Market Size and Growth of Islamic Finance in the USA

The US market for Islamic finance, while still relatively nascent compared to other global hubs like Malaysia or the UAE, shows signs of steady growth driven by a burgeoning Muslim population and increasing awareness of ethical and Sharia-compliant financial products. Understanding its current size and projected trajectory is crucial for investors and stakeholders alike.

Current Market Size of Islamic Finance in the US

Precise figures on the overall size of the US Islamic finance market are challenging to obtain due to a lack of comprehensive, centralized data collection. However, estimates suggest that the market is currently in the low billions of dollars in terms of assets under management (AUM). This encompasses various sectors, including banking, insurance, and investment, with each contributing differently to the overall figure. Transaction volumes, similarly, lack comprehensive reporting, but anecdotal evidence points to a growing number of Sharia-compliant transactions, particularly in real estate and infrastructure financing. The number of participating institutions is also relatively small, consisting primarily of smaller community banks offering some Sharia-compliant products and a handful of specialized Islamic finance institutions. More robust data collection methodologies are needed to provide a clearer picture of the market’s current size.

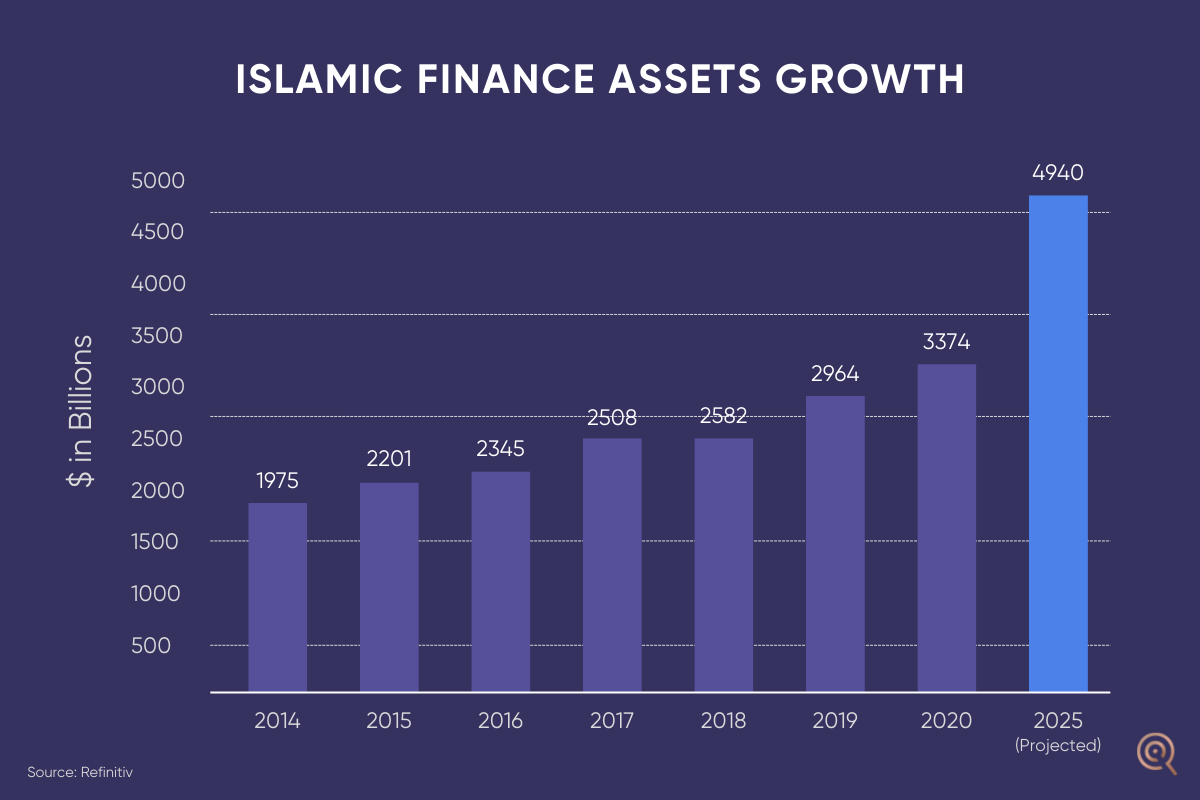

Projected Growth of Islamic Finance in the US

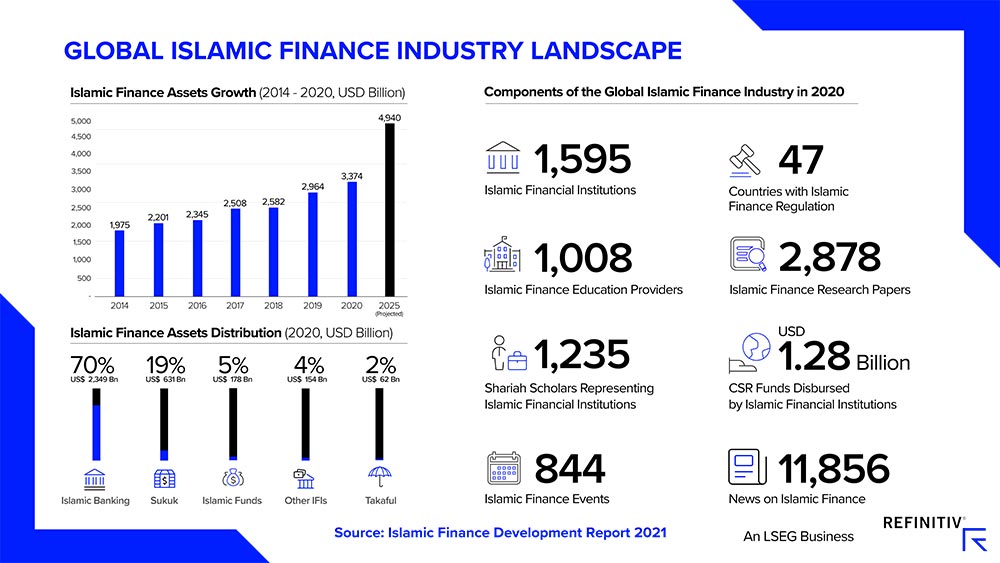

Various market research firms and financial analysts project significant growth for the US Islamic finance market over the next 5-10 years. Several factors contribute to this optimistic outlook, including the growing Muslim American population, increased awareness of ethical investment options, and the growing demand for Sharia-compliant financial products. While precise figures vary across different reports, many forecasts indicate a potential doubling or tripling of the market size within the next decade. For example, a report by [Insert Name of reputable research firm and report title here, if available] projected an annual growth rate of [Insert Percentage] between [Start Year] and [End Year]. This growth is expected to be fueled by increased participation from both institutional and individual investors. A successful case study would be the increasing number of Sukuk (Islamic bonds) issuance, albeit still limited, signifying a growing appetite for alternative financing mechanisms.

Comparison with Other Global Markets

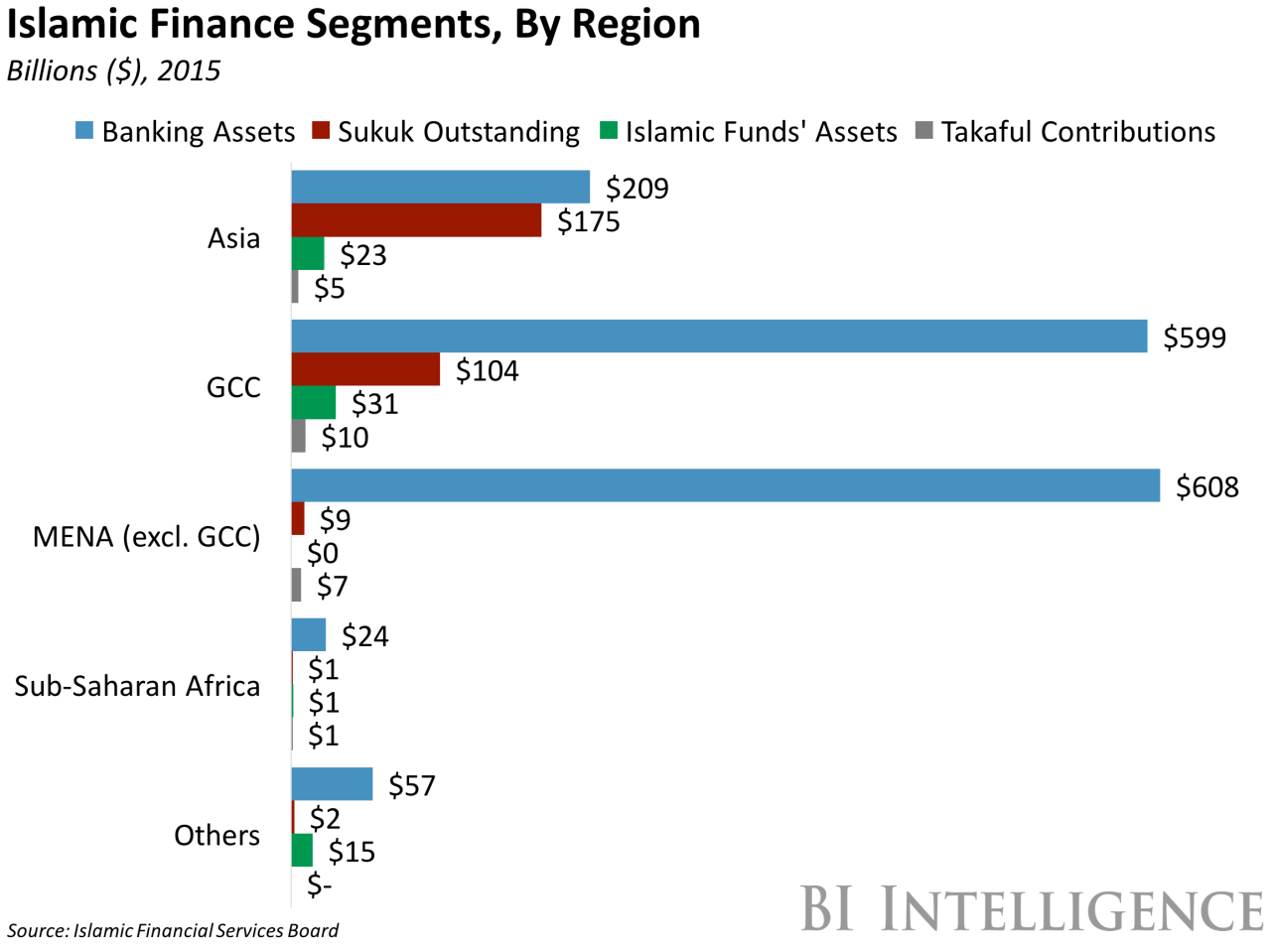

Compared to major global Islamic finance markets like Malaysia, the UAE, and Indonesia, the US market remains relatively small. These established markets boast significantly larger AUM and transaction volumes, benefiting from decades of development and supportive government policies. However, the US market’s growth rate has the potential to outpace some of these established markets, particularly considering the substantial untapped potential within the American Muslim community and the increasing interest in sustainable and ethical finance globally. This potential for faster growth is partly due to the US’s significant influence on global finance and its relatively early stage of Islamic finance development.

Market Share Distribution Across Islamic Finance Sectors

| Sector | Estimated Market Share (%) | Growth Drivers | Challenges |

|---|---|---|---|

| Islamic Banking | 40-50% | Growing demand for Sharia-compliant mortgages and personal finance | Limited product offerings, regulatory hurdles |

| Islamic Investment (Sukuk, etc.) | 25-35% | Increased investor interest in ethical and sustainable investments | Lack of awareness, regulatory uncertainty |

| Islamic Insurance (Takaful) | 15-25% | Growing awareness of Takaful products among the Muslim community | Competition from conventional insurance, regulatory complexities |

| Other (e.g., leasing) | 10% | Demand for Sharia-compliant leasing options | Limited market penetration |

Products and Services Offered within US Islamic Finance: How Big Is Islamic Finance In The Usa

The US Islamic finance industry, while still developing, offers a growing range of products and services designed to comply with Sharia principles. These products cater to a diverse Muslim population and increasingly attract non-Muslim clients seeking ethical and transparent financial solutions. Understanding the core principles and the specific features of these products is crucial for both providers and consumers.

How big is islamic finance in the usa – Islamic finance operates on principles fundamentally different from conventional finance. Interest (riba), speculation (gharar), and investment in prohibited businesses (haram) are strictly avoided. Instead, Islamic finance relies on profit-sharing, risk-sharing, and trade-based transactions. Compliance is achieved through rigorous Sharia review boards and adherence to specific contractual structures. This commitment to ethical and transparent practices distinguishes Islamic financial products from their conventional counterparts.

Islamic Banking Accounts

Islamic banking accounts avoid interest-bearing practices. Instead, they often operate on the principle of Mudarabah (profit-sharing) or Wakala (agency). Funds deposited are treated as investments, with the bank managing them and sharing profits with the depositor. Some accounts might also offer features like current accounts which operate as traditional accounts with some limitations to ensure Sharia compliance.

| Product Name | Description | Sharia Compliance Features | Target Audience |

|---|---|---|---|

| Islamic Savings Account | Interest-free savings account based on profit-sharing or agency agreements. | No interest earned; profits shared according to predetermined ratios. | Individuals and families seeking Sharia-compliant savings options. |

| Islamic Checking Account | Current account with features that adhere to Islamic principles, such as avoiding interest-based transactions. | No interest charged or earned; transactions adhere to Sharia principles. | Individuals and businesses requiring a Sharia-compliant transaction account. |

Islamic Mortgages (Home Financing)

Islamic mortgages, also known as home financing, avoid interest-based loans. Common structures include Murabaha (cost-plus financing), where the bank purchases the property and resells it to the customer at a pre-agreed markup, or Ijara (leasing), where the bank leases the property to the customer with an option to buy.

| Product Name | Description | Sharia Compliance Features | Target Audience |

|---|---|---|---|

| Murabaha Home Financing | The bank purchases the property and resells it to the customer at a markup, effectively financing the purchase. | Avoids interest; based on a cost-plus sale transaction. | Homebuyers seeking Sharia-compliant mortgage options. |

| Ijara Home Financing | The bank leases the property to the customer with an option to purchase at the end of the lease term. | Avoids interest; based on a lease-to-own agreement. | Homebuyers seeking Sharia-compliant mortgage options. |

Islamic Investments

Islamic investments focus on Sharia-compliant assets, avoiding companies involved in prohibited activities like alcohol, gambling, or pork production. Common investment vehicles include Sukuk (Islamic bonds), which represent ownership in an asset, and ethical mutual funds that invest in Sharia-compliant companies.

| Product Name | Description | Sharia Compliance Features | Target Audience |

|---|---|---|---|

| Sukuk | Islamic bonds representing ownership in an asset or project. | No interest payments; returns based on profit-sharing or asset appreciation. | Investors seeking Sharia-compliant fixed-income investments. |

| Sharia-Compliant Mutual Funds | Mutual funds investing only in companies adhering to Sharia principles. | Investments screened for Sharia compliance; avoids prohibited sectors. | Investors seeking diversified, Sharia-compliant portfolio. |

Islamic Insurance (Takaful)

Islamic insurance, or Takaful, operates on the principle of mutual cooperation and risk-sharing. Policyholders contribute to a pool of funds, which are used to cover losses incurred by members. This differs from conventional insurance, which relies on risk transfer and profit generation for the insurer.

| Product Name | Description | Sharia Compliance Features | Target Audience |

|---|---|---|---|

| Takaful Life Insurance | Life insurance based on mutual cooperation and risk-sharing among policyholders. | No interest-based payments; based on a risk-sharing model. | Individuals seeking Sharia-compliant life insurance coverage. |

| Takaful General Insurance | General insurance (e.g., auto, home) based on mutual cooperation and risk-sharing. | No interest-based payments; based on a risk-sharing model. | Individuals and businesses seeking Sharia-compliant general insurance. |

Regulatory Framework and Challenges Facing Islamic Finance in the USA

The growth of Islamic finance in the US faces a complex interplay of opportunities and obstacles, significantly shaped by the existing regulatory framework and its interpretation within the context of Islamic principles. While there isn’t a specific, comprehensive regulatory framework solely dedicated to Islamic finance, several existing laws and regulations impact its operations. Understanding these regulations and the challenges they present is crucial for fostering responsible growth within the sector.

The current regulatory environment for Islamic finance in the US is largely dictated by existing laws and regulations applicable to conventional finance, interpreted and applied within the context of Sharia compliance. This means Islamic financial institutions (IFIs) often operate under the oversight of multiple agencies, including the Office of the Comptroller of the Currency (OCC), the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Securities and Exchange Commission (SEC), depending on their specific activities. These agencies generally focus on capital adequacy, risk management, consumer protection, and anti-money laundering (AML) compliance, applying these standards to IFIs without necessarily having specific expertise in Islamic finance principles. This creates both opportunities and challenges.

Regulatory Uncertainty and its Impact

The lack of specific regulations tailored to Islamic finance products and services creates a degree of regulatory uncertainty. This uncertainty can deter potential investors and financial institutions from entering the market, as the absence of clear guidelines can lead to higher compliance costs and increased legal risks. For example, the structuring of Murabaha (cost-plus financing) transactions often requires careful consideration to ensure compliance with US accounting standards and banking regulations, which can be complex and time-consuming. The absence of standardized accounting treatment for certain Islamic financial instruments further exacerbates this issue. This lack of clarity creates a barrier to entry for smaller IFIs, limiting their ability to compete with larger, established institutions.

Challenges Related to Awareness and Capital Access

Limited awareness among both consumers and financial professionals about Islamic finance principles and products presents a significant hurdle. Many potential customers are unaware of the availability of Sharia-compliant financial products, hindering market expansion. Similarly, a lack of understanding within the broader financial community can lead to difficulties in accessing capital. Securing funding for IFIs can be challenging due to a lack of familiarity with their business models and risk profiles among conventional investors. This often results in IFIs having to rely on a limited pool of investors, restricting their growth potential.

Successful Strategies for Navigating Regulatory Hurdles

Several successful Islamic financial institutions have employed effective strategies to overcome regulatory challenges. These strategies often involve proactive engagement with regulatory bodies to clarify interpretations of existing regulations in the context of Islamic finance, and building strong relationships with regulators to foster a better understanding of their operations. Furthermore, partnering with conventional financial institutions to leverage their expertise and resources can help mitigate risks and facilitate access to capital. Proactive risk management practices, tailored to the specific needs of Islamic finance, also contribute to a stronger regulatory compliance profile. Finally, robust internal Sharia governance structures are essential to ensure consistent compliance with Islamic principles and build trust among customers and regulators.

Policy Measures to Foster Growth

Several policy measures could significantly foster the growth of Islamic finance in the US. These include the development of clearer regulatory guidelines specifically addressing Islamic financial products and services, reducing regulatory uncertainty. Educational initiatives targeting both consumers and financial professionals could raise awareness and promote a better understanding of Islamic finance. Initiatives to encourage the development of Islamic finance expertise within regulatory agencies would also be beneficial. Finally, government support for research and development in Islamic finance could help to overcome knowledge gaps and promote innovation within the sector. A clear commitment from the government to support the responsible growth of this sector, alongside the aforementioned strategies, could lead to a significant expansion of Islamic finance in the US market.

Consumer Base and Market Segmentation in US Islamic Finance

The Muslim American population represents the primary consumer base for Islamic finance in the United States. Understanding the demographics and diverse needs within this community is crucial for the growth and success of this sector. Market segmentation allows for the tailored development and delivery of Sharia-compliant financial products and services that resonate with specific consumer groups.

Demographics and Characteristics of the Muslim American Consumer Base, How big is islamic finance in the usa

The Muslim American population is diverse, encompassing a wide range of ethnicities, nationalities, socioeconomic backgrounds, and levels of religious observance. While precise figures vary depending on the source and methodology, estimates suggest millions of Muslims reside in the US, with significant concentrations in major metropolitan areas like New York, Los Angeles, Chicago, and Houston. This population is not monolithic; it comprises individuals from various cultural and linguistic backgrounds, impacting their financial literacy, preferences, and access to financial services. Many are first or second-generation immigrants, bringing with them unique financial practices and needs. A significant portion of the population falls within the middle-income bracket, although there is also a growing affluent segment.

Market Segmentation in US Islamic Finance

Several factors can be used to segment the US Islamic finance market. These include age, income level, geographic location, and the degree of religious observance. This allows for the identification of distinct customer groups with specific financial needs and preferences.

Market Segments and Their Needs

Understanding the needs of different segments is critical for effective product development and marketing.

- Young Adults (18-35): This segment often prioritizes affordability and accessibility, seeking simple, easy-to-understand products like halal mortgages or investment options with low minimums. They are typically tech-savvy and may prefer online or mobile banking solutions.

- Middle-Aged Individuals (36-55): This group, often established in their careers and families, may focus on wealth management, family planning (education funds, etc.), and long-term financial security. They may be interested in more complex investment vehicles and retirement planning options compliant with Islamic principles.

- Older Adults (55+): This segment prioritizes retirement planning and wealth preservation. They may require tailored financial advice and products that meet their specific needs for income generation and estate planning in accordance with Islamic law.

- High-Net-Worth Individuals (HNWIs): This segment, comprising wealthy Muslim Americans, seeks sophisticated investment strategies and wealth management solutions adhering to Sharia principles. Private banking and customized investment portfolios are often relevant to this group.

- Geographic Segmentation: Concentrations of Muslim populations in specific geographic areas influence product offerings and service delivery. For instance, areas with large Muslim communities might have a higher demand for Sharia-compliant mortgages or halal banking services tailored to local needs.

- Religious Observance Segmentation: The level of religious observance influences the demand for strict adherence to Sharia principles in financial products. Some consumers may prioritize products that strictly avoid interest (riba) and investments in prohibited industries (haram), while others may have a more flexible approach.

Visual Representation of Market Segmentation

Imagine an infographic with a central circle representing the total US Muslim population. From this circle, several branching segments radiate outwards, each representing a distinct market segment (e.g., Young Adults, Middle-Aged, Older Adults, HNWIs). Each segment is color-coded and labeled, with brief descriptions of its key characteristics and financial needs. The size of each segment visually represents its relative proportion within the total Muslim American population. A color legend explains the coding, and small icons (e.g., a house for mortgages, a piggy bank for savings, a graph for investments) could be used to represent the types of financial products and services relevant to each segment. The overall infographic design should be clean, modern, and easy to understand.

Tim Redaksi