Salary Range of Finance Managers at Car Dealerships

Finance managers at car dealerships play a crucial role in the profitability of the dealership, negotiating financing options for customers and securing lucrative deals. Their compensation reflects this importance, varying significantly based on several key factors. This section details the salary ranges and influential factors affecting their earnings.

Factors Influencing Finance Manager Salaries

Several factors contribute to the wide range of salaries earned by finance managers in the automotive industry. Dealership size, location, the brand they represent, and individual performance metrics all play significant roles in determining compensation. Larger dealerships, for instance, often generate more revenue, allowing them to offer higher salaries. Similarly, dealerships in high-population, affluent areas tend to pay more due to increased sales volume and higher profit margins. The brand of the dealership also matters; luxury brands typically offer higher compensation packages than those selling more budget-friendly vehicles. Finally, individual performance, measured by metrics such as the number of deals closed, the average profit per deal, and customer satisfaction ratings, directly impacts bonus structures and overall compensation.

Salary Ranges by Experience Level

Entry-level finance managers, typically those with less than two years of experience, can expect an annual salary ranging from $40,000 to $60,000. Mid-level finance managers, with 2-5 years of experience, usually earn between $60,000 and $90,000 annually. Senior-level finance managers, possessing over five years of experience and often managing teams, can earn salaries exceeding $90,000 per year, potentially reaching six figures or more depending on the factors mentioned previously. These figures are averages and can vary widely based on location and other influential factors.

Average Salaries Across Different Regions

The following table provides a comparison of average salaries for finance managers across different regions of the United States. Note that these are estimates based on available data and may not reflect every dealership or individual circumstance.

| Region | Average Salary | Salary Range | Notes |

|---|---|---|---|

| Northeast | $75,000 | $60,000 – $95,000 | Higher cost of living contributes to higher salaries. |

| Southeast | $65,000 | $50,000 – $80,000 | Lower cost of living generally results in lower salaries. |

| Midwest | $68,000 | $55,000 – $85,000 | Salaries vary based on specific state and city. |

| West | $80,000 | $65,000 – $100,000 | High cost of living in certain areas drives up salaries. |

Compensation Structure Beyond Base Salary

Finance managers at car dealerships rarely rely solely on a base salary for their income. A significant portion of their compensation often comes from performance-based incentives, benefits, and other supplementary payments, creating a complex structure that can significantly impact their overall earnings. Understanding these components is crucial to accurately assessing the financial potential of this role.

The additional compensation components significantly influence a finance manager’s total earnings and can vary considerably depending on the dealership’s size, location, and performance. These components are typically designed to motivate managers to maximize profitability and enhance customer satisfaction, thereby benefiting both the individual and the dealership. The overall structure often reflects a balance between guaranteed income and performance-related rewards.

Bonuses and Commissions

Dealership compensation structures frequently incorporate bonuses and commissions alongside base salaries. Bonuses are often tied to overall dealership performance, such as exceeding sales targets or achieving specific profit margins. Commissions, on the other hand, are typically linked directly to the finance manager’s individual performance, such as the number of financing deals closed, the volume of F&I (Finance and Insurance) products sold, or the profitability of each deal. The percentage rates for commissions and bonus thresholds vary widely. For example, a finance manager might receive a 2% commission on each vehicle financed, plus a bonus of $500 for exceeding a monthly sales target. The structure incentivizes both high sales volume and high profitability per sale.

Benefits Packages

Comprehensive benefits packages are a standard feature for finance managers at many dealerships. These packages typically include health insurance (medical, dental, and vision), paid time off (vacation, sick leave), retirement plans (401k matching or pension plans), and life insurance. The specifics of these benefits vary considerably, reflecting the dealership’s size and its overall compensation strategy. Some dealerships may also offer additional benefits such as disability insurance, employee discounts on vehicle purchases, or professional development opportunities. The value of these benefits can represent a significant portion of a finance manager’s total compensation.

Profit Sharing, How much does finance manager at car dealership make

Some dealerships may offer profit-sharing plans as part of their compensation structure for finance managers. In these plans, a portion of the dealership’s profits is distributed among employees, including finance managers, based on pre-determined formulas. This approach directly links the finance manager’s compensation to the overall success of the dealership, further incentivizing performance and team collaboration. The percentage of profits shared and the distribution method vary significantly between dealerships.

Examples of Different Compensation Structures

The following are examples illustrating the diverse compensation structures employed by car dealerships. These examples are illustrative and actual structures may vary.

- Structure A: Base Salary ($60,000) + Commission (2% of finance income) + Bonus (based on dealership profit exceeding a target).

- Structure B: Base Salary ($50,000) + Commission (1.5% of finance income) + Bonus (based on individual sales targets) + Profit Sharing (1% of dealership profit).

- Structure C: Base Salary ($75,000) + Bonus (based on a combination of individual and dealership performance metrics).

Factors Affecting Earnings: How Much Does Finance Manager At Car Dealership Make

A finance manager’s income at a car dealership is influenced by a complex interplay of factors, extending beyond just their base salary. Understanding these factors is crucial for both aspiring and current finance managers to accurately assess their earning potential and negotiate compensation effectively. Dealership performance, individual skills, and market conditions all play significant roles.

Dealership performance directly correlates with a finance manager’s compensation. High-performing dealerships, characterized by strong sales volume and high profit margins, typically offer higher earning opportunities for their finance managers. This is because finance managers’ commissions and bonuses are often tied to the overall profitability of the dealership’s finance and insurance (F&I) department. A successful F&I department contributes significantly to the dealership’s bottom line, thus rewarding the finance manager’s contributions.

Dealership Performance and Compensation

The relationship between a dealership’s success and a finance manager’s earnings is often structured through a commission-based system. For example, a finance manager might receive a percentage of the profit generated from each vehicle’s financing and extended warranty sales. A high-volume dealership selling many vehicles naturally provides more opportunities for the finance manager to earn commissions. Conversely, a dealership struggling with low sales will likely result in lower earnings for the finance manager, regardless of their individual performance. This direct link incentivizes finance managers to actively contribute to the dealership’s overall success. Furthermore, some dealerships offer bonuses based on exceeding sales targets or achieving specific F&I product penetration rates. These bonuses can significantly boost a finance manager’s annual income.

Skills and Experience Impact on Salary Negotiations

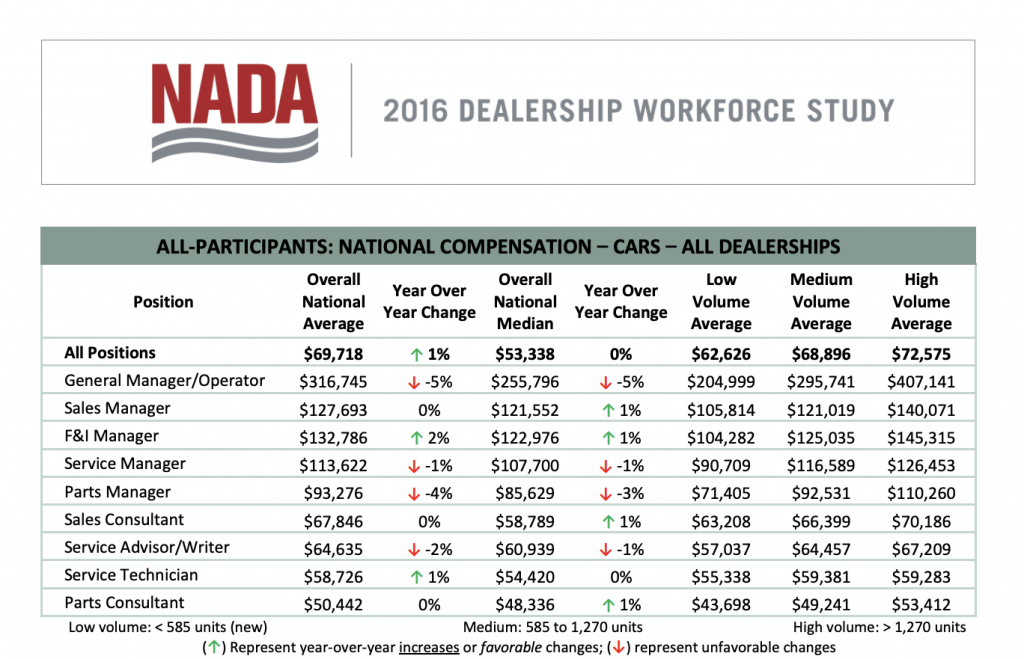

A finance manager’s skills and experience are critical factors influencing their salary negotiations. Highly skilled finance managers possessing expertise in areas such as financial product knowledge, customer relationship management, and negotiation tactics are highly sought after. These individuals can often command higher salaries and more favorable compensation packages. Years of experience in the automotive industry, particularly in F&I roles, also significantly impact earning potential. A finance manager with a proven track record of success in previous dealerships will have a stronger negotiating position compared to a less experienced individual. Moreover, specific certifications or professional designations, such as those offered by the National Automobile Dealers Association (NADA), can demonstrate expertise and enhance earning potential. For instance, a Certified Automotive Finance Manager (CAFM) designation might increase a candidate’s perceived value and lead to higher salary offers.

Tim Redaksi