Understanding Yahoo Finance Data Structure

Yahoo Finance provides a wealth of financial data, but understanding its structure is crucial for effective data retrieval. This section details the types of data available and how Yahoo Finance organizes its historical price information, along with inherent limitations in accessing this data directly through the website.

Yahoo Finance offers a comprehensive collection of data points for each listed stock. This includes not only historical price information but also a range of fundamental data, analyst ratings, and news articles. However, the focus here will be on the structure of the historical price data itself.

Available Data Points for a Stock

The core data points typically available for a stock’s historical price include: Date, Open Price, High Price, Low Price, Close Price, Adjusted Close Price, and Volume. The “Adjusted Close” price is particularly important as it accounts for corporate actions like stock splits and dividends, providing a more accurate representation of historical performance. Other data may include previous day’s close, and perhaps even pre-market and after-hours trading data, depending on the data provider and the specific stock.

Organization of Historical Price Data

Yahoo Finance organizes historical price data chronologically, typically listing the most recent data first. Each data point is associated with a specific date, allowing for easy tracking of price movements over time. The data is presented in a tabular format, making it relatively straightforward to download and analyze using spreadsheet software or programming languages. The specific format of the data may vary slightly depending on the method used to access it (e.g., through the website’s interface or using their API). However, the underlying structure of date-linked price information remains consistent.

Limitations of Accessing Historical Data Through the Yahoo Finance Website

Accessing historical data directly through the Yahoo Finance website has several limitations. Firstly, the website interface only allows for viewing a limited amount of historical data at a time. Downloading the entire history often requires manual steps for each time period, a process that becomes incredibly time-consuming for stocks with decades of trading history. Secondly, the website’s download functionality is not designed for bulk downloads, limiting the efficiency of data extraction. Finally, the data provided may not be completely comprehensive or consistently accurate, with occasional gaps or discrepancies possible. Therefore, using dedicated financial data APIs or web scraping techniques, while potentially more complex, are often preferred for comprehensive and reliable data acquisition.

Manual Download Methods: How To Download All Price History In Yahoo Finance

Downloading Yahoo Finance historical stock data manually involves using the website’s built-in features. This method is straightforward for smaller datasets but becomes cumbersome for large-scale or frequent data collection. The following steps detail the process, highlighting its limitations.

Step-by-Step Guide to Manual Download

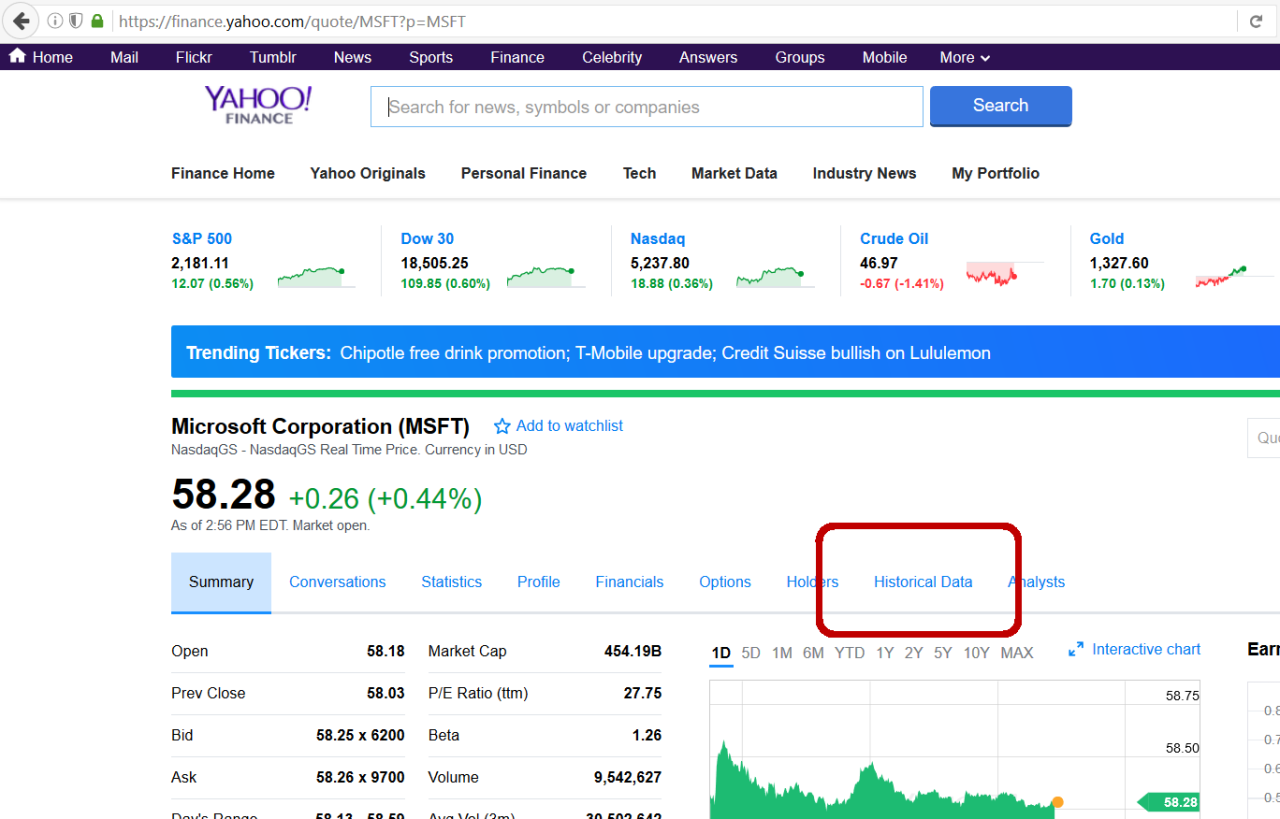

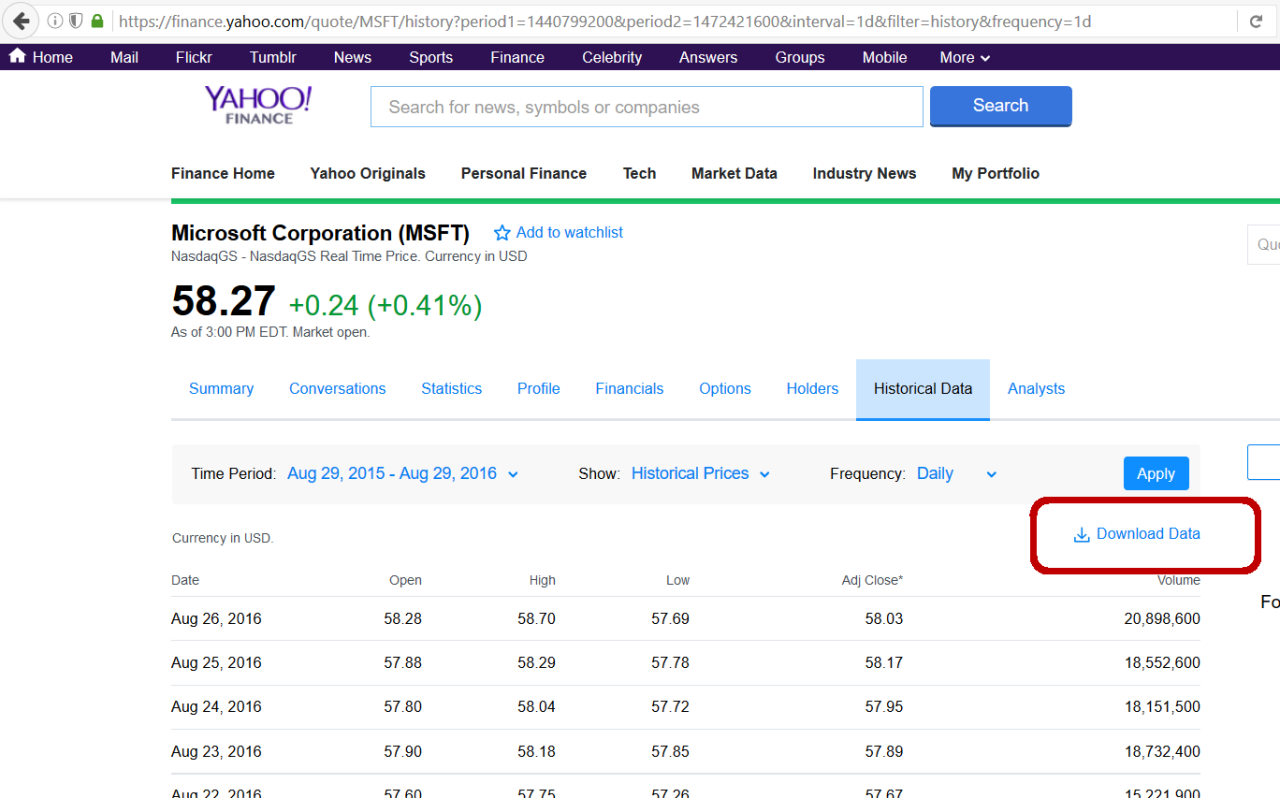

This section provides a step-by-step guide to manually downloading historical stock price data from Yahoo Finance using the website’s interface. The process involves navigating to the stock’s page, accessing the historical data section, and then downloading the data in a suitable format (typically CSV). Note that the exact appearance of the website may change slightly over time.

| Step | Action | Screenshot Description | Notes |

|---|---|---|---|

| 1 | Navigate to the Yahoo Finance website and search for the desired stock ticker symbol (e.g., AAPL for Apple). | A screenshot would show the Yahoo Finance homepage with a search bar at the top. The search bar would contain “AAPL” and the search results would prominently display the Apple Inc. stock information. | Ensure you are using the correct ticker symbol. |

| 2 | Click on the stock’s ticker symbol to open its detailed page. | A screenshot would show the Apple Inc. stock page, including the current price, charts, and other relevant information. A prominent element would be the navigation tabs, likely including a tab for “Historical Data”. | This takes you to the page containing the historical data section. |

| 3 | Locate and click on the “Historical Data” section (or similar). This usually appears in a tab or menu. | A screenshot would highlight the “Historical Data” tab or button. The screenshot would show the page displaying options for selecting the date range, frequency (daily, weekly, monthly), and data type to download. | The exact label might vary slightly depending on the website’s current design. |

| 4 | Specify the desired date range and data frequency (daily, weekly, monthly). | A screenshot would show the date range selection fields (e.g., start date and end date) and a dropdown menu to select the frequency of data (Daily, Weekly, Monthly). | Downloading data for a long period (e.g., many years) may lead to slow download times or timeout errors. |

| 5 | Click the “Download” button (or similar) to download the data. The data will usually be downloaded as a CSV file. | A screenshot would show a “Download” button or link, possibly accompanied by a file format selection (e.g., CSV). | The downloaded CSV file can then be opened using spreadsheet software like Microsoft Excel or Google Sheets. |

Limitations of Manual Downloads

Manual downloads from Yahoo Finance are limited by the amount of data that can be practically downloaded at once and the frequency of data updates. Attempting to download excessively large datasets can result in slow download speeds, timeouts, or even website errors. Furthermore, the website only provides a limited number of data points for each download, and frequent downloads may be perceived as excessive activity by the website’s security systems.

Alternative Manual Download Methods

There aren’t significant alternative manual methods for downloading Yahoo Finance data directly from the website. The process described above represents the standard approach offered by Yahoo Finance itself. Any other method would likely involve using third-party tools or scripts, which move beyond the scope of purely manual downloads.

Utilizing Third-Party Tools

Accessing Yahoo Finance’s historical price data directly can be cumbersome. Fortunately, several third-party tools and APIs offer streamlined solutions, providing access to this data with varying levels of features and limitations. Choosing the right tool depends on your specific needs and technical expertise.

Third-party tools and APIs offer various advantages for accessing Yahoo Finance data, including automated data retrieval, structured data formats, and often, access to a wider range of financial instruments beyond what’s readily available through manual downloads. However, it’s crucial to understand the limitations, including potential cost, data access restrictions, and API rate limits.

Third-Party Tools and APIs for Yahoo Finance Data

Several options exist for accessing Yahoo Finance data programmatically, each with its own strengths and weaknesses. We will examine three prominent examples: yfinance, Alpha Vantage, and Tiingo.

yfinance

yfinance is a popular Python library specifically designed to interact with Yahoo Finance. It provides a straightforward interface for retrieving historical stock prices, financial statements, and other relevant data. A key advantage is its ease of use, making it accessible to users with basic Python programming skills. However, its reliance on Yahoo Finance’s infrastructure means it’s subject to changes in Yahoo’s API and potential data inconsistencies. yfinance is free to use. Data access is limited to what Yahoo Finance publicly provides, and there are rate limits in place to prevent abuse.

Alpha Vantage

Alpha Vantage is a comprehensive financial data API offering a wide range of data points beyond just Yahoo Finance’s historical prices. It includes real-time and historical stock data, technical indicators, and economic data. Alpha Vantage offers a free plan with limited API calls, but its paid plans provide significantly higher request limits and access to more advanced features. While Alpha Vantage doesn’t directly access Yahoo Finance’s data, it offers a similar dataset and often presents it in a more structured and consistent format. A potential limitation is the cost for higher usage, which can become significant for intensive data retrieval.

Tiingo, How to download all price history in yahoo finance

Tiingo is another financial data provider offering historical stock data, along with other financial information. Unlike yfinance which directly scrapes Yahoo Finance, Tiingo provides its own curated dataset, offering a more reliable and consistent data source. Tiingo’s data is generally considered high-quality and well-structured. However, Tiingo is a paid service, with pricing based on usage and data types. The cost can be relatively high compared to free options like yfinance, but the reliability and consistency often justify the expense for professional use.

Comparison of Third-Party Tools

| Feature | yfinance | Alpha Vantage | Tiingo |

|---|---|---|---|

| Cost | Free | Free (limited), Paid (unlimited) | Paid |

| Data Source | Yahoo Finance (scraped) | Proprietary | Proprietary |

| Data Quality | Variable, subject to Yahoo Finance changes | Generally consistent | High quality, consistent |

| Ease of Use | High (Python library) | Moderate (API calls) | Moderate (API calls) |

| Data Coverage | Limited to Yahoo Finance offerings | Broad range of financial data | Broad range of financial data |

| Rate Limits | Yes | Yes (higher limits with paid plans) | Yes (usage-based) |

Programming Solutions (Python Example)

Automating the download of Yahoo Finance historical stock data offers significant advantages over manual methods, enabling efficient data acquisition for large-scale analysis or algorithmic trading strategies. Python, coupled with the `yfinance` library, provides a powerful and straightforward approach to achieving this. This section demonstrates the process, highlighting key parameters and error handling techniques.

This section details using Python’s `yfinance` library to download historical stock data. The example provided will illustrate the process, including parameter usage and error handling.

Downloading Historical Stock Data with yfinance

The `yfinance` library simplifies the process of retrieving historical stock data from Yahoo Finance. The core function is `download()`, which takes several key arguments to specify the data to be downloaded. Below is a complete code example demonstrating its usage:

import yfinance as yf

# Define the ticker symbol and date range

ticker = "AAPL"

start_date = "2022-01-01"

end_date = "2023-12-31"

# Download the data

try:

data = yf.download(ticker, start=start_date, end=end_date)

print(data)

except Exception as e:

print(f"An error occurred: e")

This script first imports the `yfinance` library. Then, it defines the ticker symbol (`AAPL` in this case), and the start and end dates for the desired historical data. The `yf.download()` function retrieves the data, and a `try-except` block handles potential errors during the download process. The downloaded data, a Pandas DataFrame, is then printed to the console.

yfinance Parameters: Date Ranges and Data Frequencies

The `yf.download()` function offers several parameters for customizing the data retrieval. Crucially, these include specifying the date range and the data frequency.

The `start` and `end` parameters define the date range. These should be strings in ‘YYYY-MM-DD’ format. For instance, `start=”2020-01-01″` and `end=”2023-12-31″` would download data from January 1st, 2020 to December 31st, 2023.

The `interval` parameter controls the data frequency. Options include:

- `1m` (1 minute)

- `2m` (2 minutes)

- `5m` (5 minutes)

- `15m` (15 minutes)

- `30m` (30 minutes)

- `60m` (60 minutes)

- `90m` (90 minutes)

- `1h` (1 hour)

- `1d` (1 day) – Default

- `5d` (5 days)

- `1wk` (1 week)

- `1mo` (1 month)

Note that higher frequency data (e.g., 1-minute data) may not be available for all stocks or for the entire historical period.

Error Handling and Exception Management

Network issues, incorrect ticker symbols, or other problems can interrupt the data download. The `try-except` block in the example above is crucial for robust code. The `except Exception as e:` clause catches any exception that might occur during the download and prints an informative error message. More specific exception handling (e.g., catching `requests.exceptions.RequestException` for network errors) can provide even more detailed error diagnostics. This allows for graceful handling of unexpected situations and prevents the script from crashing.

Legal and Ethical Considerations

Accessing and utilizing data from Yahoo Finance, like any online platform, requires adherence to its terms of service and relevant legal frameworks. Understanding these guidelines is crucial to avoid legal repercussions and maintain ethical data practices. This section Artikels key legal and ethical considerations involved in downloading Yahoo Finance price history.

Yahoo Finance’s terms of service explicitly govern the permissible use of its data. Violating these terms can lead to account suspension or legal action. Specifically, the terms address acceptable usage, data scraping limitations, and the prohibition of activities that could overload or disrupt Yahoo Finance’s servers. Understanding these limitations is paramount before engaging in any data collection.

Yahoo Finance Terms of Service and Acceptable Use

The Yahoo Finance Terms of Service detail acceptable uses of their website and data. These terms often restrict automated data collection, especially through methods like web scraping, unless explicitly permitted through APIs or other officially supported channels. Unauthorized scraping can be viewed as a violation of their terms and potentially lead to legal consequences. Users should carefully review the current terms of service to understand the boundaries of acceptable data access and usage. A key aspect is the rate at which data is accessed; excessive requests in a short period could be interpreted as a denial-of-service attempt.

Ethical Considerations of Web Scraping

Ethical web scraping involves respecting the website’s infrastructure and the rights of its owners. Excessive scraping can strain server resources, impacting the performance and availability of the website for legitimate users. This can be considered unethical and, in some cases, illegal. Furthermore, respecting robots.txt files, which specify which parts of a website should not be accessed by automated tools, is crucial for ethical web scraping. Ignoring these guidelines is not only unethical but can also lead to legal issues. Responsible data collection prioritizes the website’s stability and the user experience.

Best Practices for Responsible Data Usage

Responsible data usage entails respecting Yahoo Finance’s terms of service and adhering to ethical web scraping practices. This includes implementing rate limiting to avoid overwhelming their servers, respecting robots.txt directives, and clearly identifying yourself (or your application) as the source of data collection. Furthermore, using the data responsibly and ethically means being transparent about its source and avoiding any misuse that could harm Yahoo Finance or its users. This could involve ensuring the data is not used for malicious purposes, such as market manipulation or insider trading. Transparency and respect for the platform are paramount.

Tim Redaksi