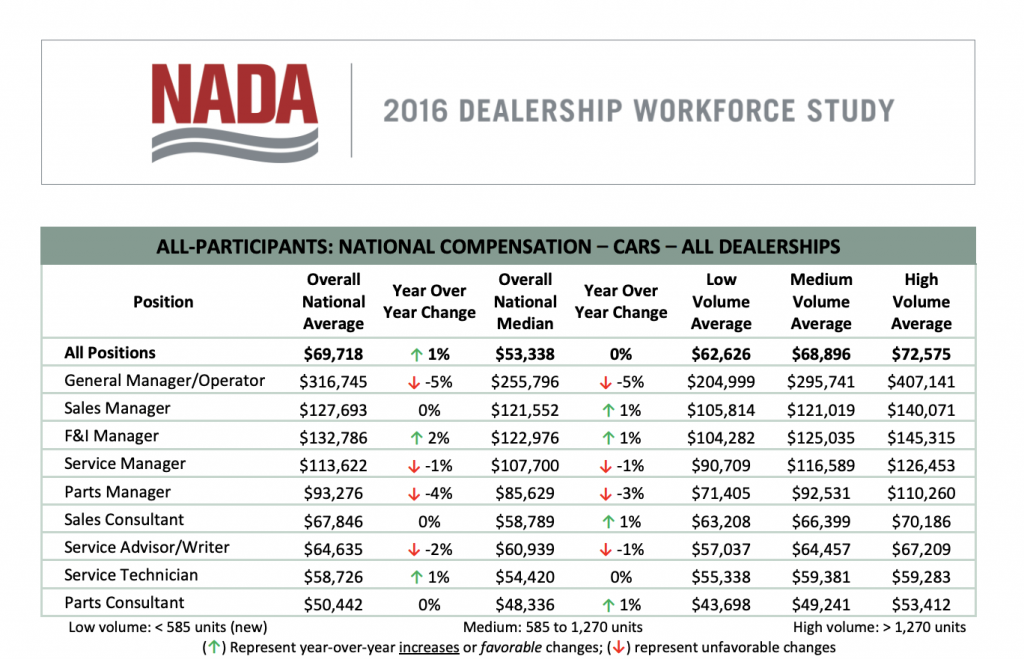

- Dealership Size and Volume: Larger dealerships with higher sales volumes generally offer higher compensation packages. The potential for greater commission earnings and bonuses directly correlates with the number of vehicles sold and financed.

- Dealership Brand: Luxury brands often pay more than mass-market brands. The prestige associated with selling high-end vehicles, and the higher profit margins involved, often translates to higher compensation for finance managers.

- Performance Metrics: Finance managers are frequently evaluated on key performance indicators (KPIs), such as the number of deals closed, the average finance amount, and customer satisfaction scores. Exceeding targets often results in substantial bonuses.

Compensation Structures Beyond Base Salary

While a base salary forms the foundation of compensation, many finance managers also receive significant income through commissions and bonuses. Benefits packages also contribute to the overall compensation.

- Commissions: A common component of a finance manager’s compensation is a commission based on the profit generated from financing deals. This can be a percentage of the finance reserve or a flat fee per deal.

- Bonuses: Dealerships often offer bonuses based on exceeding sales targets, improving customer satisfaction scores, or achieving other performance metrics. These bonuses can be significant and contribute substantially to overall earnings.

- Benefits: Standard benefits packages, such as health insurance, paid time off, and retirement plans, are also part of the compensation package. The comprehensiveness of these benefits can vary depending on the dealership and its size.

Geographic Variations in Compensation: How Much Do Car Dealership Finance Managers Make

Finance manager salaries in the automotive industry exhibit significant geographic variation across the United States. Several interconnected factors, including cost of living, market demand, and the level of competition within the industry, contribute to these differences. Understanding these regional disparities is crucial for both aspiring finance managers and dealerships seeking to attract and retain talent.

Regional Salary Comparisons

Analyzing compensation data from various sources, including online job boards, salary surveys, and industry reports, reveals considerable discrepancies in average salaries for automotive finance managers across different regions. For instance, major metropolitan areas on the West Coast, particularly in California, often report higher average salaries compared to their counterparts in the Midwest or Southeast. Similarly, urban areas generally offer higher compensation than rural locations due to higher costs of living and increased competition among dealerships. A hypothetical bar chart, illustrating these differences, might show a significantly taller bar for “West Coast Urban” compared to a much shorter bar for “Southeast Rural,” reflecting this disparity. The methodology for gathering this data involved compiling salary information from reputable online job boards, filtering for finance manager positions in specific regions, and averaging the reported salaries after accounting for experience level and other relevant factors.

Economic Factors Influencing Regional Salary Differences

Cost of living plays a dominant role in shaping regional salary variations. Areas with high costs of living, such as major cities on the coasts, require higher salaries to attract and retain qualified professionals. The increased demand for qualified finance managers in high-growth markets also contributes to higher compensation. Dealerships in areas experiencing rapid economic expansion often compete more aggressively for talent, driving up salaries. Conversely, regions with lower economic activity or a saturated market for finance managers may offer lower compensation packages. Competition among dealerships within a particular geographic area is another critical factor. In highly competitive markets, dealerships may offer higher salaries and benefits to attract top talent and maintain a competitive edge.

Visualization of Salary Variations Across the United States

A map visualizing salary variations across the United States would use a color-coded system to represent salary ranges. A legend accompanying this map might use a gradient from dark blue (representing the lowest average salaries) to dark red (representing the highest average salaries). For example, states like California, New York, and parts of the Northeast might appear in dark red, while states in the Midwest and South might be depicted in lighter shades of blue. This visualization would offer a clear and concise overview of the geographical disparities in compensation for automotive finance managers. The exact shades and ranges would be determined by the specific data gathered and analyzed during the research process. It’s important to note that this map would represent average salaries and would not account for individual variations based on experience, skills, or specific dealership performance.

Impact of Dealership Type and Size

A finance manager’s compensation is significantly influenced by the type and size of the dealership they work for. Factors such as the brand prestige, dealership volume, and overall market conditions all play a crucial role in determining their earning potential. Understanding these factors provides valuable insight into the wide salary range observed within the automotive finance industry.

Dealership type and size directly impact the volume of transactions a finance manager handles, the profitability of those transactions, and ultimately, their compensation. Larger dealerships with higher sales volumes naturally offer greater opportunities for commission-based earnings, while the brand reputation can influence the average transaction value and thus the potential for higher overall compensation.

Compensation Differences Across Dealership Brands

The brand a dealership represents significantly impacts a finance manager’s salary. Luxury dealerships, representing brands like Mercedes-Benz, BMW, or Lexus, generally offer higher compensation packages than dealerships selling domestic or import brands in the mainstream market. This is because luxury vehicles command higher prices, resulting in larger finance deals and potentially higher profit margins for the dealership, leading to higher commission potential for the finance manager. Conversely, finance managers at dealerships selling more affordable vehicles may have a higher volume of transactions but lower profit margins per deal, potentially leading to lower overall compensation. The same principle applies to the comparison between import and domestic brands; established luxury import brands often offer higher earning potential than less prestigious domestic brands.

Compensation at Small vs. Large Dealership Groups

Dealership size is another critical factor influencing a finance manager’s compensation.

How much do car dealership finance managers make – The compensation packages for finance managers differ considerably between small, independent dealerships and large, multi-location dealerships. This difference stems primarily from the scale of operations, the volume of sales, and the resources available for compensation.

- Small, Independent Dealerships: Finance managers at smaller dealerships may receive a lower base salary but potentially a higher commission percentage on each deal. This structure compensates for the potentially lower overall volume of transactions compared to larger dealerships. Benefits packages may also be less comprehensive. The financial stability of the dealership itself is also a factor; smaller, less established dealerships may not be able to offer as competitive a compensation package as a larger, more financially secure entity.

- Large, Multi-Location Dealerships: Large dealerships often offer higher base salaries and a more comprehensive benefits package. While the commission percentage per deal might be lower, the sheer volume of transactions processed allows for significantly higher overall earnings. These dealerships often have more sophisticated finance and insurance (F&I) products and training programs, leading to increased sales opportunities and higher earning potential for finance managers.

Key Performance Indicators (KPIs) and Compensation

Dealerships utilize various KPIs to evaluate finance manager performance and directly tie these metrics to compensation. These KPIs are designed to incentivize the finance manager to maximize profitability for the dealership through effective F&I product sales and efficient deal structuring.

Performance is often measured by a combination of quantitative and qualitative factors. The most common KPIs include:

- Average Finance and Insurance (F&I) Product Penetration Rate: This measures the percentage of customers purchasing F&I products (e.g., extended warranties, gap insurance, etc.). A higher penetration rate directly reflects the finance manager’s success in selling these profitable add-ons and leads to higher commission.

- Average Dealership Reserve: This represents the profit margin generated on each deal, reflecting the finance manager’s skill in negotiating favorable terms and maximizing profitability for the dealership. Higher reserve directly translates into higher earnings.

- Customer Satisfaction Scores: While not always directly tied to monetary compensation, positive customer feedback is crucial. A high level of customer satisfaction can lead to improved reputation and higher sales volume, ultimately benefiting the finance manager’s earnings.

- Volume of Deals Closed: This KPI measures the sheer number of deals closed by the finance manager, showcasing their efficiency and ability to process a high volume of transactions. While not always the sole determining factor, a high volume contributes to overall earnings, especially in commission-based compensation structures.

Educational Background and Experience

A finance manager’s salary in a car dealership is significantly influenced by their educational background and professional experience. While not always mandatory, a strong educational foundation and relevant skills significantly boost earning potential and career progression. The combination of formal education and practical experience creates a powerful synergy, leading to higher compensation packages.

The relationship between educational attainment and salary is demonstrably positive. Individuals holding a bachelor’s degree in finance, accounting, business administration, or a related field generally command higher starting salaries than those with only a high school diploma or associate’s degree. Furthermore, pursuing a Master of Business Administration (MBA) can further enhance earning potential, particularly for those aiming for senior management roles within larger dealerships. An MBA often provides advanced knowledge in financial modeling, strategic planning, and leadership, skills highly valued in the automotive finance sector.

Impact of Specific Skills and Certifications, How much do car dealership finance managers make

Possessing specific skills and certifications is crucial for securing higher salaries. Proficiency in financial software, strong analytical abilities, and excellent communication skills are highly sought after. Certifications such as the Certified Public Accountant (CPA) designation or the Chartered Financial Analyst (CFA) charter, while not always required, can significantly increase a candidate’s marketability and command higher compensation. These certifications demonstrate a commitment to professional development and a high level of competency in financial matters. Dealerships often prefer candidates with demonstrable expertise in areas such as credit analysis, loan structuring, and risk management, and certifications often serve as evidence of this expertise.

Career Paths and Starting Salaries

Several career paths can lead to a finance manager position. Entry-level positions like a finance associate or loan officer provide valuable on-the-job training and experience. Starting salaries for these roles vary depending on location and dealership size but generally fall within a specific range. Individuals with a bachelor’s degree and relevant internships might command a higher starting salary compared to those entering with only a high school diploma. A progression from a sales associate role to a finance manager position is also possible, but typically requires a longer timeframe and often involves demonstrating exceptional sales performance and a keen interest in the financial aspects of the business. This path might result in a slightly lower starting salary in the finance manager role compared to someone with direct finance experience, but the accumulated sales knowledge and customer relationship skills can be highly valuable. Graduates with an MBA might enter at a higher level, potentially skipping the entry-level finance associate role and securing a more senior finance position with a commensurately higher salary. However, even with an MBA, practical experience remains vital for advancement and achieving the highest salary levels.

Benefits and Perks

Car dealership finance managers often receive comprehensive compensation packages that extend beyond base salary. These benefits and perks play a significant role in attracting and retaining talent within a competitive industry. Understanding the typical offerings can provide valuable insight into the overall compensation picture.

Common Benefits Packages

Many dealerships offer standard benefits packages to their finance managers, aiming to provide security and support for their employees. These packages typically include a range of essential benefits, contributing significantly to the overall compensation.

| Benefit Type | Description | Typical Coverage | Value |

|---|---|---|---|

| Health Insurance | Medical, dental, and vision coverage. | Often includes options for family coverage. Specific plans vary. | Varies greatly depending on the plan chosen and the employer’s contribution. Can represent a substantial portion of overall compensation. |

| Retirement Plans | 401(k) plans with employer matching contributions. | Matching contributions often range from 3% to 5% of the employee’s contribution. | The value depends on the employee’s contributions and the employer’s matching, along with investment performance. |

| Paid Time Off (PTO) | Vacation, sick leave, and holidays. | Accrual rates vary depending on tenure and company policy. | The value depends on the number of days accrued and the employee’s salary. |

Less Common Benefits and Perks

Beyond the standard benefits, some dealerships offer additional perks to attract and retain top finance managers. These incentives can significantly enhance the overall compensation package and create a more attractive work environment.

Dealerships, particularly larger or more successful ones, may offer company cars, often a higher-end model to reflect the position’s status. Performance-based bonuses tied to sales volume or profitability are another common incentive, directly rewarding the finance manager’s contributions to the dealership’s success. Opportunities for professional development, such as attending industry conferences or pursuing relevant certifications, demonstrate a commitment to employee growth and skill enhancement.

Benefits Package Comparison: Luxury vs. Non-Luxury Dealerships

Generally, luxury dealerships tend to offer more generous and comprehensive benefits packages compared to non-luxury dealerships. This is often reflected in higher base salaries, more comprehensive health insurance plans, larger employer matching contributions to retirement plans, and more extensive PTO. Luxury dealerships may also be more likely to offer perks such as company cars and larger performance bonuses, aligning with the higher-end nature of their products and clientele. However, the specific benefits offered can still vary widely based on the size, location, and overall financial performance of the individual dealership.

Tim Redaksi