Understanding the Financing Process

Selling a financed car involves navigating the complexities of the existing loan. A clear understanding of the financing process is crucial for both the seller and the buyer to ensure a smooth and legally sound transaction. This section will Artikel the key aspects of car financing and the procedures for transferring ownership.

Types of Car Financing

Several types of financing exist for car purchases. The most common include traditional bank loans, loans from credit unions, and financing offered directly by dealerships. Bank loans typically involve a fixed interest rate and a set repayment schedule. Credit union loans often offer competitive rates and potentially more flexible terms. Dealership financing can be convenient but may come with higher interest rates. Understanding the terms of your specific loan – including the interest rate, loan term, and remaining balance – is paramount before attempting to sell the vehicle.

Transferring the Loan to a New Buyer

Transferring a car loan to a new buyer is not a simple assignment of debt; it requires the lender’s approval. The process typically involves the buyer applying for a loan with their own lender, or assuming the existing loan (subject to lender approval). The latter option, loan assumption, requires a credit check and approval from the original lender on the buyer’s qualifications. If the buyer doesn’t qualify, they will need to secure their own financing, and the seller will need to pay off the existing loan before transferring the title.

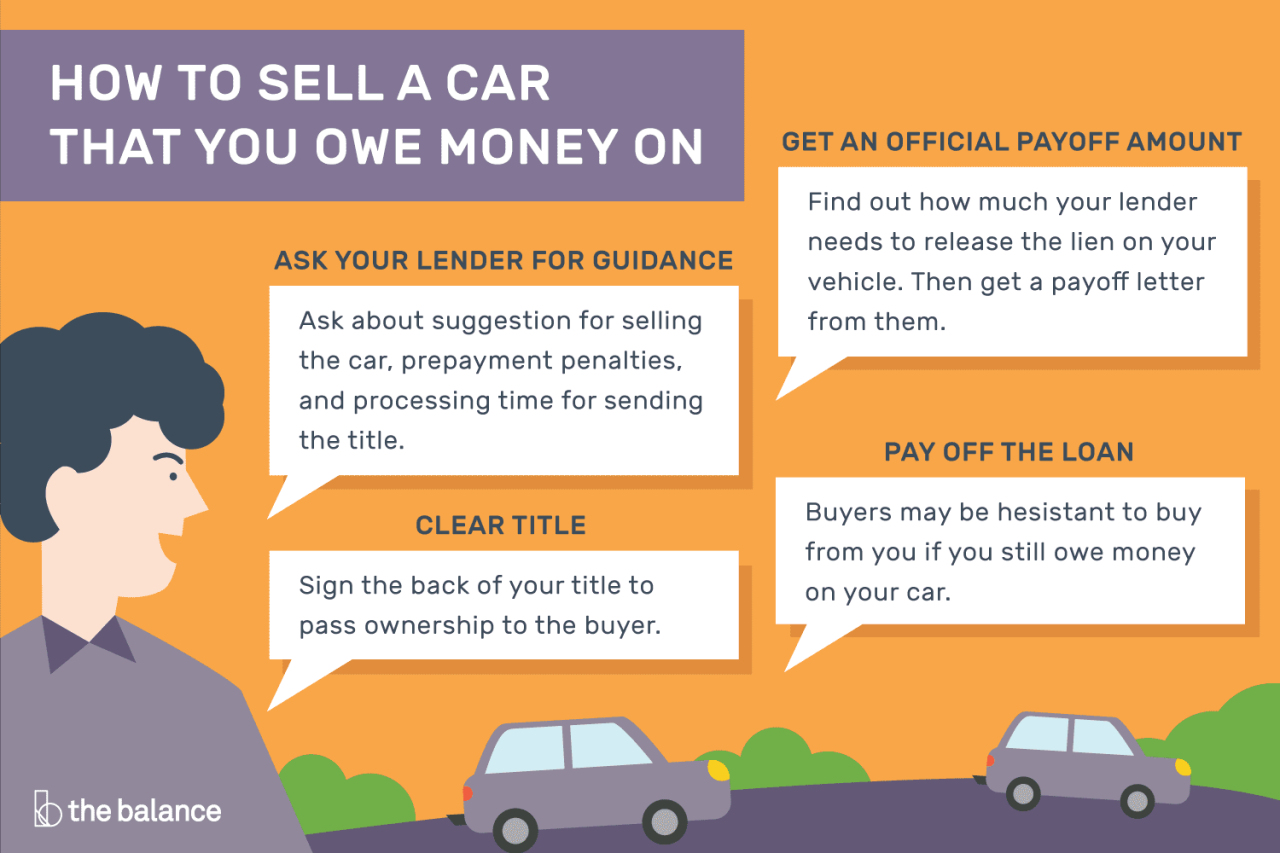

Obtaining Payoff Information from the Lender

Securing the payoff amount is a critical step. This is the exact amount needed to settle the loan in full. To obtain this information, contact your lender directly—either by phone or through their online portal. Request a payoff quote specifying the date you intend to pay off the loan. This is important because the payoff amount may fluctuate slightly due to accruing interest. Keep detailed records of all communication with your lender, including the date, time, and the name of the representative you spoke with. Always verify the payoff amount in writing before making the final payment.

Loan Payoff Methods Comparison

The method you choose to pay off your loan can impact the timing and potential fees involved. Below is a comparison of common methods:

| Method | Timeframe | Fees | Advantages/Disadvantages |

|---|---|---|---|

| Wire Transfer | Immediate | Potentially minimal or none | Fast and efficient; may incur small bank fees. |

| Certified Check | 1-3 business days | Usually none | Safe and reliable; requires a visit to your bank. |

| Personal Check | 7-10 business days (or longer) | Potentially none | Convenient; but takes longer to process and may be rejected. |

| Online Payment | Varies by lender; typically immediate to a few business days | Potentially minimal or none | Convenient and often fast; requires online banking access and lender acceptance. |

Pricing Your Financed Car: How To Sell A Financed Car

Selling a financed car requires a different pricing strategy than a cash sale. You need to balance the car’s market value with your outstanding loan balance to ensure a profitable sale. Understanding these factors is crucial for setting a competitive and financially sound price.

Pricing Strategies: Financed vs. Cash

The primary difference in pricing between a financed and a cash sale lies in the seller’s financial obligations. With a cash sale, the profit is simply the selling price minus the purchase price. However, with a financed vehicle, the profit calculation also incorporates the remaining loan balance. You must sell the car for enough to cover the loan and ideally generate a profit. A lower selling price might result in a loss, especially if the loan balance exceeds the market value. Conversely, a higher selling price maximizes profit but might reduce buyer interest.

Factors Influencing Selling Price

Several key factors influence the optimal selling price of a financed car. These include the vehicle’s market value, the outstanding loan balance, and its overall condition.

- Market Value: This represents the price a willing buyer would pay for your car in its current condition. Various online tools and resources can help determine this value.

- Loan Balance: This is the amount you still owe on your car loan. The higher the loan balance, the higher the selling price needs to be to avoid a loss.

- Condition: The car’s condition, including mileage, maintenance history, and any damage, significantly impacts its market value. A well-maintained car in excellent condition will command a higher price than a neglected one.

Online Tools for Determining Market Value

Several online resources provide estimates of a vehicle’s fair market value. Websites like Kelley Blue Book (KBB), Edmunds, and the National Automobile Dealers Association (NADA) Guides offer tools to input vehicle information (year, make, model, trim, mileage, condition) to receive an estimated value. These values often provide a range, reflecting the variation in condition and market fluctuations. It’s recommended to consult multiple sources for a more comprehensive understanding of your car’s worth.

Pricing Examples

The following table illustrates how different loan balances and market values impact the suggested selling price and potential profit or loss. Remember, these are examples and actual values may vary.

| Loan Balance | Market Value | Suggested Selling Price | Profit/Loss |

|---|---|---|---|

| $10,000 | $12,000 | $12,000 | $2,000 Profit |

| $15,000 | $13,000 | $15,000 (to cover loan) | $0 (Breakeven) |

| $8,000 | $10,000 | $9,500 | $1,500 Profit |

| $12,000 | $10,000 | $12,000 (to cover loan) | $2,000 Loss (may require negotiation or additional funds) |

Marketing and Advertising Your Financed Car

Selling a financed car requires a strategic approach to marketing and advertising that highlights both the vehicle’s features and the attractive financing options. Effectively communicating these aspects to potential buyers is crucial for a successful sale. This section will explore effective strategies for reaching your target audience and converting them into customers.

Online and Offline Advertising Strategies, How to sell a financed car

Successful marketing involves a blend of online and offline strategies. Online, utilize free classifieds sites like Craigslist or Facebook Marketplace, alongside paid advertising on platforms like Google Ads or social media. Consider targeting your ads geographically to reach potential buyers in your local area. Offline, explore options such as placing ads in local newspapers or community bulletin boards. Consider strategically placing flyers in high-traffic areas relevant to your target demographic. Remember that a compelling photograph is crucial for all your advertisements. For instance, a well-lit photo showcasing the car’s exterior and interior, highlighting any unique features or recent maintenance, will significantly improve your chances of attracting serious buyers. A high-quality image can often make the difference between a click and a scroll.

Advantages and Disadvantages of Selling Platforms

Choosing the right platform significantly impacts your selling process. Dealerships offer convenience and a potentially faster sale but typically result in a lower profit margin due to their fees and commissions. Private sales, while offering greater profit potential, require more effort in advertising, handling inquiries, and managing the transaction. Each option presents trade-offs that should be carefully considered based on your priorities and circumstances. For example, a dealership might offer a quicker sale and less hassle, but you’ll receive less money for your car. A private sale takes more time and effort but allows you to keep a larger share of the profits.

Sample Ad Copy

Crafting compelling ad copy is essential. Here’s an example:

“2018 Honda Civic – Excellent Condition! Low Monthly Payments Available! This meticulously maintained Honda Civic is ready for its next owner. Boasting [list key features, e.g., low mileage, recent servicing, safety features], this vehicle offers exceptional value. Attractive financing options are available to qualified buyers through [mention financing details or lender, if applicable, e.g., your local credit union, or “flexible financing plans available”]. Contact [your contact information] for a test drive today!”

Marketing Plan

A well-defined marketing plan is key. Your target audience might be young professionals seeking reliable transportation or families needing a spacious vehicle. Advertising channels should be chosen based on your target audience’s preferences. For instance, younger audiences might be more receptive to social media ads, while older audiences may respond better to print advertising. Budget allocation should consider the cost of each channel, aiming for a balance between reach and return on investment. For example, a budget of $500 could be allocated as follows: $200 for online classified ads, $150 for social media boosted posts, and $150 for print ads in a local newspaper. This allocation can be adjusted based on the effectiveness of each channel and the overall response.

Tim Redaksi