Understanding Principal Finance Account Access Methods: How Do I Access My Principal Finance Account

Accessing your Principal Financial account is straightforward, offering several convenient methods to suit your preferences. Understanding the security measures associated with each method is crucial for protecting your financial information. This section details the various access options and their associated security protocols.

Principal Finance Account Access Methods

Principal offers multiple ways to access your account: online through their website, via their mobile application, and by phone. Each method offers a different level of convenience and security.

Online Account Access Security Measures

Accessing your account online requires navigating to the Principal Financial website. Security is paramount; the website utilizes robust encryption (HTTPS) to protect data transmitted between your computer and their servers. Multi-factor authentication (MFA), often involving a one-time code sent to your registered mobile phone or email, adds an extra layer of protection against unauthorized access. Strong password requirements and regular security updates further enhance the system’s security.

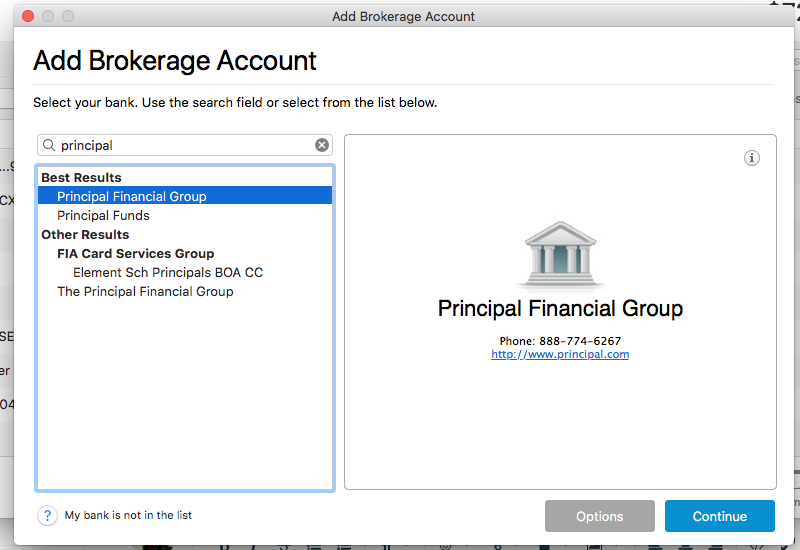

Step-by-Step Guide to Website Access

1. Navigate to the official Principal Financial website. Ensure you are on a secure connection (HTTPS).

2. Locate the “Log In” or “Sign In” button, typically found in the upper right-hand corner of the webpage.

3. Enter your registered username and password.

4. If MFA is enabled, you will be prompted to enter a one-time code sent to your registered mobile phone or email address.

5. Once authenticated, you will gain access to your account dashboard.

Mobile App Access and Security

The Principal Financial mobile app provides convenient access to your account on your smartphone or tablet. Security measures mirror those of the website, including encryption and MFA. The app also typically features biometric authentication options like fingerprint or facial recognition for added security. Regular software updates ensure the app maintains the latest security patches.

Phone Access and Security, How do i access my principal finance account

Phone access involves contacting Principal Financial’s customer service line. While convenient for certain inquiries, this method doesn’t provide direct account access. Security relies on the verification process employed by the customer service representative, which typically involves confirming your identity using personal information. This method is less secure than online or mobile app access due to the reliance on verbal confirmation.

Comparison of Access Methods

| Method | Security | Convenience | Accessibility |

|---|---|---|---|

| Website | High (HTTPS, MFA) | Moderate | Requires computer or internet-enabled device |

| Mobile App | High (HTTPS, MFA, Biometrics) | High | Requires smartphone or tablet |

| Phone | Moderate (Verbal Verification) | Moderate | Requires phone access |

Troubleshooting Login Issues

Accessing your Principal Finance account can sometimes present challenges. Understanding the common causes of login failures and the available solutions can significantly streamline the process. This section details troubleshooting steps and contact information to resolve login problems.

How do i access my principal finance account – Login failures typically stem from a few key issues. The most frequent cause is an incorrect password. Users may accidentally enter the wrong characters, use an outdated password, or simply forget their login credentials. Another common problem is a locked account, often triggered by multiple unsuccessful login attempts. This security measure protects accounts from unauthorized access. Finally, technical glitches on the website or with your device can also temporarily prevent login.

Password Reset Process

If you’ve forgotten your password, Principal Finance offers a secure password reset procedure. Initiating the process typically involves clicking a “Forgot Password” or similar link on the login page. You’ll then be prompted to answer your security questions, previously set up during account creation. These questions serve as a verification method to confirm your identity. Successfully answering them will allow you to create a new password. Alternatively, you may be given the option to receive a password reset link via email, sent to the address associated with your account. This email will contain a temporary link or code allowing you to reset your password. It’s crucial to follow the instructions carefully and create a strong, unique password to enhance account security.

Troubleshooting Login Flowchart

The following describes a visual representation of the troubleshooting process. Imagine a flowchart starting with a box labeled “Login Attempt Failed.” This box would have arrows branching to three separate boxes: “Incorrect Password,” “Locked Account,” and “Technical Issues.”

The “Incorrect Password” box would lead to a box instructing the user to “Try Again,” and if unsuccessful, to a “Reset Password” box. The “Reset Password” box then branches into two boxes: one for answering security questions and the other for receiving a password reset link via email. Both ultimately lead to a “New Password Created” box and then to a successful “Login” box.

The “Locked Account” box would lead to a box instructing the user to “Contact Customer Support,” which then leads to the “Login” box after the account is unlocked.

The “Technical Issues” box would also direct the user to “Contact Customer Support,” followed by the “Login” box once the issue is resolved. Finally, a successful “Login” box marks the successful completion of the process.

Contacting Customer Support

If you continue to experience login difficulties after attempting the troubleshooting steps, contacting Principal Finance’s customer support is recommended. Their contact information, including phone numbers and email addresses, can usually be found on their website’s help or support section. Be prepared to provide relevant account information for verification purposes when contacting support. They are equipped to assist with a variety of login issues, including account unlocks and technical troubleshooting.

Account Security and Best Practices

Protecting your Principal Finance account is paramount to safeguarding your financial information. Implementing robust security measures is crucial to prevent unauthorized access and potential financial losses. This section details essential security practices and the features Principal Finance provides to enhance your account’s safety.

Strong passwords and multi-factor authentication are cornerstones of online security. A strong password is complex, combining uppercase and lowercase letters, numbers, and symbols, and should be at least 12 characters long. It should also be unique to your Principal Finance account and not reused on other websites or services. Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile phone or email, in addition to your password. This significantly reduces the risk of unauthorized access, even if your password is compromised.

Principal Finance Security Features

Principal Finance employs several security measures to protect user accounts. These include encryption of data both in transit and at rest, robust fraud detection systems that monitor for suspicious activity, and regular security audits to identify and address vulnerabilities. The platform also utilizes advanced technologies to detect and prevent various types of cyberattacks. Account monitoring tools allow users to review their account activity and identify any unusual transactions. Furthermore, Principal Finance provides security alerts, notifying users of potential security breaches or suspicious login attempts. These features work in concert to provide a secure environment for managing your finances.

Security Risks of Public Wi-Fi

Accessing your Principal Finance account from public Wi-Fi networks poses significant security risks. Public Wi-Fi networks are often unsecured, meaning your data transmission is not encrypted. This makes your account vulnerable to eavesdropping by malicious actors who can intercept your login credentials and other sensitive information. Using public Wi-Fi for financial transactions is strongly discouraged. Consider using a secure VPN (Virtual Private Network) if you must access your account from a public network. A VPN encrypts your internet traffic, making it much harder for others to intercept your data.

Best Practices for Account Security

Maintaining the security of your Principal Finance account requires consistent vigilance and proactive measures. The following best practices are essential for minimizing risks:

Regularly updating your password is crucial. Aim to change your password every three months, or even more frequently if you suspect a security breach. Avoid using easily guessable passwords or reusing passwords across multiple accounts. Employ a password manager to generate and securely store strong, unique passwords for all your online accounts. Be wary of phishing scams – these fraudulent attempts to obtain your login credentials often appear as legitimate emails or text messages. Never click on suspicious links or provide your personal information in response to unsolicited requests. Always access your Principal Finance account directly through the official website, rather than clicking links from emails or other untrusted sources. Regularly review your account activity for any unauthorized transactions or suspicious activity. Report any suspicious activity to Principal Finance immediately.

Navigating the Principal Finance Account Interface

The Principal Financial online account dashboard provides a centralized location to manage your financial accounts. Its intuitive design aims to streamline access to key information and facilitate common account management tasks. Understanding the layout and features of the dashboard is crucial for efficient account navigation.

The dashboard is organized into distinct sections, each providing access to specific account information and functionalities. This allows for quick and easy access to your financial data, regardless of the type of account you hold. Understanding these sections will improve your overall experience using the platform.

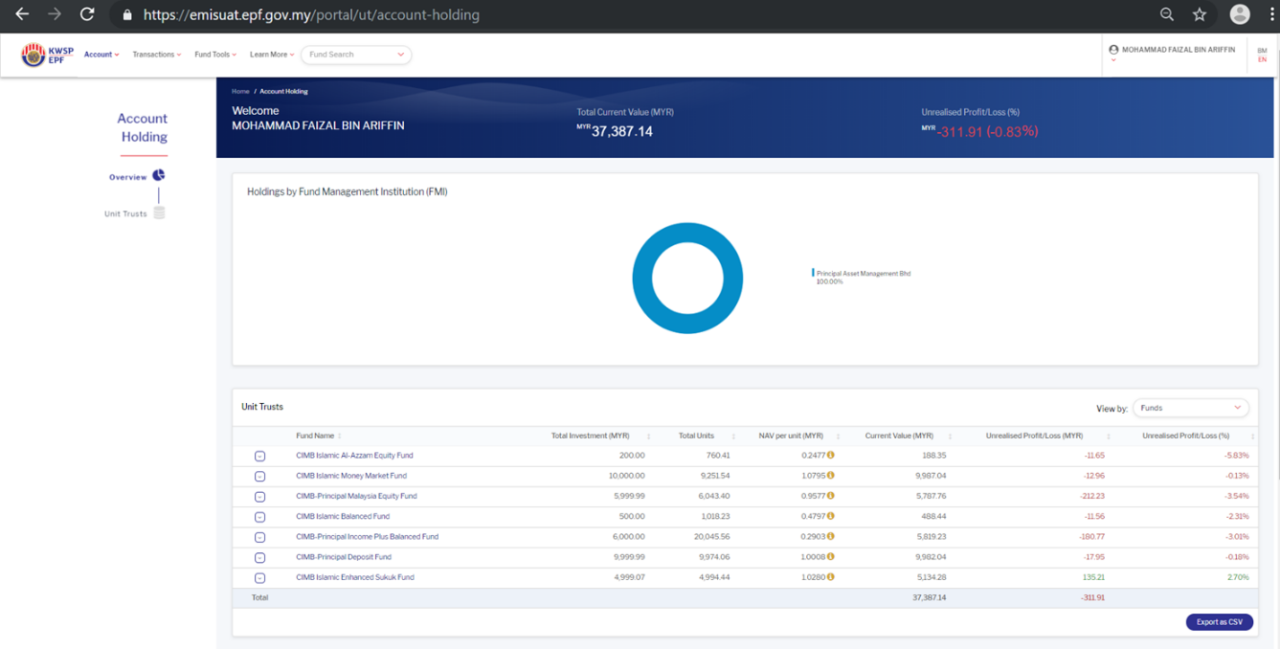

Account Summary

This section presents a high-level overview of your financial holdings. It typically displays your total account balance, a summary of your investment accounts, and perhaps a quick view of recent transactions. Think of it as a personalized financial snapshot, providing a quick glance at your overall financial picture. The display might include color-coded charts or graphs to visually represent asset allocation or account performance. For example, a pie chart might illustrate the percentage of your investments allocated to stocks, bonds, and cash.

Account Details

This area provides detailed information on individual accounts. You can access specific account numbers, balances, and transaction histories for each of your accounts. You’ll find options to drill down into individual accounts for a more in-depth view of your financial activity. For example, selecting a specific investment account would provide a detailed list of transactions, including dates, amounts, and descriptions. You can also typically view detailed holdings information, including current market values and performance metrics.

Transactions

This section displays a comprehensive record of all your recent transactions. You can usually filter this information by date range, account type, or transaction type to locate specific entries easily. Each transaction typically includes the date, amount, description, and any relevant reference numbers. The platform may offer downloadable transaction history in various formats, such as CSV or PDF, for record-keeping purposes. Searching for a specific transaction is typically facilitated by date or search functions.

Account Settings

Here, you can manage your personal information, contact preferences, and account security settings. This is where you would update your address, phone number, or email address. You can also review and modify security questions and password settings to ensure the security of your accounts. There might also be options to enroll in or manage features like two-factor authentication for enhanced security.

Visual Representation of the Account Dashboard

Imagine the dashboard as a webpage divided into distinct sections. At the top, a banner displays a welcome message and your name. Below this, the Account Summary section is prominently featured, showing key financial figures in a clear and concise manner. To the left, a navigation menu allows you to easily access other sections, such as Account Details, Transactions, and Account Settings. The central area displays the content of the currently selected section, dynamically updating based on your navigation. The right-hand side might feature helpful links, quick access to customer support, or personalized financial advice based on your account activity.

Performing Common Account Actions

Transferring funds between accounts typically involves selecting the source and destination accounts, entering the transfer amount, and confirming the transaction. Updating personal information usually involves accessing the Account Settings section, locating the relevant field, entering the new information, and saving the changes. The system will often require confirmation or verification steps to ensure the accuracy and security of these actions. These actions are designed to be straightforward and intuitive, with clear instructions provided at each step.

Mobile App Functionality

The Principal Finance mobile app offers convenient access to your account information and transaction capabilities, mirroring many features of the website but optimizing them for mobile use. While the website provides a more comprehensive view and detailed reporting options, the app prioritizes ease of access and quick transaction completion for users on the go.

The app and website share core functionalities such as viewing account balances, reviewing transaction history, and transferring funds. However, certain advanced features, like detailed reporting tools or complex account management options, might be more readily available or easier to navigate on the website. The app focuses on the most frequently used features, making it a streamlined and efficient tool for everyday account management.

Mobile App Download and Installation

Downloading and installing the Principal Finance mobile app is a straightforward process. First, locate the app in your device’s app store (Google Play Store for Android devices or the Apple App Store for iOS devices). Search for “Principal Finance” and select the official app from Principal Financial Group. Once located, tap the “Install” or “Get” button. The app will download and install automatically. After installation, you can launch the app and log in using your existing Principal Finance online banking credentials.

Managing Mobile App Notifications and Settings

The Principal Finance mobile app allows users to customize their notification preferences and manage various app settings. Within the app’s settings menu (typically accessible through a gear icon or similar), users can choose to receive alerts for various account activities, such as low balance warnings, successful transactions, or security notifications. Users can also adjust notification frequencies (e.g., immediate, daily, weekly) and select specific types of alerts they wish to receive. Additionally, settings may include options to manage biometric login (fingerprint or facial recognition), adjust display preferences (font size, theme), and manage linked accounts.

Accessing Account Information and Performing Transactions via Mobile App

Using the Principal Finance mobile app to access your account information and perform transactions is intuitive and user-friendly. After logging in, the app’s home screen typically displays your account summary, including key balances and recent transactions. To view detailed account information, navigate to the appropriate section within the app’s menu. This might involve tapping on specific account types or using a search function. Performing transactions, such as transferring funds or paying bills, usually involves selecting the relevant option from the main menu, following the on-screen prompts, and confirming the transaction details. The app provides clear instructions and security measures throughout the transaction process. For example, a user might navigate to the “Transfer Funds” section, select the source and destination accounts, enter the transfer amount, and then confirm the transfer using a multi-factor authentication method.

Tim Redaksi