Understanding Your Loan: How To Sale A Car That Is Financed

Selling a car with an outstanding loan requires a clear understanding of your financing agreement. Knowing the specifics of your loan—its type, remaining balance, and payoff process—is crucial for a smooth and successful sale. This section will Artikel the key aspects of navigating your loan to facilitate a hassle-free car sale.

How to sale a car that is financed – The type of auto loan you have significantly impacts the selling process. Secured loans, the most common type, use your car as collateral. If you default on payments, the lender can repossess the vehicle. Unsecured loans, less common for car purchases, don’t use the car as collateral. However, they usually come with higher interest rates. Selling a car with a secured loan requires paying off the loan balance before transferring ownership, while selling a car with an unsecured loan doesn’t technically require this, although it’s generally advisable to do so to avoid potential credit issues.

Obtaining a Payoff Quote, How to sale a car that is financed

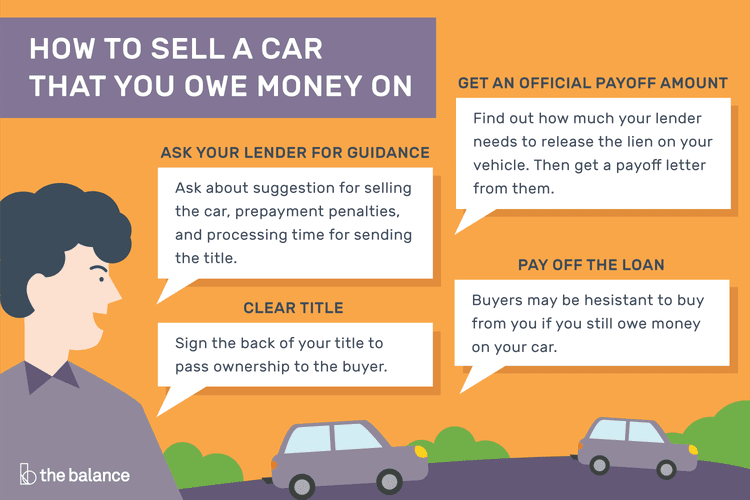

To determine the exact amount needed to pay off your loan, you must obtain a payoff quote from your lender. This quote provides the total amount required to settle your loan in full, including any remaining principal, accrued interest, and any applicable fees. Requesting this quote is typically done through your lender’s online portal, by phone, or via mail. The quote should clearly specify the payoff amount, the date the quote is valid for (payoff quotes often have an expiration date), and the method of payment they accept. It’s important to verify that all fees and charges are included, and to understand any penalties for early payoff. For example, some lenders may charge a prepayment penalty, so confirming this detail in advance is vital.

Calculating the Remaining Loan Balance

While the payoff quote from your lender is the most accurate figure, understanding how the remaining balance is calculated can be helpful. This calculation typically involves the original loan amount, the interest rate, the payment schedule, and any additional fees or charges. You can often find a loan amortization schedule either online through your lender’s portal or on your loan statements. This schedule details the principal and interest portions of each payment over the life of the loan. Using this schedule, you can determine the remaining principal balance. However, remember that this doesn’t include accrued interest or any potential fees, so it’s not a substitute for a formal payoff quote. For instance, if your amortization schedule shows $5,000 remaining principal but your lender’s payoff quote is $5,300, the difference ($300) accounts for accrued interest and fees. Always use the lender’s payoff quote for the final calculation.

Tim Redaksi