Understanding Finance Charges

Finance charges represent the total cost of borrowing money. They encompass all fees and interest associated with a loan or credit agreement, impacting the overall repayment amount. Understanding these charges is crucial for making informed financial decisions.

Types of Finance Charges

Finance charges are multifaceted and can include several components. The most common are interest, fees, and sometimes insurance premiums. Interest is the cost of borrowing the principal amount, typically calculated as a percentage of the outstanding balance. Fees can vary widely depending on the type of loan or credit; examples include origination fees, late payment fees, and annual fees. In some cases, lenders might require borrowers to purchase insurance, adding to the overall finance charge.

Examples of Finance Charges in Practice

Finance charges apply across various financial products. Credit card balances accrue interest charges based on the outstanding balance and the card’s annual percentage rate (APR). Personal loans often include origination fees, which are one-time charges assessed at the beginning of the loan. Auto loans typically involve interest charges calculated on the loan’s principal amount over the repayment term. Mortgages, a significant form of borrowing, also have interest charges, often calculated monthly, alongside potential fees for processing and insurance.

Factors Influencing Finance Charge Calculations

Several factors influence the calculation of finance charges. The most significant is the interest rate, which directly determines the cost of borrowing. The loan term, or repayment period, also plays a crucial role; longer terms generally result in higher total finance charges due to accumulating interest over a longer period. The loan amount, or principal, is another key factor; larger loan amounts will result in higher finance charges. Finally, any associated fees, such as application fees or prepayment penalties, will contribute to the overall finance charge.

Comparison of Interest Rates and Finance Charges Across Loan Types

The following table compares approximate interest rates and finance charges for different loan types. Note that these are illustrative examples and actual rates and charges can vary significantly based on individual lender policies, creditworthiness, and market conditions.

| Loan Type | Approximate Interest Rate Range | Example Loan Amount | Approximate Total Finance Charge (over loan term) |

|---|---|---|---|

| Credit Card | 15% – 30% | $5,000 | $1,500 – $3,000 (depending on repayment behavior and interest rate) |

| Personal Loan | 6% – 20% | $10,000 | $1,000 – $3,000 (depending on interest rate and loan term) |

| Auto Loan | 4% – 12% | $25,000 | $3,000 – $9,000 (depending on interest rate and loan term) |

| Mortgage | 3% – 7% | $200,000 | $40,000 – $90,000 (depending on interest rate and loan term) |

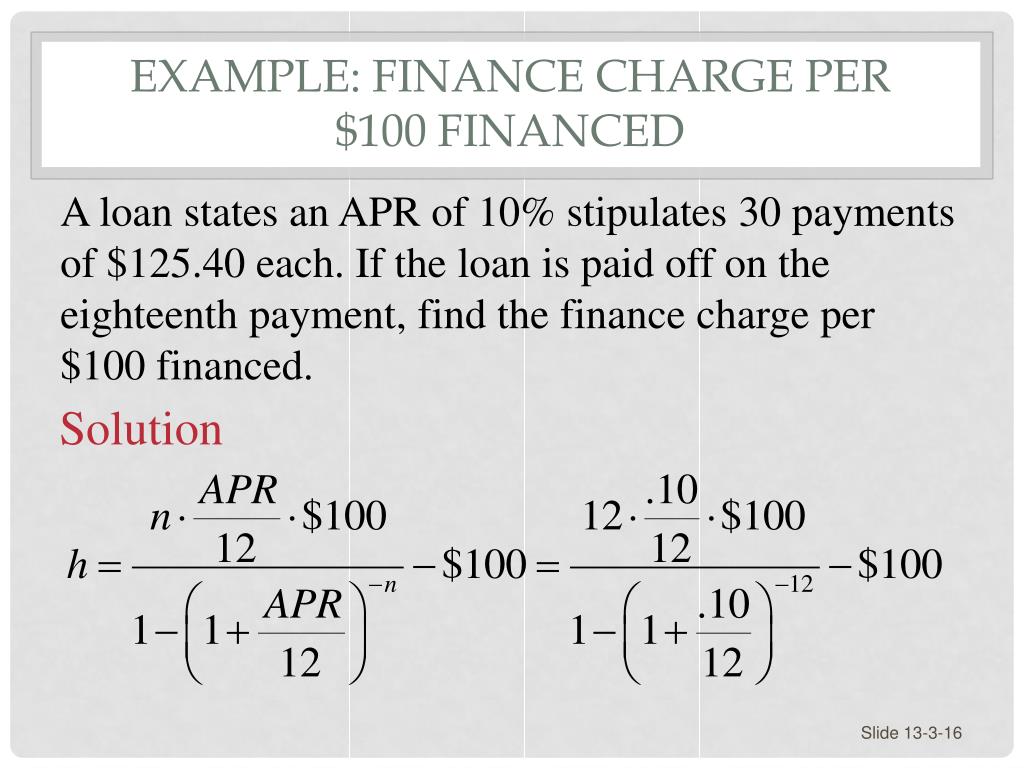

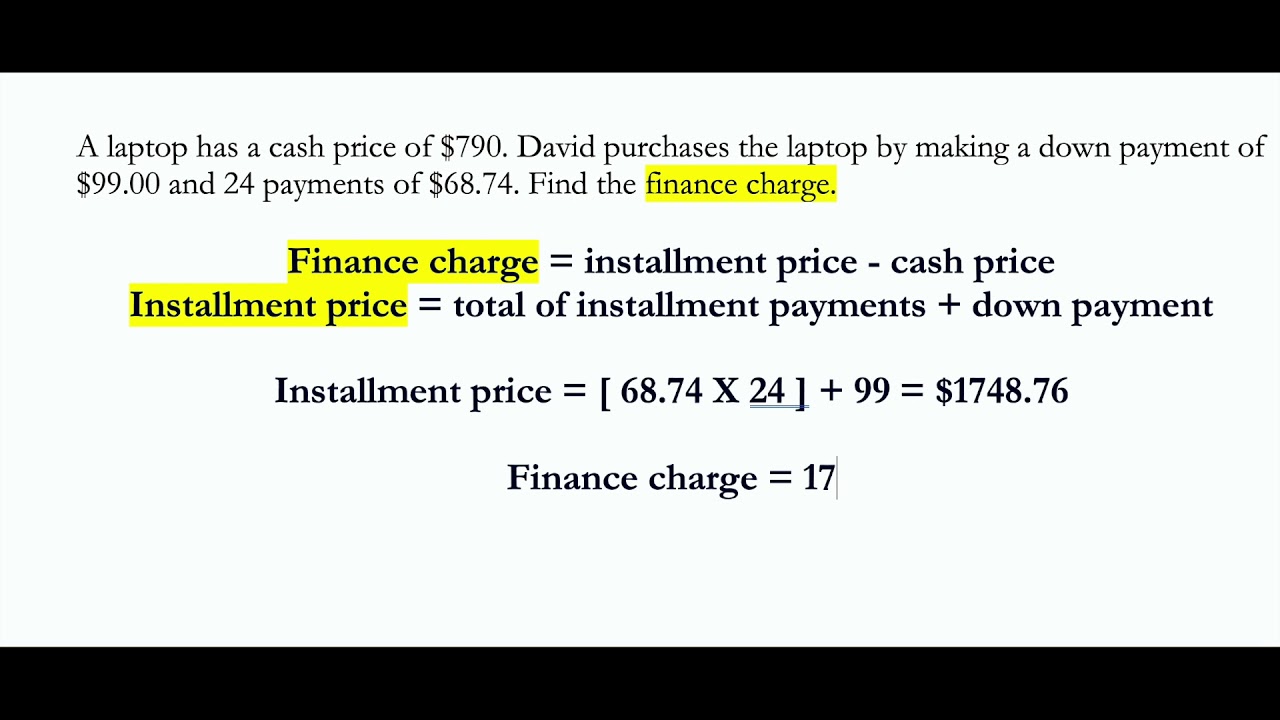

Calculating Finance Charges Manually

Understanding how finance charges are calculated is crucial for responsible borrowing. This section will guide you through the manual calculation of finance charges, covering both simple and compound interest methods. We’ll explore the formulas and provide examples to illustrate the differences in total cost.

Simple Interest Finance Charge Calculation

Simple interest is calculated only on the principal amount borrowed. The formula is straightforward and easy to apply. The formula for calculating simple interest is:

Simple Interest = Principal x Interest Rate x Time

Where:

* Principal is the initial amount borrowed.

* Interest Rate is the annual interest rate (expressed as a decimal).

* Time is the loan term in years.

For example, let’s say you borrow $1,000 at an annual interest rate of 5% for 2 years. The simple interest would be:

Simple Interest = $1000 x 0.05 x 2 = $100

The total amount you would repay is the principal plus the simple interest: $1000 + $100 = $1100.

Compound Interest Finance Charge Calculation

Compound interest is calculated on the principal amount plus any accumulated interest. This means that interest earned in one period is added to the principal, and subsequent interest calculations are based on this larger amount. The calculation is more complex than simple interest and involves repeated applications of the interest rate over the loan term.

For instance, let’s use the same example as above: $1,000 borrowed at 5% annual interest for 2 years, but this time compounded annually.

* Year 1: Interest = $1000 x 0.05 = $50. New balance: $1050

* Year 2: Interest = $1050 x 0.05 = $52.50. New balance: $1102.50

The total interest paid is $102.50, which is $2.50 more than with simple interest. The difference becomes more significant with longer loan terms and higher interest rates. Note that the compounding frequency (annually, semi-annually, monthly) affects the final amount. More frequent compounding leads to higher total interest.

Comparison of Simple and Compound Interest Finance Charges

The primary difference lies in how interest is calculated. Simple interest only considers the initial principal, while compound interest incorporates accumulated interest into subsequent calculations. As demonstrated in the previous examples, compound interest results in a higher total finance charge over the loan term compared to simple interest. The longer the loan term and the higher the interest rate, the greater the difference will be.

Finance Charge Calculation Table

The following table illustrates the calculation of finance charges for various loan amounts and interest rates using simple interest. Remember that compound interest will yield higher finance charges.

| Loan Amount | Interest Rate (%) | Loan Term (Years) | Simple Interest Finance Charge |

|---|---|---|---|

| $5,000 | 3 | 5 | $750 |

| $10,000 | 5 | 3 | $1500 |

| $20,000 | 7 | 2 | $2800 |

| $15,000 | 4 | 4 | $2400 |

Finance Charge Disclosure Regulations: How To Find Finance Charge

Transparent and accurate disclosure of finance charges is crucial for consumer protection and fair lending practices. Legal frameworks across various jurisdictions mandate specific disclosures to ensure borrowers understand the true cost of credit. Failure to comply can lead to significant penalties and reputational damage for lenders.

Legal Requirements for Disclosing Finance Charges

Laws governing finance charge disclosures aim to provide consumers with clear and readily understandable information about the cost of borrowing. These regulations typically specify the format, content, and timing of disclosures, ensuring that key information is presented prominently and in a consistent manner. The specific requirements vary depending on the type of credit product (e.g., credit cards, mortgages, installment loans) and the applicable jurisdiction. These laws often require that the finance charge be expressed as an annual percentage rate (APR), which standardizes the cost of borrowing across different loan terms and structures. Additionally, many jurisdictions stipulate that all fees and charges included in the finance charge must be clearly itemized.

Key Elements of Finance Charge Disclosures

Several key elements are typically mandated in finance charge disclosures. These include the total finance charge, the annual percentage rate (APR), the amount financed, the total amount payable, and the payment schedule. The disclosure must also clearly state any other fees or charges included in the finance charge, such as late payment fees, prepayment penalties, or origination fees. Furthermore, the regulations often specify the required font size, placement, and prominence of these disclosures to ensure they are easily visible and understandable to the consumer. The precise details of what constitutes a “key element” may vary slightly from one jurisdiction to another.

Consequences of Non-Compliance with Finance Charge Disclosure Regulations

Non-compliance with finance charge disclosure regulations can result in severe consequences for lenders. These can include significant financial penalties, legal action from consumers or regulatory bodies, and reputational damage. In some cases, non-compliance can lead to the invalidation of the credit agreement itself, potentially releasing the borrower from their repayment obligations. The severity of the penalties often depends on the nature and extent of the non-compliance, as well as the relevant jurisdiction’s enforcement policies. For example, repeated or willful violations can lead to substantially higher penalties than isolated instances of unintentional non-compliance.

Examples of Finance Charge Disclosure Regulations Across Jurisdictions

The United States utilizes the Truth in Lending Act (TILA), which requires detailed disclosures of finance charges for most consumer credit transactions. The European Union, on the other hand, has implemented the Consumer Credit Directive, which harmonizes consumer credit regulations across member states, setting minimum standards for finance charge disclosures. In contrast, individual countries such as Canada and Australia have their own distinct legislative frameworks governing finance charge disclosures, reflecting their specific market conditions and consumer protection priorities. These variations highlight the need for lenders to carefully consider the specific legal requirements applicable to their target markets.

Strategies for Minimizing Finance Charges

Minimizing finance charges is crucial for maintaining healthy personal finances. High interest rates can significantly impact your budget and overall financial well-being. By employing effective strategies and responsible borrowing habits, you can substantially reduce the amount you pay in interest over the life of a loan or credit card debt.

Reducing Credit Card Finance Charges

Several strategies can help reduce finance charges on credit cards. These methods focus on responsible spending habits and proactive debt management.

- Pay More Than the Minimum Payment: Paying more than the minimum payment each month dramatically reduces the principal balance faster, leading to lower interest charges over time. For example, if your minimum payment is $50 and you can afford $100, the extra $50 directly reduces your principal, saving you on interest in subsequent months.

- Pay Your Balance in Full Each Month: This is the most effective way to avoid finance charges altogether. By paying your entire balance before the due date, you prevent accruing any interest.

- Transfer Balances to a Card with a Lower APR: Balance transfer cards often offer introductory 0% APR periods. This allows you to pay down your debt without incurring interest for a specified timeframe, providing a valuable opportunity to reduce your overall finance charges. However, remember that after the introductory period, the APR typically increases, so it’s vital to pay off the balance before this happens.

- Negotiate a Lower Interest Rate: Contact your credit card company and inquire about lowering your interest rate. Good credit history and responsible payment behavior can strengthen your negotiation position. A lower APR directly translates to lower finance charges.

Responsible Borrowing Practices

Responsible borrowing practices are essential for minimizing finance charges across all types of loans. These practices involve careful planning and mindful decision-making before taking on debt.

- Borrow Only What You Need: Avoid borrowing more than necessary. A smaller loan means less interest to pay over time.

- Shop Around for the Best Interest Rates: Compare offers from multiple lenders to secure the lowest possible interest rate. Even small differences in APR can significantly impact your total finance charges.

- Choose a Shorter Loan Term: While monthly payments will be higher, a shorter loan term means you’ll pay less interest overall. For example, a 3-year loan will generally accrue less interest than a 5-year loan with the same principal amount.

- Maintain a Good Credit Score: A higher credit score qualifies you for better interest rates, directly reducing finance charges.

Benefits of Early Debt Payoff

Paying off debt early significantly reduces finance charges. The sooner you repay the principal, the less interest you accumulate. This results in considerable savings over the life of the loan. For instance, consider a $10,000 loan at 10% interest over 5 years. Paying it off in 3 years would save you a substantial amount in interest compared to the full 5-year term.

Minimizing Finance Charges on Loans: A Flowchart

The flowchart below visually represents the steps to minimize finance charges on loans.

Imagine a flowchart with the following steps:

1. Assess Your Financial Situation: Evaluate your income, expenses, and existing debt.

2. Determine Your Need: Clearly define the purpose and amount of the loan you require.

3. Shop Around for Lenders: Compare interest rates, fees, and loan terms from various lenders.

4. Choose the Best Loan: Select the loan with the lowest interest rate and favorable terms.

5. Create a Budget: Develop a realistic budget that includes the loan payment.

6. Make Extra Payments: Whenever possible, make additional payments to reduce the principal balance quickly.

7. Monitor Your Progress: Regularly track your loan balance and payments to ensure you’re on track.

8. Consider Refinancing: If interest rates fall, explore refinancing options to lower your interest rate.

Common Misconceptions about Finance Charges

Understanding finance charges is crucial for responsible borrowing, yet several misconceptions surround them. Clearing up these misunderstandings empowers consumers to make informed financial decisions and avoid unexpected costs. This section addresses common errors in understanding finance charges, highlighting the distinction between APR and finance charges, and illustrating how deceptive marketing practices can obscure crucial information.

APR versus Finance Charges

The Annual Percentage Rate (APR) and finance charges are often confused, leading to misinterpretations of borrowing costs. The APR represents the yearly cost of borrowing, including interest and other fees, expressed as a percentage. Finance charges, on the other hand, are the total dollar amount paid for the privilege of borrowing money. This includes interest, but also encompasses other fees like late payment penalties, processing fees, and potentially other charges specific to the loan agreement. For example, a loan with a 10% APR might have a total finance charge of $500 over its term, encompassing both the interest accrued and any additional fees. The APR provides a standardized measure for comparison across different loans, while the finance charge represents the actual total cost to the borrower.

Misleading Marketing and Finance Charge Information

Deceptive marketing tactics can make it difficult to determine the true cost of borrowing. For instance, advertisements might highlight a low introductory interest rate without clearly stating the subsequent higher rate or the total finance charges over the loan’s lifetime. Another common tactic is emphasizing the monthly payment amount without disclosing the overall finance charge, making the loan seem more affordable than it actually is. Consider a credit card offering a “0% APR for 12 months” promotion. While enticing, the fine print might reveal high finance charges once the promotional period ends, or significant fees for balance transfers. This creates a false sense of security and can lead to significant unexpected expenses for the consumer.

Frequently Asked Questions about Finance Charges, How to find finance charge

Understanding finance charges involves addressing several key questions. The following clarifies common queries regarding their calculation, disclosure, and minimization.

| Question | Answer |

|---|---|

| What exactly constitutes a finance charge? | Finance charges encompass all costs associated with borrowing money, including interest, late payment penalties, processing fees, and other applicable fees as Artikeld in the loan agreement. |

| How are finance charges calculated? | Calculation methods vary depending on the loan type. Simple interest is calculated on the principal amount, while compound interest is calculated on the principal plus accumulated interest. Specific formulas and methods are Artikeld in the loan agreement. |

| Where can I find the finance charge information? | The total finance charge must be clearly disclosed in the loan agreement or credit card terms and conditions. Federal regulations require this information to be readily accessible. |

| Are there ways to reduce my finance charges? | Yes, several strategies exist, including paying down debt quickly, making extra payments, choosing loans with lower APRs, and diligently avoiding late payment fees. |

Tim Redaksi